Self-Advocacy: Your Financial Plan’s Secret Weapon

Brave New World: Financial Advice for the 21st Century

Generation X, Millennials, and Gen Z are navigating our finances in a world that is very different from the last century. We are getting married older, starting new family structures, working from home or as entrepreneurs, and buying pet insurance for the first time.

However, many financial resources still base advice on family dynamics, workplace norms, and market conditions that were applicable forty years ago. While well-meaning, it often doesn’t take into consideration your actual lifestyle or how today’s world works.

Brave New World: Financial Advice for the 21st Century is our series to address this gap.

These articles will focus on practical, updated advice for those that are still working their way to wealth, with topics such as increasing your financial stability by advocating for yourself at work, avoiding lifestyle creep, and utilizing available programs to pay off your student loans.

Our goal is to give you actionable steps you can take to find success in 2024, not 1984.

Your income is usually one of the first building blocks of your financial plan. For most people, that income comes from their salary at work. If you are just starting your career, it is important to maximize your potential earnings by advocating for fair, competitive wages early on. If you have been in the workforce for a while, it is critical to continually analyze your income and be sure you are on track to reach goals such as retirement or funding education. One way to protect and grow your income is to advocate for yourself at work.

A higher salary early on allows more time for savings and investment accounts to take advantage of compounding interest. Your salary is also the foundation for other employee benefits. Think of your 401(k) contributions and any company matches, or your employer life insurance policy; all these benefits are calculated based on your salary.

By negotiating a higher starting salary when you start a new job or making the case for a raise after a promotion, you have the opportunity to increase your income, even by a small amount. These increases can mean exponential growth for savings such as your retirement account.

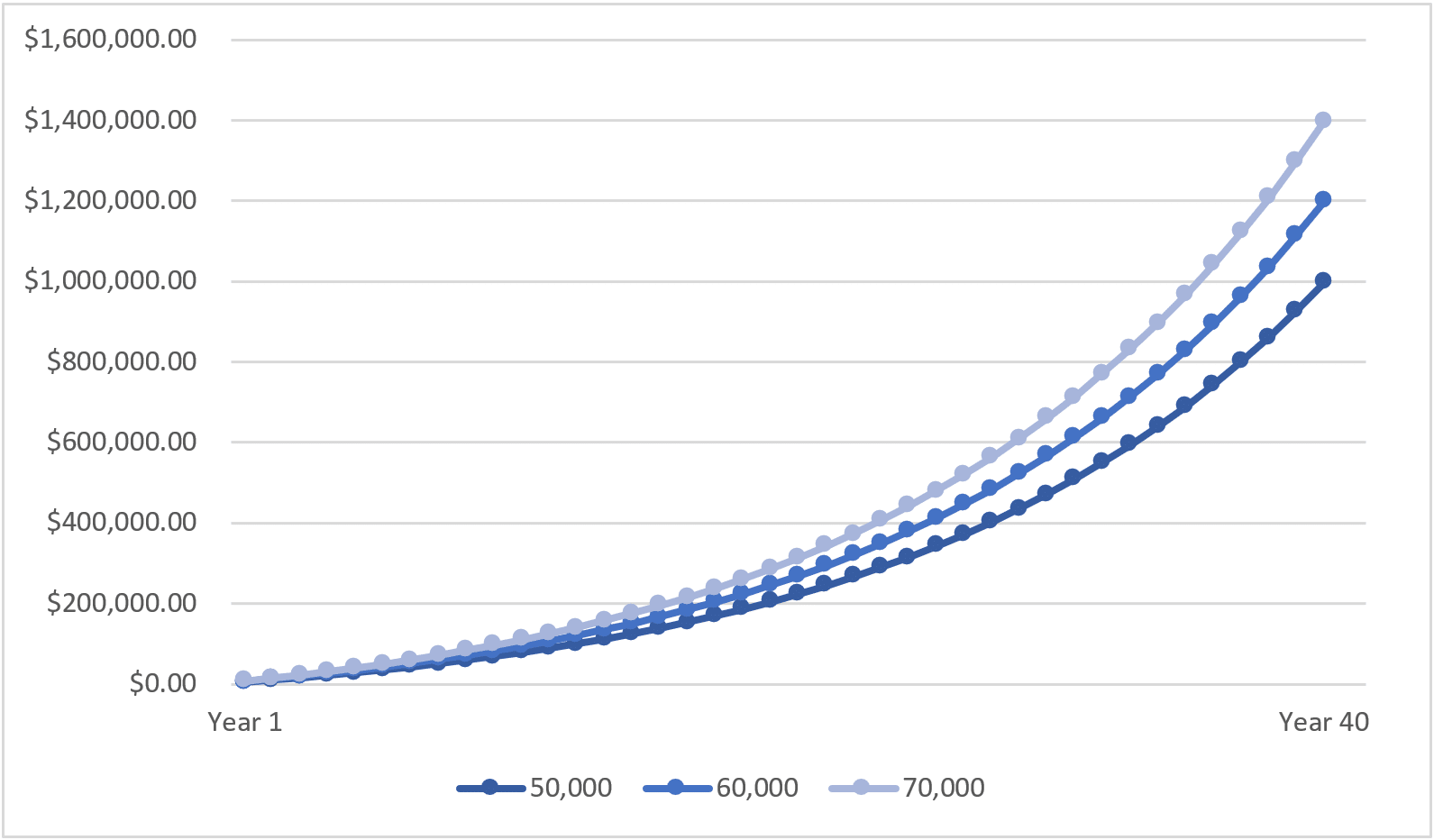

Consider, if you contribute 5% of your monthly salary to your 401(k) and you receive a 5% employer match. If your salary is $50,000, that monthly contribution is about $416. At $60,000, you would contribute $500 a month, and at $70,000 it would be $583. The $167 difference between your retirement contribution at the lower salary seems nominal.

However, when invested over 40 years, even a conservative annualized return assumption of 7% would compound that additional $80,000 into nearly $400,000 of potential returns. A small increase in salary early in your career can allow you to reach your goals and provide financial freedom.

Self-advocacy in the workplace is especially important for women. According to PayScale, in 2023, women continue to make less than men working in the same role and women aren’t promoted as frequently or quickly as their male counterparts. When they are promoted, even women at the executive level are consistently paid less than men in comparable jobs.

In our next two articles, we will be outlining how to advocate for yourself in the workplace. First, we will discuss how to make the case for your salary, both when you start a new role and after you’ve been at your job for a while. Next, we will talk about how to stay in the workforce, by advocating for your needs through job flexibility and accommodations.

No article is going to be able to cover all the specifics of your situation, but a personalized financial plan can! Our financial advisors will take a holistic look are your financial situation and personal goals to put together your plan. This will help chart realistic solutions and different options to help get you succeed.

Sources and Further Reading

The information contained within has been obtained from sources believed to be reliable but cannot be guaranteed for accuracy. The opinions expressed are subject to change from time to time and do not constitute a recommendation to purchase or sell any security nor to engage in any particular investment strategy. Investment Advisory Services are offered through Greenwood Capital Associates, LLC, an SEC-registered investment advisor.

Excerpts from or links to this article on the Greenwood Capital Insights page have been included in Greenwood Capital social media pages and distributed Greenwood Capital newsletter. As is the nature of social media, the general public is able to post comments and/or “likes” in response to these excerpts and/or links. These comments are unsolicited and are posted by either clients or non-clients, which could be interpreted as client testimonials or public endorsements, respectively, and no cash or non-cash compensation is provided. A conflict of interest could exist related to unsolicited posts as Greenwood Capital and its investment adviser representatives could indirectly benefit from these posts.