Set Your Standards: Financial Planning is Life Planning, Especially in the Workplace

Brave New World: Financial Advice for the 21st Century

Generation X, Millennials, and Gen Z are navigating our finances in a world that is very different from the last century. We are getting married older, starting new family structures, working from home or as entrepreneurs, and buying pet insurance for the first time.

However, many financial resources still base advice on family dynamics, workplace norms, and market conditions that were applicable forty years ago. While well-meaning, it often doesn’t take into consideration your actual lifestyle or how today’s world works.

Brave New World: Financial Advice for the 21st Century is our series to address this gap.

These articles will focus on practical, updated advice for those that are still working their way to wealth, with topics such as increasing your financial stability by advocating for yourself at work, avoiding lifestyle creep, and utilizing available programs to pay off your student loans.

Our goal is to give you actionable steps you can take to find success in 2024, not 1984.

We’ve talked before about the importance of increasing your salary and the impact that has on your financial plan and future goals. Another key element of securing your salary is maintaining your ability to earn a paycheck.

Advocating for yourself can provide the flexibility necessary to allow you to stay in the workforce as your life changes. This allows you to retain your salary and continue contributing to your savings. Continuing to work can also increase your social security benefit while reducing economic vulnerability and preventing you from losing health insurance coverage.

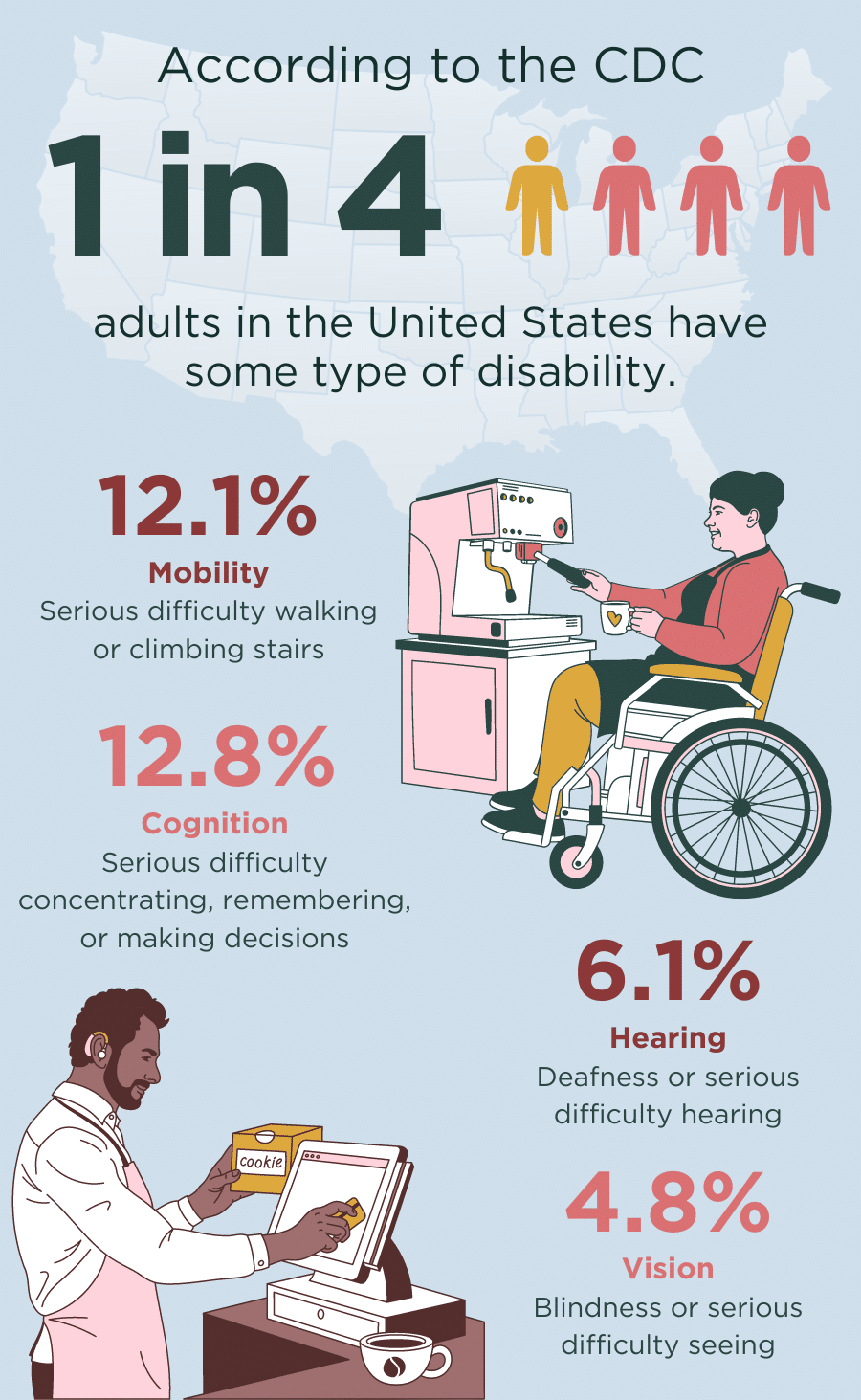

There are many things that may threaten your ability to stay in the workforce. 27% of Americans will experience a disability at some point in their life. An illness, accident, or loss of function may impact your ability to work in the same way you may have in the past.

For parents, raising a family often requires increased flexibility from childbirth recovery to time off for graduation. As your own parents age, you may need to accommodate caregiving and facilitate end-of-life decisions. These situations disproportionately impact women, who are twice as likely to leave the workforce for caregiving and childcare needs.

Job flexibility can allow you to stay at work and maintain your income. Especially post-Covid, flexible work environments that can improve your work-life balance are becoming standard. More employers realize that job flexibility can benefit all employees, creating a competitive, dedicated workforce.

What Can Flexibility Look Like?

This flexibility may look different, depending on your needs. Some examples include:

1. Alternate Hours, such as working 7-3 instead of 9-5

2. Working from home arrangements, either temporary, part-time, or permanent

3. Taking a leave or going part-time. Keep in mind, that certain types of caregiving and medical leave are protected by the Family and Medical Leave Act (FMLA).

4. Disability Accommodations. The Americans with Disabilities Act (ADA) requires most employers to provide reasonable accommodation to individuals with a disability. Even if the ADA does not apply to your situation, consider collaborating with your employer on solutions to improve your work and health.

Remember, increased accessibility often benefits others around you too! For example, introducing written minutes after a meeting can benefit both your colleagues with hearing loss and allow colleagues who speak English as a second language a better opportunity to review the content.

Advocating for accessibility and flexibility in the workplace can help stabilize your income and let you reach your financial goals. But taking the steps to advocate for your needs can also increase your job satisfaction, improve your work-life balance, and even contribute to the success of your colleagues.

Your salary is one of the building blocks of a solid financial plan. As you stay in the workforce, a Certified Financial Planner® can help you budget and invest your salary while giving you an in-depth view of your financial situation.

Accommodations can be big or small and cover a range of conditions including ADHD, hearing loss, and diabetes.

Here are some examples:

- Written instructions with short, clear steps, so people can review information and use read-aloud tools

- Reduced background noise or limited fluorescent lights

- Ergonomic workstations and accessible software

- Multiple formats for training, such as video, text-based, or in-person meetings

- Reserved parking

- Closed captions or live transcription for videoconferences

- Time off for therapy appointments

No article is going to be able to cover all the specifics of your situation, but a personalized financial plan can! Our financial advisors will take a holistic look are your financial situation and personal goals to put together your plan. This will help chart realistic solutions and different options to help get you succeed.

Sources and Further Reading

Disability Impacts All of Us Infographic | CDC

Women and Caregiving: Facts and Figures – Family Caregiver Alliance

Women Leaving the Workforce at Unprecedented Rates | Bipartisan Policy Center

What Working Parents Want At Work (flexjobs.com)

How To Make Remote Work More Effective for Parents (forbes.com)

Is remote work effective: We finally have the data | McKinsey

Managing Flexible Work Arrangements (shrm.org)

Pursuing growth in 2021: PwC’s US Pulse Survey of C-suite executives

Family and Medical Leave Act | U.S. Department of Labor (dol.gov)

Reasonable Accommodations in the Workplace | ADA National Network (adata.org)

Introduction to the Americans with Disabilities Act | ADA.gov

Learn More About Financial Planning

Excerpts from or links to this article on the Greenwood Capital Insights page have been included in Greenwood Capital social media pages and distributed Greenwood Capital newsletter. As is the nature of social media, the general public is able to post comments and/or “likes” in response to these excerpts and/or links. These comments are unsolicited and are posted by either clients or non-clients, which could be interpreted as client testimonials or public endorsements, respectively, and no cash or non-cash compensation is provided. A conflict of interest could exist related to unsolicited posts as Greenwood Capital and its investment adviser representatives could indirectly benefit from these posts.