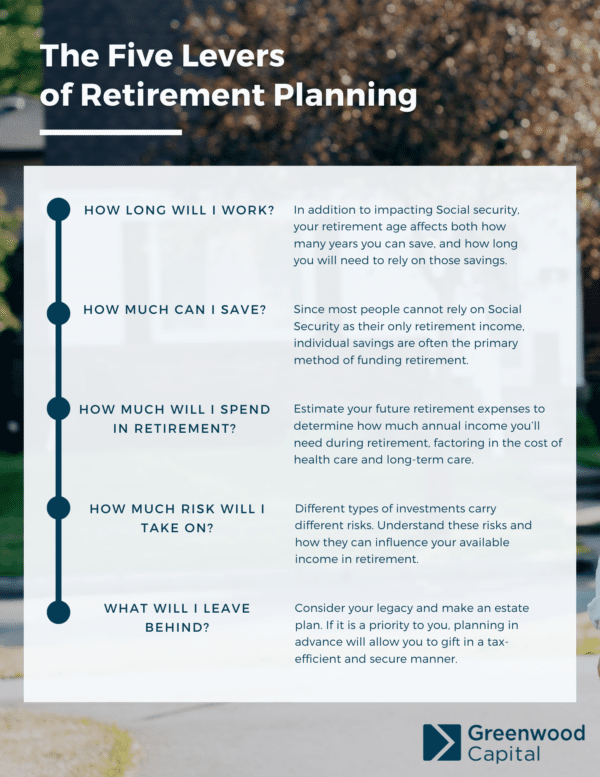

The Five Levers of Retirement Planning

Amidst volatile markets and dire headlines, it can be stressful to try and plan for retirement.

Will your money last?

While there are many factors you cannot influence, there are five things you can control:

- How Long Will I Work?

- How Much Can I Save?

- How Much Will I Spend in Retirement?

- How Much Risk Will I Take On?

- What Will I Leave Behind?

We call these the Five Levers. Plan your retirement by answering these questions and adjusting these levers to account for your priorities and goals. By creating a solid financial plan, you will be able to have peace of mind as you approach retirement, and the flexibility to adjust for changes as they come.

Learn more about how to set yourself up for success by downloading our guide:

The Five Levers of Retirement Planning.

Request your copy today by filling out the form.

Wealth Management Team

Melissa D. Bane

CPA, CFP®, PFS®, ChFC

Senior Client Private Advisor

John W. Cooper

CFP®

Senior Private Client Advisor

Denise H. Lollis

CPFA®

Chief Operating Officer

Chief Compliance Officer

Callie Bradshaw

Private Client Specialist

Germein De Sario

Private Client Administrator

K. Diane Smith

Private Client Administrator

William M. Coxe, Jr.

CRPC™

Private Client Advisor

Brian L. Disher

CFP®

Director of Wealth Management

Get timely and thoughtful insights on how to reach your financial planning and investment management goals.

Greenwood Capital is a premier wealth and asset management firm in South Carolina. We serve families, financial advisors, and institutional investors by providing a comprehensive and consultative approach to financial planning and investment management. We differentiate ourselves by offering direct access to our investment managers and making in-house portfolio decisions rather than relying on third-party investment managers. Our experienced team takes a global perspective in managing your financial concerns and a personal approach to customizing your investment plan by getting to know you. Established in 1983, Greenwood Capital manages approximately $1.7 billion in assets.

Greenville Office

201 W. McBee Avenue

Suite 300

Greenville, SC 29601

864.335.2425

Greenwood Office

425 Main Street

Suite 100

Greenwood, SC 29646

864.941.4049

Greenwood Capital Associates, LLC is an SEC-registered investment advisory firm. Before 2001, Greenwood Capital Associates and the term “Firm” refers to Greenwood Capital Associates, Inc. (GCAI), established in 1983. On or about June 29, 2001, Greenwood Capital Associates, LLC acquired substantially all the assets of GCAI, a sub-chapter S corporation. Greenwood Capital Associates, LLC registration dates back to 2001.