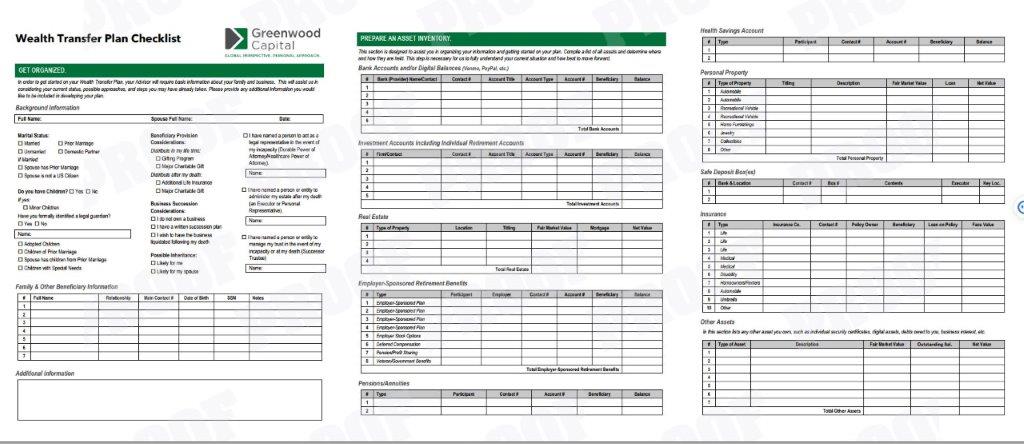

Wealth Transfer Checklist

Preparing your Wealth Transfer Plan can initially seem very overwhelming. To help you get started we have created a Checklist to guide you through the main steps:

Getting Organized

Preparing an Asset Inventory

Consulting an Attorney

Reviewing & Filing Documents

Using the checklist, you will note your current situation, detail your wishes, and compile a list of your assets in one document.

Women and Money: Taking Charge of Your Financial Future

Women face many unique financial challenges throughout their lifetime, yet today, women have never been in a better position to achieve financial security.

In our Women & Money Guide, Melissa Bane covers those unique challenges and 6 steps to take charge of your finances and ensure your financial future.

The Five Levers of Retirement Planning

Amidst volatile markets and dire headlines, it can be stressful to try and plan for retirement.

Will your money last?

While there are many factors you cannot influence, there are five things you can control. We call these the Five Levers. Plan your retirement by answering these questions and adjusting these levers to account for your priorities and goals. By creating a solid financial plan, you will be able to have peace of mind as you approach retirement, and the flexibility to adjust for changes as they come.

Learn more about how to set yourself up for success by downloading our guide:

The Five Levers of Retirement Planning.

If you are not comfortable handling your own investments, the good news is there are thousands of financial services professionals who can help. Unfortunately, finding the right investment services provider may seem almost as confusing, intimidating, and time-consuming as choosing the right investments.

This brochure will cut through the confusion. It provides information to help you find an investment services provider who is right for you— one who offers the services you want on terms you understand and accept.

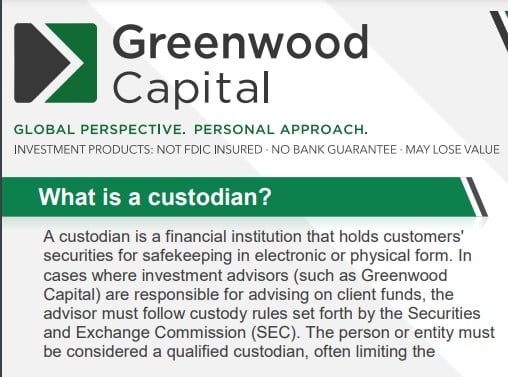

Do you understand the difference in the advisor role and the custodian role and how each can benefit you the investor?

Who helps you determine investment goals and who provides record keeping for tax purposes?

Peruse our Custodial Relationship for answers to these questions and more to fully understand the differences and roles of each.

Who are Financial Advisors?

Types of Financial Advisors In this current series we have been sharing the traditional and modern...

A Woman’s Journey Towards Financial Security

I grew up in a single parent household watching my mom struggle to put food on the table and keep a roof over the heads of her five children, all while working a minimum wage job. It left a lasting impression on me.

Creating a Wealth Transfer Plan for You and Your Heirs

At first glance, a Wealth Transfer plan may sound like a task that is outside your skill set....