Mark Pyles is comfortable with contradictions. He spent the first part of his career as an academic who focused on teaching real-world skills to students entering the financial industry. He is often thinking about the future, but he is cautious against making rash decisions. He is just as likely to be playing folk music on his guitar or running numbers on market macroeconomics. In his work, he strikes a balance between creativity, diligence, and statistical expertise.

Mark’s journey in finance started unexpectedly as a freshman at Eastern Kentucky University.

“Back then you couldn’t register online. You had to go in person for orientation and register for your first semester’s classes with someone.” He explained.

“I thought I wanted to do something in business, but my plan was to just start as undeclared because I didn’t know exactly which field I wanted to focus on. And I got there and the line for undeclared majors was crazy! But right next to it, there was a table for finance majors that had nobody in it. And so, I declared finance as my major because of that, so that I could go home early.”

Mark figured he could change his degree later on, but that became unnecessary when he took his first finance class with Professor Duke Thompson. The experience was transformative, introducing Mark to the lifestyle and possibilities that a career in academics could offer within the realm of finance. Never one to do something half-heartedly, he enrolled at the University of Kentucky immediately after earning his bachelor’s degree. At UK, Mark earned his master’s in economics and Ph.D. in finance simultaneously and graduated with his doctorate in three years.

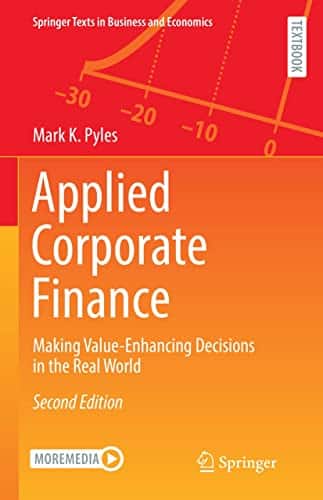

Eager to build something, Mark moved to South Carolina and began working at the College of Charleston. As one of the oldest schools in the country, the university had a rich history and an excellent academic reputation. However, the School of Business and the Department of Finance had a much shorter history in the traditionally liberal arts institution. Over the next 18 years, Mark was instrumental in helping build out the finance department, and along the way saw the introduction of a full finance degree and served as the founding director of the School of Business Investment Program. During this time, he also published over 40 peer-reviewed academic articles and two textbooks.

As an educator, Mark prioritized teaching transferable, real-world skills. In his efforts to teach current, marketable skills and information, he ran into the age-old question within the realm of business disciplines: the divide between academia and real-world practice.

“What I’ve come to understand is that nothing is black and white. In a way, academics are both way ahead and way behind practice at the same time. Virtually everything we do in the “real world” was birthed in academics. Most of the asset analysis techniques and portfolio management strategies came from some really smart person, years and years ago, writing a paper or doing a dissertation on it. In that way, academics guide the professional world in new and innovative paths.

On the other hand, academics tend to be way behind on the teaching side. We start teaching things probably a decade after they’re practically needed. This has always bothered me—we send students out into the real world equipped with knowledge and skills that were very much in demand a decade ago.”

“Most of the asset analysis techniques and portfolio management strategies came from some really smart person, years and years ago, writing a paper or doing a dissertation on it.”

The Investment Program he founded was part of the solution in his mind, as it provided real-world management experience to students who truly want to differentiate themselves from the pack. However, Mark also understood that it is difficult to teach what one has not experienced. After obtaining tenure and full professorship, Mark looked for opportunities to help bridge this disconnect and better prepare his students for the real world. He began consulting in his time outside the College. He had first connected with Greenwood Capital in 2014 through his work with the Investment Symposium (an annual event hosted by the Investment Program) and began working as a consultant for the Greenwood Capital investment team in 2021. Working with the Investment Committee gave Mark new insight into the practicalities of the topics he was teaching.

It also challenged him: “I loved every second of it. I really did. I felt dumb again for the first time in two decades, and that’s, I guess, weird, but that’s what I was looking for. That’s what I wanted.”

This experience was invigorating, and it finalized Mark’s decision to transition out of academia. In June 2023, Mark joined Greenwood Capital as the Director of Multi-Asset Strategies.

““I chose Greenwood Capital because it is incredibly established and I think there are supremely intelligent, kind human beings who have created that stability. But at the same time, there’s always this “what’s next” mentality. What can we do to make this better? Naturally, a part of that is to make the firm more successful and profitable.

But it goes deeper than that. Walter has this mentality (he and I are so much alike in this regard) that if it’s been a while since you’ve done, or thought of, something new and challenging – the itch to do so gets overwhelming. We can’t be afraid of being afraid in this business, and Greenwood Capital allows that mentality to infuse throughout strategic planning. While there are 40 years of experience rooted in processes that are disciplined, repeatable, client-driven – there’s also intentionality that surrounds future plans.

And I see Greenwood Capital in much the same way I saw the College of Charleston when I chose to go there. The College of Charleston was over 230 years old when I got there. It didn’t need me to survive, but I saw a hole in there where I could make a difference. When I left 18 years later—and I’m very honored to be able to say this—I left it different (at least in small measure) than when I entered it. I see the same opportunity here. I feel there are things I can influence. My goal is to be able to look back at my second 20-year career and say: yeah, that mattered.”