“When you have nothing, it seems like you can never have anything. From the outside looking in, it can seem so simple, but when you’re in that situation, it seems impossible. I’ve been there and I thought I would always live hand to mouth. Day to day. Week to week. But I realized, first I need to invest in myself, in education. And then I learned how to move forward, step by step, from there.”

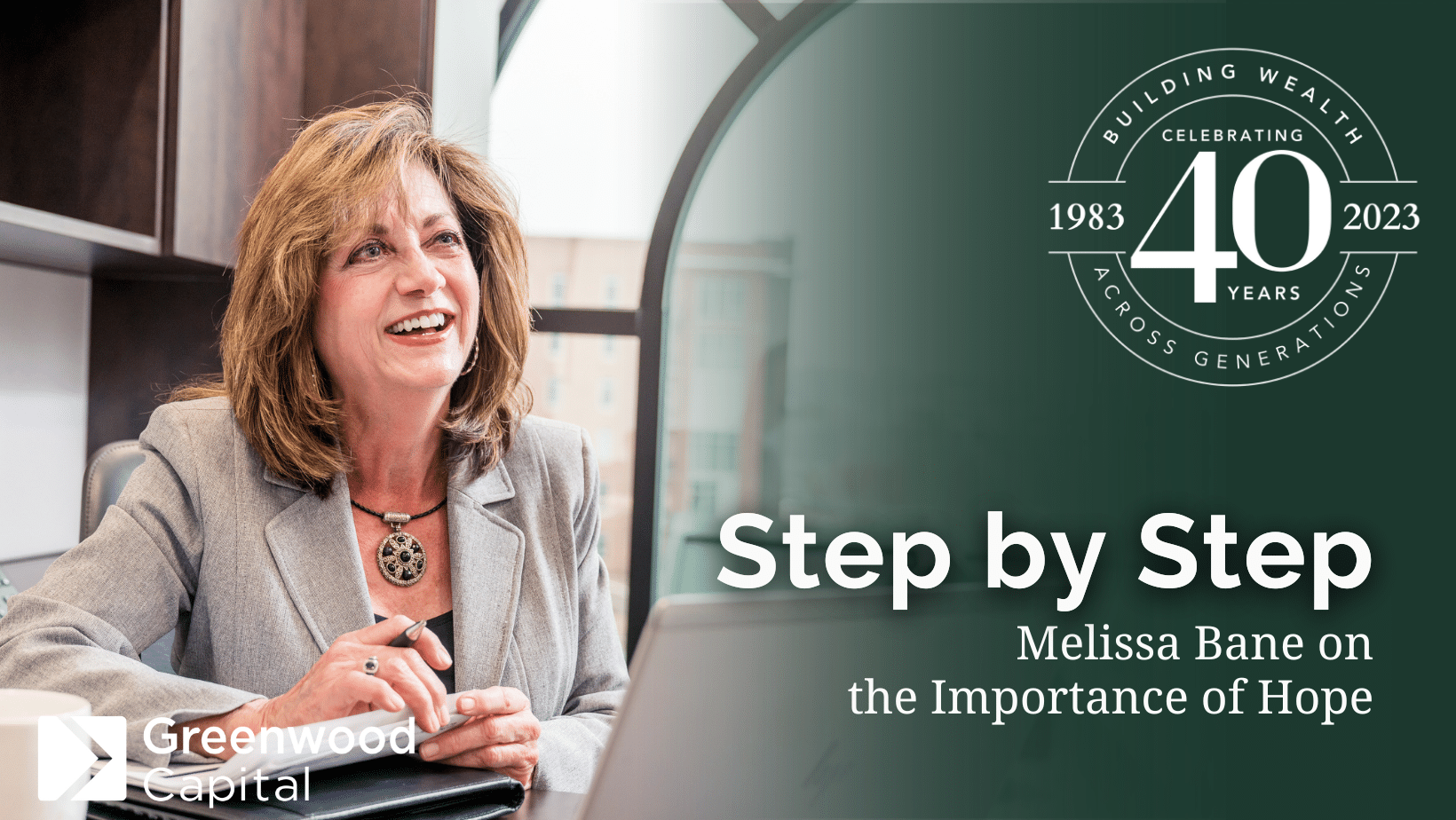

“Step by step” seems to be an understatement when looking at Melissa’s journey. Over her 30-year career in the financial industry, Melissa has worked as a Senior Staff Accountant at an accounting firm, a Director of Finance for a global manufacturer, and a Vice President and Trust Officer at Countybank. In 2013, she became the first female advisor at Greenwood Capital and is now a Senior Private Client Advisor and a Principal at the firm.

She is passionate about using that experience to educate her clients and community. She often speaks at local book clubs, conferences, and civic organizations on topics ranging from budgeting to tax considerations for small businesses.

“Financial literacy is very important to me. Not just for women, but for everyone, because we don’t teach it in our schools, unless you’re going down the financial career path. It’s really mind-boggling to me that we don’t cover basic personal financial management in school.”

Melissa’s compassionate approach to financial literacy is evident in how she works with her clients. Her process is judgment-free and focused on concrete, attainable solutions. She recently worked with a young family whose credit card debt had begun to snowball. The joyful arrival of a new baby also brought increased costs and a lowered income for one parent. Melissa walked them through their full financial picture, including how much those interest charges were crippling their future goals. Melissa outlined a clear plan with a lot of encouragement. Six months later, that family had paid off those credit cards, started saving for retirement, and had new life insurance policies put in place to protect their child and future.

Of course, this family’s success is a testament to their dedication and sacrifice. But it also demonstrates Melissa’s philosophy that taking the small steps and believing you can achieve them is a major factor in success. So, she brings a healthy dose of encouragement to every client relationship.

“My favorite part of the job is solving client problems before they even know they have them. I provide proactive recommendations…I try to anticipate client needs to determine what would benefit them most before they even ask a question. And I love doing that. “

In any given week, Melissa has stories to share about problems she helped solve. She shared about a client who came in recently hoping to find room in the budget for a little sports car. The woman had always put her sons first, never having the chance to own a fun car. When Melissa updated the woman’s financial plan, she uncovered a widow’s benefit that her client was unaware of. Melissa was able to provide guidance on how to both budget for the new (to her) car and claim that benefit.

Melissa is one of only a handful on women in the state to achieve both her CPA (Certified Public Accountant) and CFP (Certified Financial Planner) designations. She regularly uses her knowledge of the tax code and her client’s personal situation to make innovative recommendations. She’s always looking at the details; whether by finding new ways to help a client save money on their taxes or working with a client’s attorney to meticulously work through a client’s estate planning process.

To uncover these details, Melissa needs to know her clients. She learns about their families, their goals, and their dreams. A little red sports car or a plan to pay off credit cards are not big in the grand scheme of the economic market. But to Melissa’s clients, and therefore, to Melissa, these things matter.

She also recognizes that sharing these goals and dreams can be intimate. It can be difficult to confront financial mistakes of the past or share aspirations that seem too lofty to say out loud. So, Melissa often shares her story first, giving her clients the gift of knowing that they are not alone.

“[Melissa is] always looking at the details; whether by finding new ways to help a client save money on their taxes or working with a client’s attorney to meticulously work through a client’s estate planning process.”

“Whatever your story, people need to hear it. You never know who you will encounter that can really benefit from hearing it. People need to know who you are and people know need to know your why.

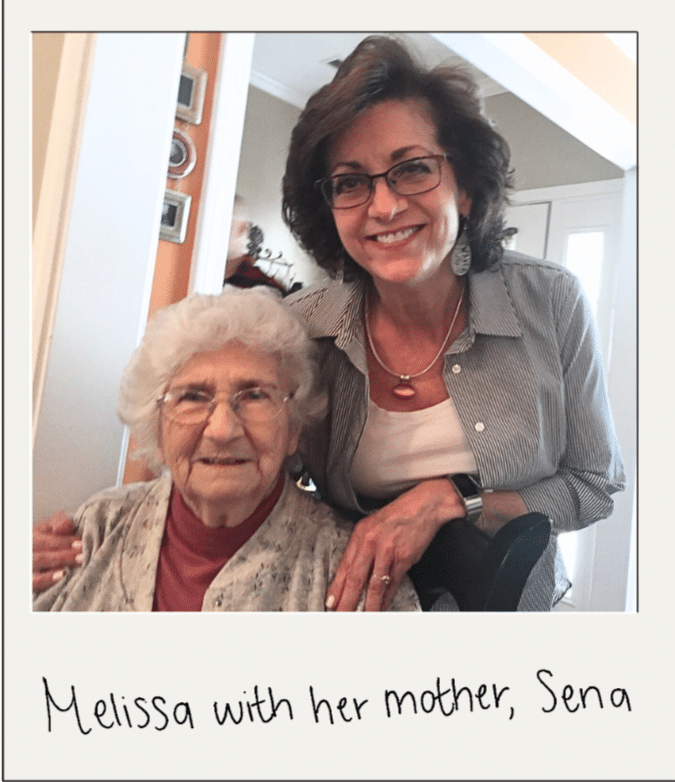

For me, I grew up watching my mom struggle. She found herself with a high school diploma and five children to raise. She did what she had to do. But I think she had trouble seeing past the end of her nose, much less dream of a bright future for herself or her children.

And that’s why I like to work with people that need hope and a path forward. People like my mom and me. I didn’t think I had a chance at a successful future either when I married and had my first child before graduating high school. But when my son was born, I knew I wanted more for him. I wanted to show him that he could do better. That I could do better. And many small steps later, I did.

That is true for everyone. With dedication and trustworthy professional guidance, there is hope and a path forward, whatever your goal.”

The information contained within has been obtained from sources believed to be reliable but cannot be guaranteed for accuracy. The opinions expressed are subject to change from time to time and do not constitute a recommendation to purchase or sell any security nor to engage in any particular investment strategy. Investment Advisory Services are offered through Greenwood Capital Associates, LLC, an SEC-registered investment advisor.

Excerpts from or links to this article on the Greenwood Capital Insights page have been included in Greenwood Capital social media pages and distributed Greenwood Capital newsletter. As is the nature of social media, the general public is able to post comments and/or “likes” in response to these excerpts and/or links. These comments are unsolicited and are posted by either clients or non-clients, which could be interpreted as client testimonials or public endorsements, respectively, and no cash or non-cash compensation is provided. A conflict of interest could exist related to unsolicited posts as Greenwood Capital and its investment adviser representatives could indirectly benefit from these posts.