Walter B. Todd, III

President/Chief Investment Officer

The information contained within has been obtained from sources believed to be reliable but cannot be guaranteed for accuracy. The opinions expressed are subject to change from time to time and do not constitute a recommendation to purchase or sell any security nor to engage in any particular investment strategy. Investment Advisory Services are offered through Greenwood Capital Associates, LLC, an SEC-registered investment advisor.

On behalf of all the employees at Greenwood Capital,

Sincerely,

Walter B. Todd, III

President/Chief Investment Officer

The information contained within has been obtained from sources believed to be reliable but cannot be guaranteed for accuracy. The opinions expressed are subject to change from time to time and do not constitute a recommendation to purchase or sell any security nor to engage in any particular investment strategy. Investment Advisory Services are offered through Greenwood Capital Associates, LLC, an SEC-registered investment advisor.

In summary, I know the quarter did not end on a high note for financial markets and, as outlined above, there are certainly plenty of culprits to point to as for why that might be the case. However, I would note that while the S&P 500 ended down over 5% from its high reached in early September, many components underneath the headline index had been correcting for several months, with the average stock down well over 12% from its high. The index correction may not be over, but for many constituents, we may be closer to that reality. We continue to find opportunities in various corners of the market and remain encouraged by the market’s relative resilience to the headlines of the day. Rates remain relatively low and credit spreads remain well behaved. All positives as we move into the final quarter of the year.

I will conclude my remarks there but, as always, please feel free to email or call if you have any questions or follow up. We remain in the office and welcome the opportunity to meet with you and reconnect in person if that is something you desire and are comfortable doing. Thank you as always for your continued trust in and support of Greenwood Capital.

On behalf of all the employees at Greenwood Capital,

Sincerely,

Walter B. Todd, III

President/Chief Investment Officer

The information contained within has been obtained from sources believed to be reliable but cannot be guaranteed for accuracy. The opinions expressed are subject to change from time to time and do not constitute a recommendation to purchase or sell any security nor to engage in any particular investment strategy. Investment Advisory Services are offered through Greenwood Capital Associates, LLC, an SEC-registered investment advisor.

October 11, 2021

I’m going to start this letter with a scary thought – there are less than 80 shopping days left till Christmas. Yikes! Worse yet, with the supply chain disruptions getting worse, there may be far fewer days than that if you want to find many goods in stock. Last quarter we touched on the increased cost companies were incurring getting goods through the global supply chain. Now cost might not be the issue, but simply physically getting the goods delivered at any cost is becoming the challenge.

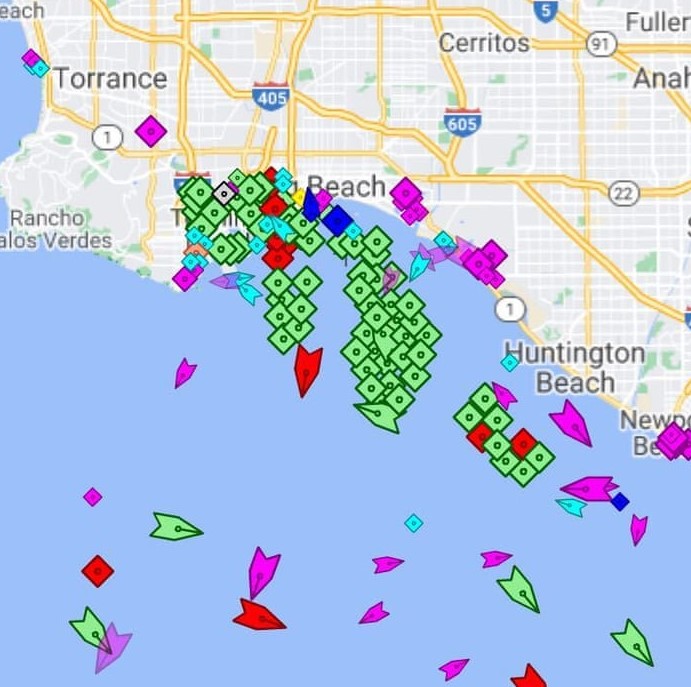

The map to the right shows a record 73 cargo ships waiting off the Los Angeles-Long Beach port complex to unload goods. This is the largest port in the US and accounts for 40% of imports and 30% of exports for the country. These disruptions in goods deliveries are manifesting themselves in increases in out-of-stock items in stores and also higher prices for those goods that are in stores (more on this in our Market Commentary post). So, as we move on to talk about financial markets and other various topics in this letter, my advice to you would be to do your holiday shopping early.

Hopefully this message makes it to the North Pole soon. If not, we might have to adapt the line from the movie – “Yes Virginia there is a Santa Claus”…but his sleigh is stuck off the Long Beach port.

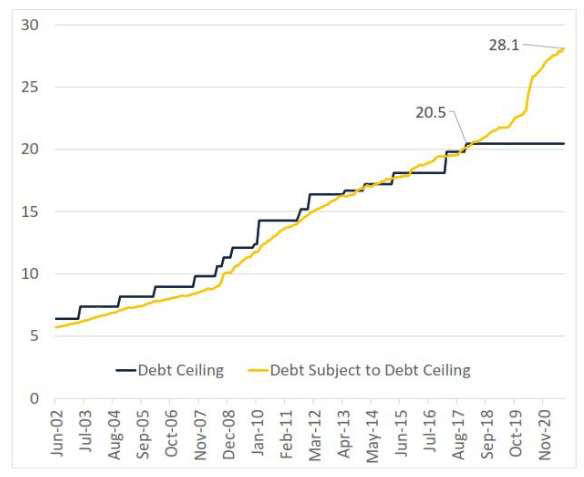

US Debt Ceiling

I cannot avoid talking about the elephant in the room of the US Debt Ceiling. I mentioned it at the end of last quarter’s letter and it has yet to be resolved. As a reminder, we have been through this ridiculousness (my opinion) before, many times. In fact, in the past fifty years the US has raised or suspended the debt ceiling over eighty times. It has become more of a brinksmanship exercise in the past decade. In 2011, for example, the US went to the edge of default, with the country’s debt rating lowered by S&P, before finally raising the debt ceiling. The problem with this game of chicken is that if you wait too late to avoid the other car, you can both get in a wreck and lose. Don’t get me wrong, our long-term debt is not sustainable. It needs to be addressed with a thoughtful, long-term plan, but not in the current public display of partisanship from both sides. As in the past, I believe it will ultimately get resolved but what is the collateral damage from the fight? We will know soon enough as it needs to be raised or suspended within the next few weeks.

Evergrande

Suffice it to say that 2021 has not been a good year for things that start with the word “Ever.” First we had Ever Given, the name of a ship stuck in the Suez Canal in January, the shipping company was named Evergreen. Now recently we have Evergrande, a property developer in China that appears to be collapsing under the weight of its debt and a crackdown by China on all things capitalism during 2021. With somewhere between $300 and $500 billion worth of debt (depending on whether you look at on-balance sheet or off), it is not an insignificant sum of money that could get wiped out.

However, while many have tried to make analogies to this being China’s “Lehman moment,” we do not believe this is the case. Most of the financial exposure to Evergrande remains within China meaning the direct financial fall-out from the company’s collapse should be manageable from a global perspective.

Still, to the extent that there are repercussions to China’s economy, as the second largest economy in the world, this could pull growth lower in the rest of the world.

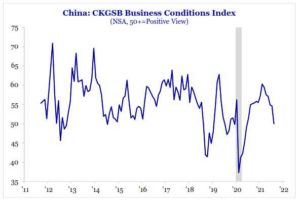

We are seeing some evidence of such a slowdown in the recent data out of China (see chart at right). We continue to monitor the developments there, both from a policy and economic perspective.

Inflation

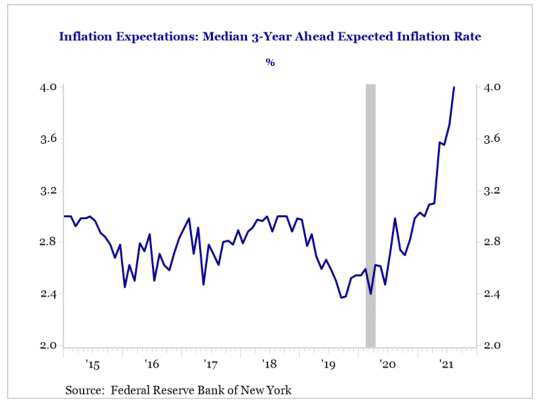

We spent some time talking about inflation last quarter, and that is still a subject that is top of mind among consumers and investors. The chart to the left shows consumer inflation expectations over next three years are at the highest level in over a decade. This is understandable given housing price increases of 20% or more over the past year and the national average gasoline price up over 35% year-to-date in 2021.

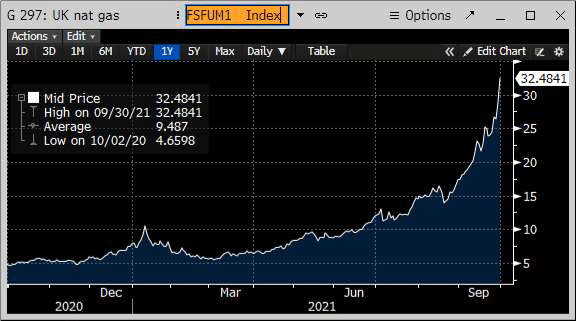

This is not just a US phenomenon. In fact, we may be fortunate compared to consumers in the UK where natural gas prices have risen over 300% during the year. See chart to the right to see what that looks like. We have another story out of China today indicating the government has ordered the country’s top state-owned energy companies to secure supplies at all costs. While economists and others, including the Federal Reserve, like to exclude energy costs from the inflation figures they look at to set policy, that is not going to help folks stay warm this winter should these shortages continue.

Washington Policy

I regret to say that I could spend this whole letter getting into the details of what is going on in Washington policy (even beyond the debt ceiling debate discussed earlier). Let me hit a few highlights for you (or should they be “lowlights?”). As I write this letter on September 30, the Senate has just passed a Continuing Budget Resolution (CBR) to keep the government funded until December 3rd this year. The House is expected to pass this measure and avert a government shutdown. The fact that this CBR only goes through the beginning of December unfortunately assures that I will be talking about this in the next quarterly letter (apologies ahead of time). Meanwhile, Congress continues to debate the larger $3.5 trillion funding package (which is why they had to pass the CBR to begin with) which includes additional spending and also tax provisions. We referenced these tax increases last quarter.

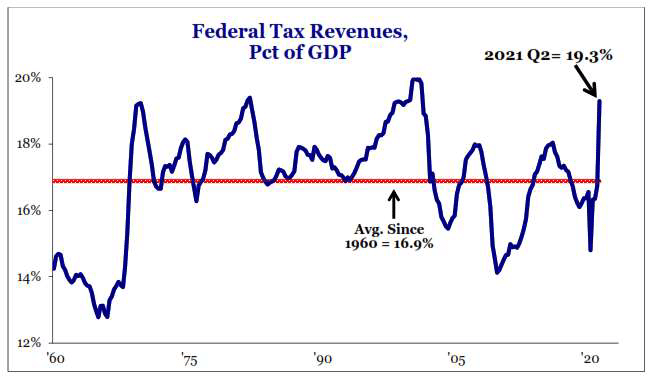

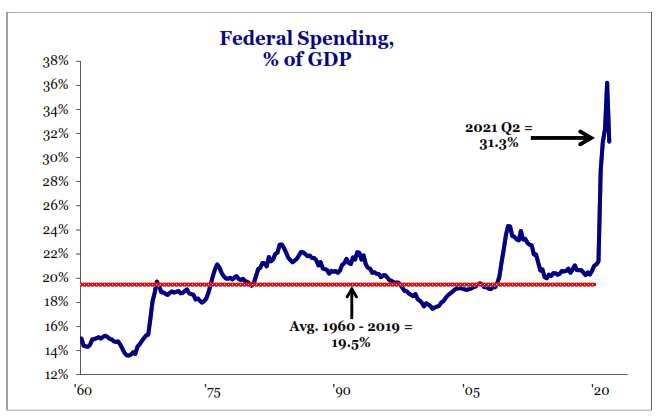

While we still do not have any final decisions, it appears capital gains and corporate taxes are likely to come in around 25%. I would note, as the chart above shows, that federal tax revenues are the highest they have been (as a % of GDP) in over twenty years. Why do we need tax increases again? Oh yeah, look at the chart to the above right; spending is at all-time highs as well. Then we have the infrastructure package from last quarter, which has yet to be voted on as of this writing. The vote is expected in the coming days, but do not hold your breath. Ok, everybody got all that straight?

Conclusion

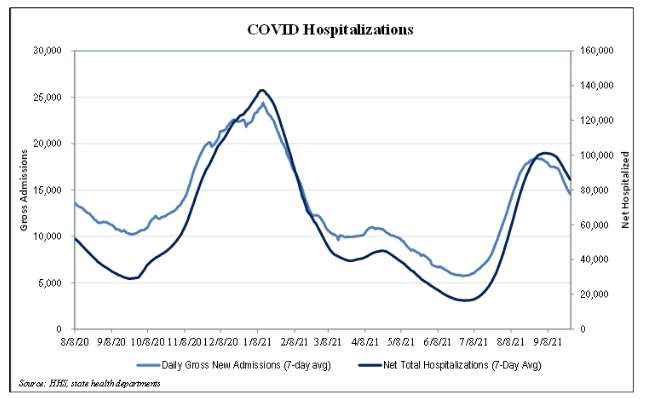

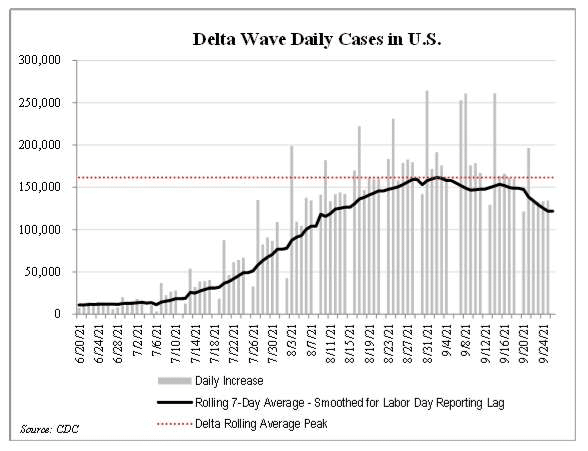

Ok, so I know this letter has been filled with discussion about all the problems out there, but these are the bricks in the wall of worry that the market is climbing. Having said that, I would like to end this commentary on a more positive note: the case counts for the Delta variant in the US appear to be rolling over from their peak. The chart on the bottom left shows the 7- day moving average of cases while the chart on the bottom right shows hospitalizations. I know we are not out of the woods yet, but an improvement none the less.

In summary, I know the quarter did not end on a high note for financial markets and, as outlined above, there are certainly plenty of culprits to point to as for why that might be the case. However, I would note that while the S&P 500 ended down over 5% from its high reached in early September, many components underneath the headline index had been correcting for several months, with the average stock down well over 12% from its high. The index correction may not be over, but for many constituents, we may be closer to that reality. We continue to find opportunities in various corners of the market and remain encouraged by the market’s relative resilience to the headlines of the day. Rates remain relatively low and credit spreads remain well behaved. All positives as we move into the final quarter of the year.

I will conclude my remarks there but, as always, please feel free to email or call if you have any questions or follow up. We remain in the office and welcome the opportunity to meet with you and reconnect in person if that is something you desire and are comfortable doing. Thank you as always for your continued trust in and support of Greenwood Capital.

On behalf of all the employees at Greenwood Capital,

Sincerely,

Walter B. Todd, III

President/Chief Investment Officer

The information contained within has been obtained from sources believed to be reliable but cannot be guaranteed for accuracy. The opinions expressed are subject to change from time to time and do not constitute a recommendation to purchase or sell any security nor to engage in any particular investment strategy. Investment Advisory Services are offered through Greenwood Capital Associates, LLC, an SEC-registered investment advisor.