Walter B. Todd, III

President/Chief Investment Officer

The information contained within has been obtained from sources believed to be reliable but cannot be guaranteed for accuracy. The opinions expressed are subject to change from time to time and do not constitute a recommendation to purchase or sell any security nor to engage in any particular investment strategy. Investment Advisory Services are offered through Greenwood Capital Associates, LLC, an SEC-registered investment advisor.

Sincerely,

Walter B. Todd, III

President/Chief Investment Officer

The information contained within has been obtained from sources believed to be reliable but cannot be guaranteed for accuracy. The opinions expressed are subject to change from time to time and do not constitute a recommendation to purchase or sell any security nor to engage in any particular investment strategy. Investment Advisory Services are offered through Greenwood Capital Associates, LLC, an SEC-registered investment advisor.

On behalf of all the employees at Greenwood Capital,

Sincerely,

Walter B. Todd, III

President/Chief Investment Officer

The information contained within has been obtained from sources believed to be reliable but cannot be guaranteed for accuracy. The opinions expressed are subject to change from time to time and do not constitute a recommendation to purchase or sell any security nor to engage in any particular investment strategy. Investment Advisory Services are offered through Greenwood Capital Associates, LLC, an SEC-registered investment advisor.

I will conclude my remarks there but, as always, please feel free to email or call if you have any questions or follow up. The past 12 months have presented many challenges and opportunities as well. I am very proud of the team here at Greenwood Capital and I hope that we have been able to meet your expectations for service as your trusted financial partner.

On behalf of all the employees at Greenwood Capital,

Sincerely,

Walter B. Todd, III

President/Chief Investment Officer

The information contained within has been obtained from sources believed to be reliable but cannot be guaranteed for accuracy. The opinions expressed are subject to change from time to time and do not constitute a recommendation to purchase or sell any security nor to engage in any particular investment strategy. Investment Advisory Services are offered through Greenwood Capital Associates, LLC, an SEC-registered investment advisor.

April 7, 2020

I had to start this letter with the picture of the massive tanker, Ever Given (yes that is the ship’s name, not Evergreen). What a fitting image of a full-size excavator that looks like a Tonka toy next to this ship trying to free it from the bank of the Suez Canal. In many ways this felt like the world fighting to break free from the Covid pandemic over the past twelve months – overwhelmed and outmanned. Yet here we are in April 2021 with over 150 million Americans with at least one vaccine shot, an economy that is beginning to reopen and economic growth in 2021 that is likely to rival anything we have seen in the past 40 years.

And to think a year ago, the cartoon to the right captured the sentiment in April 2020. I hope this letter finds you well and I trust that today you have sufficient supplies of all your essentials. There is no shortage of topics to talk about, so let’s get to it.

Vaccination Progress

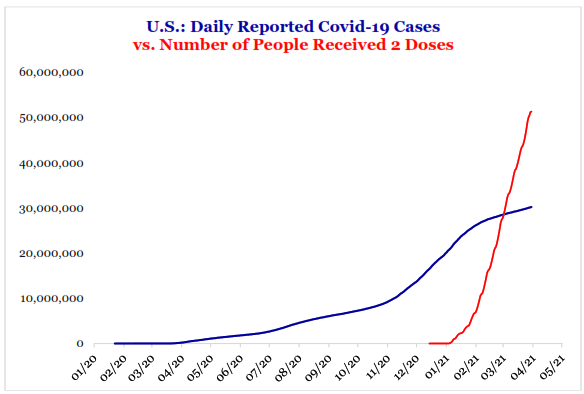

To start with some encouraging news, the chart below highlights an important milestone that was passed in the first quarter this year. In the US, we surpassed more people being vaccinated than total cases reported. And we are progressing at an even faster pace in recent days, averaging nearly 3 million vaccination doses per day and reaching a new high of 5 million doses administered in one day over the past weekend. I have to say thank you once again to the scientists and front-line workers making this happen in such a short time frame.

As vaccinations have increased, we are seeing mobility data improve around the US, including increased air travel and restaurant reservations. If 2020 was the year of the toilet paper shortage, 2021 might be the year of flight and hotel room shortages as capacity in these industries was cut significantly during the downturn. Still, despite this positive backdrop on the virus in this country, we see problems emerging overseas in Europe, India, and elsewhere due to a lack of vaccine supply and variants in the disease causing more lockdowns and a slower recovery. We need to watch this emerging risk carefully in the coming weeks and months.

Fiscal Stimulus & Revenue Offsets

I have talked for the past three quarters in these pages about the impact of the fiscal stimulus issued during the past year but I have to mention it again. The reason is, the US government keeps rolling out a new program almost every quarter. The latest was a $1.9 trillion program called the American Rescue Plan.

| When | What | Amount | % GDP |

|---|---|---|---|

| 6-Mar-20 | Coronavirus & Vaccine R&D | $8 Billion | 0.0% |

| 18-Mar-20 | Paid Sick Leave & Un. Claims | $192 Billion | 0.9% |

| 27-Mar-20 | CARES Act | $1.7 Trillion | 7.9% |

| 21-Apr-20 | Payroll Protection Plan | $483 Billion | 2.2% |

| 27-Apr-20 | Phase 4 | $900 Billion | 4.2% |

| 11-Mar-21 | American Rescue Plan | $1.9 Trillion | 8.8% |

The table above provides a summary of the fiscal programs dating back to last year – a total, $5.2 trillion or 24% of GDP. Keep in mind that the initial CARES Act was passed when the unemployment rate was 15%. The latest $1.9 trillion was passed with an unemployment rate of 6%. And here is a heads-up on next quarter’s letter—we are going to probably talk about it again because there is another $2 to $4 trillion of spending that is proposed in the coming months. Granted this next round would be spread over eight years, but you get the idea. If there is any question about why financial markets have recovered and we are looking at GDP growth possibly in the double-digits in 2021, look no further than this table. Oh, and do not forget that nearly $8 trillion Federal Reserve balance sheet. That is helpful as well.

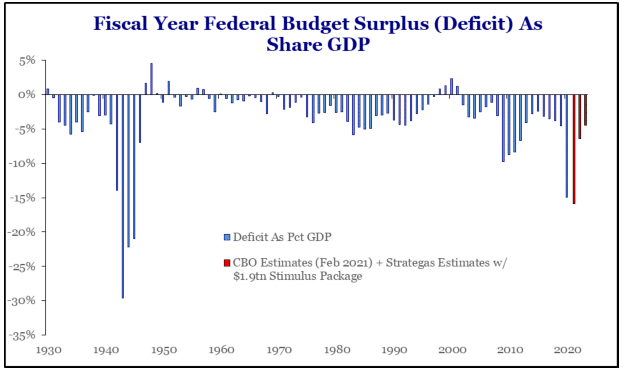

One distinctive feature of all the money spent so far on stimulus is that there have been no revenue offsets to the expenditures (revenue offsets are a nice way to say tax increases). Deficit spending has some limit, right? I mean you cannot go on spending with deficits year after year without any consequences, can you?

Well, actually, the chart to the left below would seem to say you can. At least, that is what the US has been doing for the better part of the past 90 years. However, despite this seemingly endless supply of money, the next round of spending proposals comes with revenue offsets that may pose some risks to the markets in the future. For starters, the Biden Administration has proposed various increases in corporate tax rates that would raise approximately $2 trillion in revenue over 15 years to offset $2.3 trillion in infrastructure spending over 8 years (the American Jobs Plan). The market has taken this initial proposal in stride.

However, the second round of spending, likely to be detailed in the coming weeks/months will include additional tax proposals, including higher individual rates for the highest earners, possibly higher capital gains taxes and potential changes to estate taxes. It is this next round of tax hikes (excuse me, revenue offsets) that may cause some indigestion for investors as certain aspects could become effective upon enactment if passed. We will see how all this shakes out in the coming months. As usual, watching the sausage get made will not be pretty and given the narrow majorities in the Senate and House, Democrats will need to have everyone on board to move forward. One thing I can say with confidence is this will not be a repeat of the relatively easy pass of the American Rescue Plan earlier this year. One item to keep an eye on as we move through the legislative process is the filibuster rule in the Senate. As it stands currently, the filibuster provides some checks and balances in the Senate for the majority party, requiring 60 votes for many measures to pass. There have been rumblings lately about potentially changing or eliminating the filibuster. If done, this would open the door to more significant policy changes than currently contemplated. As a moderate Democrat that has historically been opposed to changing the rule, Senator Joe Manchin of West Virginia holds a significant amount of power in this discussion, so watch what he says.

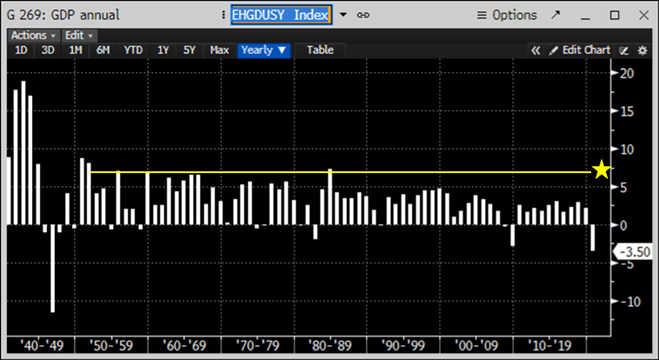

Economic Growth

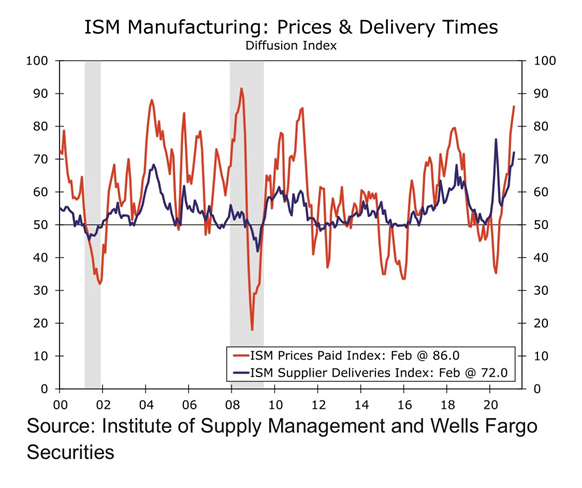

While the prospect of higher taxes as well as less spending create a significant headwind for 2022, the current year could be one with the type of economic growth very few in the investment industry have seen. Annual GDP growth has the potential to be in excess of 7%. That is something the US has not seen since 1984 and prior to that 1955 (see the chart at right). As I mentioned earlier, this growth is being super-charged by stimulus from the federal government and the central bank coinciding with the reopening of the economy as vaccinations accelerate. This is creating some real supply chain issues for many industries and increasing prices on a number of different products.

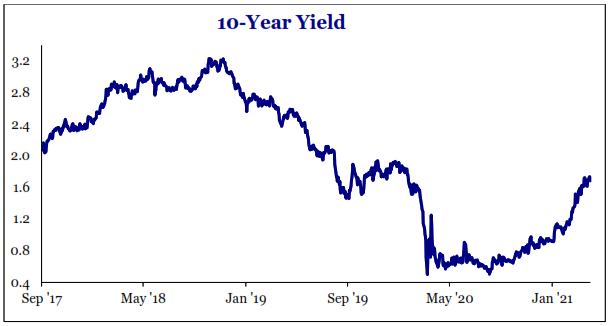

The chart on the left shows an acceleration in the prices-paid component as well as delivery times in the latest ISM Manufacturing report. Beyond these government reports, you have also probably read the stories about the semiconductor shortage impacting automobile and consumer electronics production globally; or how about the shortage of housing inventory and associated price increases for homes – up 11.2% year-over-year in the latest Case-Shiller reading. The Federal Reserve acknowledges these temporary, demand-driven spikes in prices but says we do not have any sustainable inflation. Time will tell. In the meantime, interest rates are responding to the increasing inflation pressures and government spending. The chart on the right above illustrating US 10-year Treasury yields as well as John Wiseman’s piece in the accompanying Market Commentary for more details.

Game Stop’s Race to the Top

Of course, no discussion of the past three months would be complete without mentioning the GameStop saga that emerged in mid-January. The stock went from $20 to $500 and back to $40 all in the span of a month, fueled by an epic short squeeze that moved against investors betting the company would go out of business.

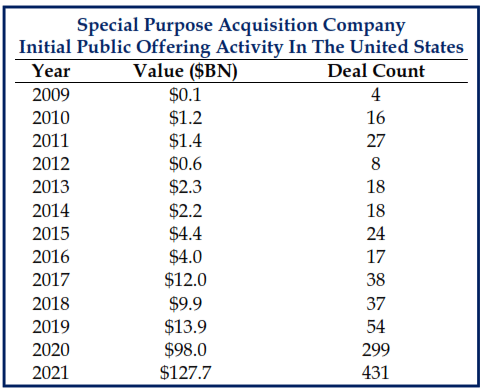

One fund in particular, Melvin Capital, lost more than 50% on this position. This situation, along with explosion in the issuance of SPACs (Special Purpose Acquisition Companies –see table on the following page) are a symptom of the excess liquidity current in the system as well as the move to no-cost trading that occurred in October 2019.

This backdrop coupled with the increasing use of margin debt by investors (Google Greensill Capital or Archegos Capital to read more) to try and boost returns are evidence of excessive risk taking in certain corners of the market. So far, the Federal Reserve, when asked about Financial Stability concerns and the consequences of very loose monetary policy, have dismissed these concerns. However, I can assure you they are monitoring it behind the scenes. For the time being, the punch bowl remains at the party but those that are being overserved are being carried out of the room, one by one.

I will conclude my remarks there but, as always, please feel free to email or call if you have any questions or follow up. The past 12 months have presented many challenges and opportunities as well. I am very proud of the team here at Greenwood Capital and I hope that we have been able to meet your expectations for service as your trusted financial partner.

On behalf of all the employees at Greenwood Capital,

Sincerely,

Walter B. Todd, III

President/Chief Investment Officer

The information contained within has been obtained from sources believed to be reliable but cannot be guaranteed for accuracy. The opinions expressed are subject to change from time to time and do not constitute a recommendation to purchase or sell any security nor to engage in any particular investment strategy. Investment Advisory Services are offered through Greenwood Capital Associates, LLC, an SEC-registered investment advisor.