Walter B. Todd, III

President/Chief Investment Officer

The information contained within has been obtained from sources believed to be reliable but cannot be guaranteed for accuracy. The opinions expressed are subject to change from time to time and do not constitute a recommendation to purchase or sell any security nor to engage in any particular investment strategy. Investment Advisory Services are offered through Greenwood Capital Associates, LLC, an SEC-registered investment advisor.

Sincerely,

Walter B. Todd, III

President/Chief Investment Officer

The information contained within has been obtained from sources believed to be reliable but cannot be guaranteed for accuracy. The opinions expressed are subject to change from time to time and do not constitute a recommendation to purchase or sell any security nor to engage in any particular investment strategy. Investment Advisory Services are offered through Greenwood Capital Associates, LLC, an SEC-registered investment advisor.

On behalf of all the employees at Greenwood Capital,

Sincerely,

Walter B. Todd, III

President/Chief Investment Officer

The information contained within has been obtained from sources believed to be reliable but cannot be guaranteed for accuracy. The opinions expressed are subject to change from time to time and do not constitute a recommendation to purchase or sell any security nor to engage in any particular investment strategy. Investment Advisory Services are offered through Greenwood Capital Associates, LLC, an SEC-registered investment advisor.

On this front, we are getting an increasing number of questions about crypto currencies, including Bitcoin and others. While there is no question that the blockchain technology behind Bitcoin is changing the technology landscape, the future of Bitcoin specifically may be more dependent on the regulations and scrutiny it faces as it becomes more popular – just look to the latest crack down from China and other countries as an example. I will certainly admit that I do not fully understand the subject, but what I do know is that countries will not quietly give up control of their sovereign currencies and their ability to tax their citizens. We will continue to endeavor to learn more and in the interim, feel free to call if you would like to discuss further. Justin Bartanus on our staff is our resident expert on the subject here at Greenwood Capital.

I will conclude my remarks there but, as always, please feel free to email or call if you have any questions or follow up. Please continue to look at the Insights section of our website for additional resources, including our recent video on transitory inflation. We are happy to report that we are back in the office now and welcome the opportunity to meet with you and reconnect in person if that is something you desire and are comfortable doing. Thank you as always for your continued trust in Greenwood Capital.

On behalf of all the employees at Greenwood Capital,

Sincerely,

Walter B. Todd, III

President/Chief Investment Officer

The information contained within has been obtained from sources believed to be reliable but cannot be guaranteed for accuracy. The opinions expressed are subject to change from time to time and do not constitute a recommendation to purchase or sell any security nor to engage in any particular investment strategy. Investment Advisory Services are offered through Greenwood Capital Associates, LLC, an SEC-registered investment advisor.

It is interesting to note on inflation that in the quarter where the Federal Reserve actually raised the idea that inflation was running hotter than they expected (at their June meeting), financial markets are moving in the opposite direction. Treasury yields, for example, have moved down from 1.77% at the end of March to 1.49% today. Similarly, the equity market has recently rotated away from those sectors that would benefit from inflation (Materials, Energy, Financials, Industrials) toward Technology and Healthcare. Rates and the sector performance will be important to watch going forward (see our Market Commentary for more discussion on these topics).

Government Spending

Moving on to Washington policy, I gave you a heads-up in last quarter’s letter that we would be talking about yet another fiscal package this time around and our good friends in Washington did not disappoint. We have a tentative deal on a bipartisan infrastructure package of approximately $590 billion. Rather small when compared to the trillion-dollar spending bills of the past year, but this bill is likely just a down payment on a larger budget and reconciliation deal yet to come in the fall. Recall that Democrats had proposed an additional $1.5 to $2 trillion in spending on various infrastructure and related projects. This additional spending is also likely to be accompanied by tax increases, including corporate and capital gains tax increase proposals that we discussed last quarter. While I know there is tremendous amount of interest and concern about what these new taxes will ultimately be, it is difficult to pinpoint what the rates might be and when they may become effective. Our best guess is that corporate and capital gains taxes will be in the 25% to 28% range. Corporate taxes likely go into effect next year, but capital gains could start this year. We are watching the process closely and will let you know as the outlook becomes clearer later this year.

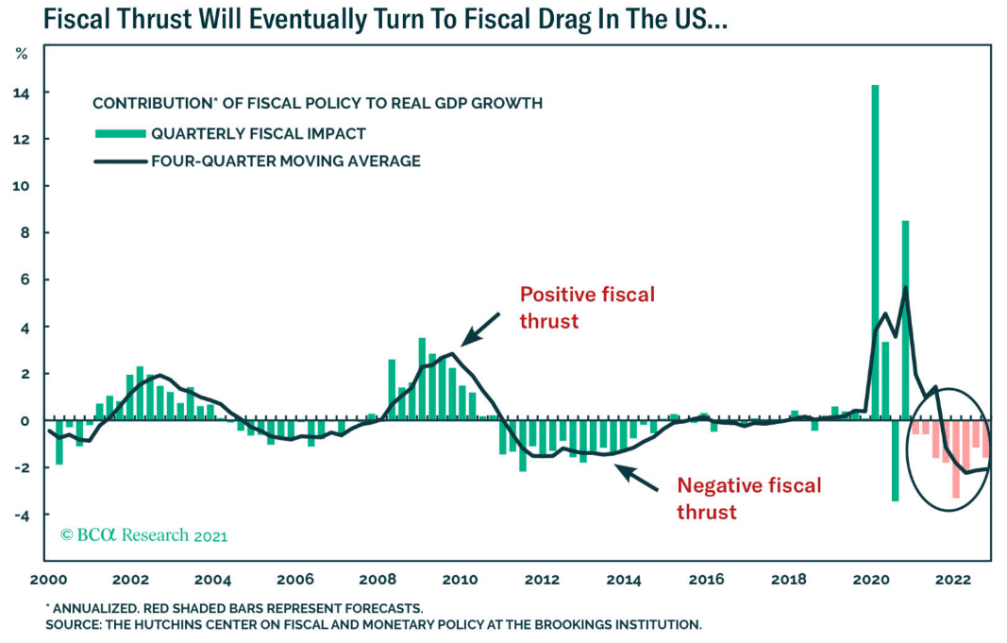

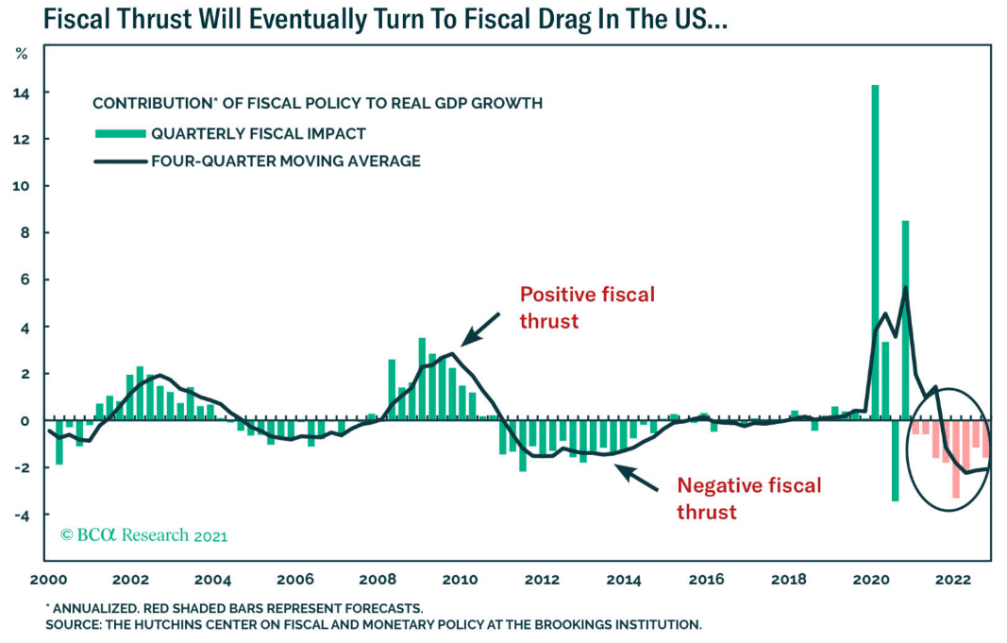

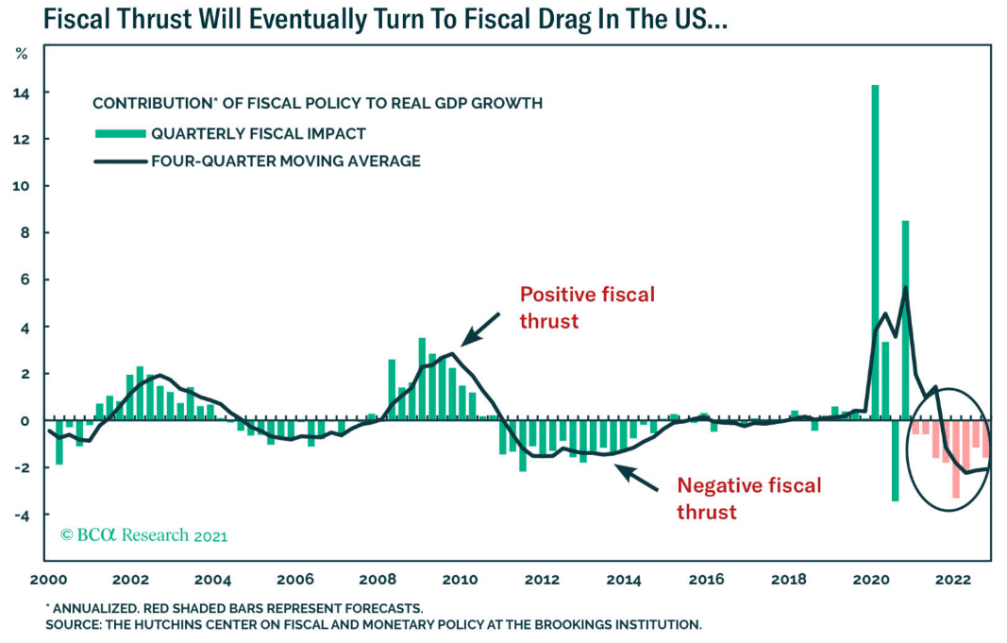

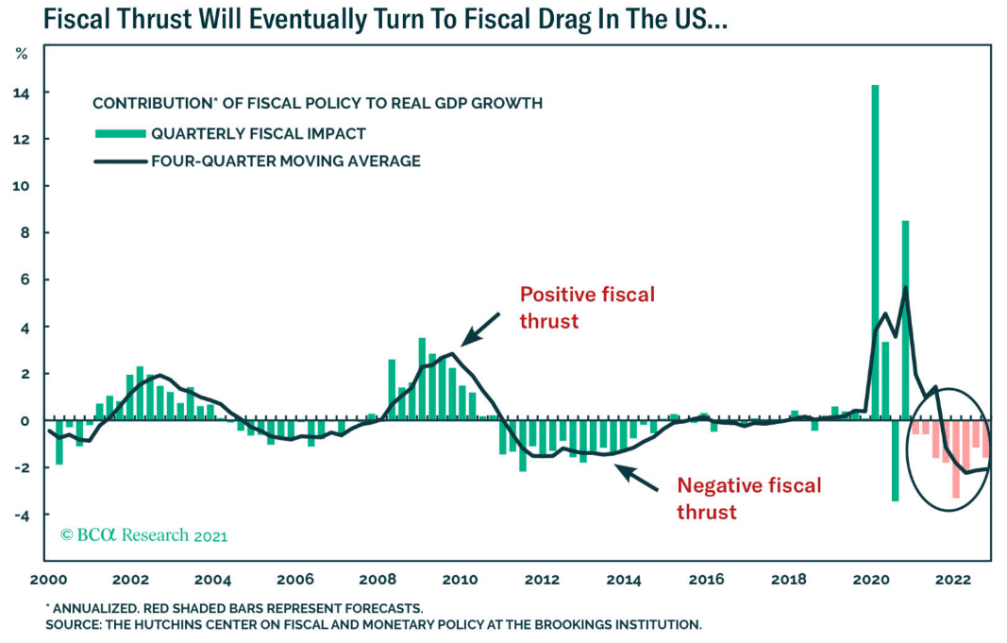

The bottom line is, as we look ahead and think about 2022, it will be important to remember that despite the continued largesse provided by the Federal Government this year, the tailwind of fiscal spending will start to wane in the coming twelve months (see chart), eventually becoming a drag on growth.

Finally, as we move toward the fall, with the debate on these spending bills and the budget, watch for a discussion on extending the debt ceiling. This has been suspended for a while, but could become a problem as it is scheduled to come back into effect and technically expire at the end of July. The government can continue to operate into September and probably early October, but at some point, it will need to be addressed. The last big showdown we had on the debt ceiling occurred in 2011. That did not end well.

For the time being however, as John McAlhany highlights in our Market Commentary piece, the economic data in the US and globally continues to be robust. We know that the Delta variant of Covid has been raising some concerns about reopening, especially in the UK and Australia. Still, the early results here are that even as cases are accelerating in these areas, deaths and hospitalizations have not followed, as of now. We will watch these developments closely and note that this may have something to do with the recent weakness in rates and the reopening trade we discussed above.

Bitcoin & Blockchain

I ended the letter last quarter talking about some of the excessive speculation we were seeing in the form of SPAC’s / IPO’s, soaring prices in non-profitable companies and other assets like crypto currencies. While these areas have seen pullbacks of 25-30% from their highs and in the case of Bitcoin, over 40%, we are starting to see a bid come back into these markets in the past month, coinciding with the recent fall in interest rates.

Going back to our discussion on inflation, it is traditionally defined as too much money chasing too few goods. I believe this is the case in certain areas of the financial markets. There is so much money in the system (chart, below right, quoted in trillions) from central banks and governments around the world that is looking for a home and finding it in ever more speculative corners of the market.

On this front, we are getting an increasing number of questions about crypto currencies, including Bitcoin and others. While there is no question that the blockchain technology behind Bitcoin is changing the technology landscape, the future of Bitcoin specifically may be more dependent on the regulations and scrutiny it faces as it becomes more popular – just look to the latest crack down from China and other countries as an example. I will certainly admit that I do not fully understand the subject, but what I do know is that countries will not quietly give up control of their sovereign currencies and their ability to tax their citizens. We will continue to endeavor to learn more and in the interim, feel free to call if you would like to discuss further. Justin Bartanus on our staff is our resident expert on the subject here at Greenwood Capital.

I will conclude my remarks there but, as always, please feel free to email or call if you have any questions or follow up. Please continue to look at the Insights section of our website for additional resources, including our recent video on transitory inflation. We are happy to report that we are back in the office now and welcome the opportunity to meet with you and reconnect in person if that is something you desire and are comfortable doing. Thank you as always for your continued trust in Greenwood Capital.

On behalf of all the employees at Greenwood Capital,

Sincerely,

Walter B. Todd, III

President/Chief Investment Officer

The information contained within has been obtained from sources believed to be reliable but cannot be guaranteed for accuracy. The opinions expressed are subject to change from time to time and do not constitute a recommendation to purchase or sell any security nor to engage in any particular investment strategy. Investment Advisory Services are offered through Greenwood Capital Associates, LLC, an SEC-registered investment advisor.

So, prices are elevated as the economy reopens and demand outstrips supply in certain areas. However, we would agree with the Federal Reserve that many of the sharper price increases should start to moderate as supply catches up. Whether the time this takes to happen is “transitory” as the Federal Reserve likes to say, I guess depends on your definition of time. Some prices may take months to correct, others years and in some instances, may be permanently higher. Wages would be one example where recent increases seem unlikely to go in reverse.

As employers around the world fight to fill positions, the minimum wage in the US is moving higher, even as there is no federal mandate to do so. Supply and demand are working to create a higher equilibrium starting wage somewhere around $15/hr. It is hard to see this going back to $10/hr or lower. You can imagine that those businesses that can pass along higher prices will do so to offset these increased costs. Witness Chipotle Mexican Grill which hiked menu prices by about 4% recently. Yet part of the problem in the labor market has been the supply imbalance created by workers not seeking out jobs in the marketplace. There are a variety of factors at play here, but one that is often cited is the excess unemployment benefits that began last year during the pandemic, continuing to be paid.

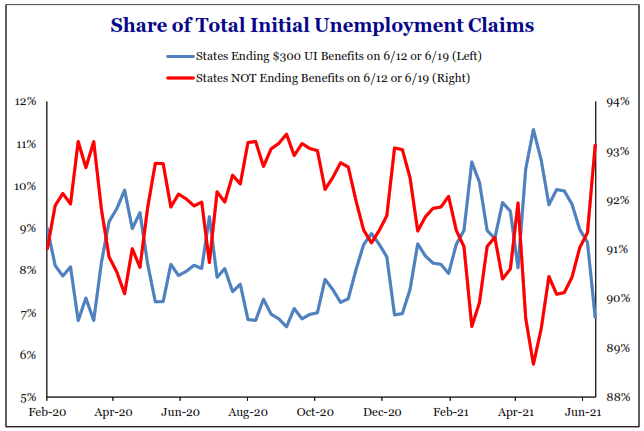

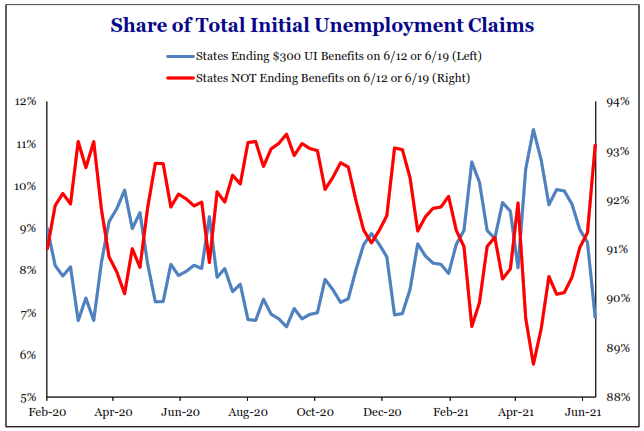

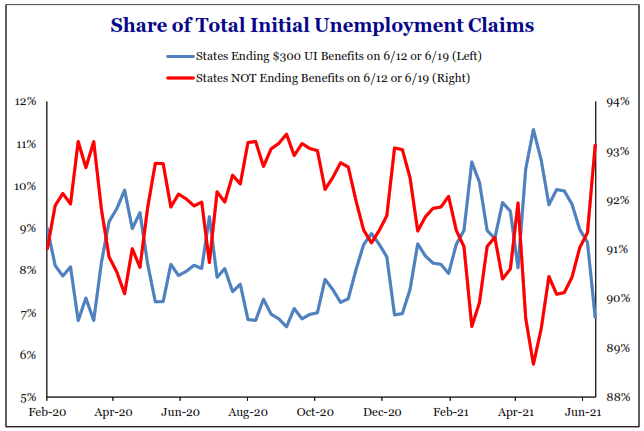

These excess federal benefits are set to expire in September, but twenty-five states have announced plans to end them by the first week of July, with twelve of those ending them by June 19. It is early, but the chart to the left shows some evidence that removing these benefits is creating fewer initial unemployment claims in these states (i.e. more people are looking for and finding jobs). If this trend continues, we could see some alleviation of the supply/demand mismatch in the labor market. Time will tell.

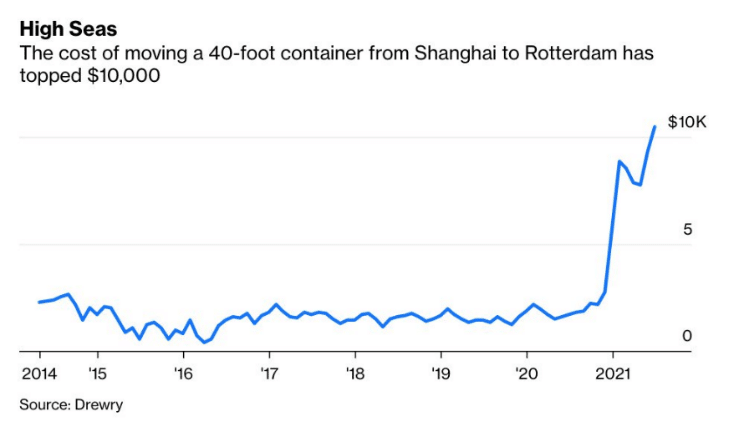

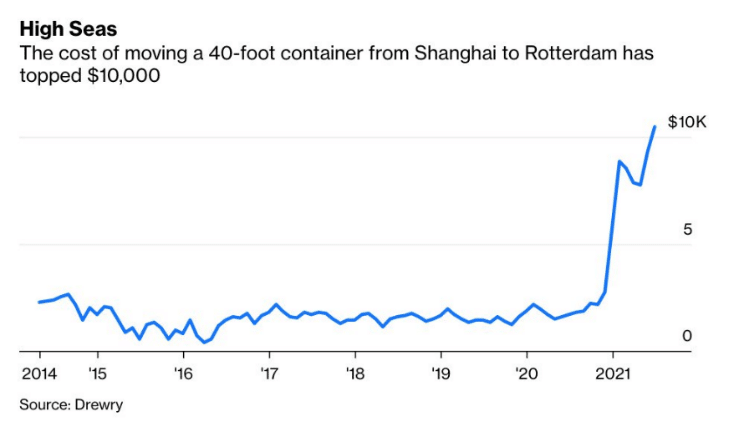

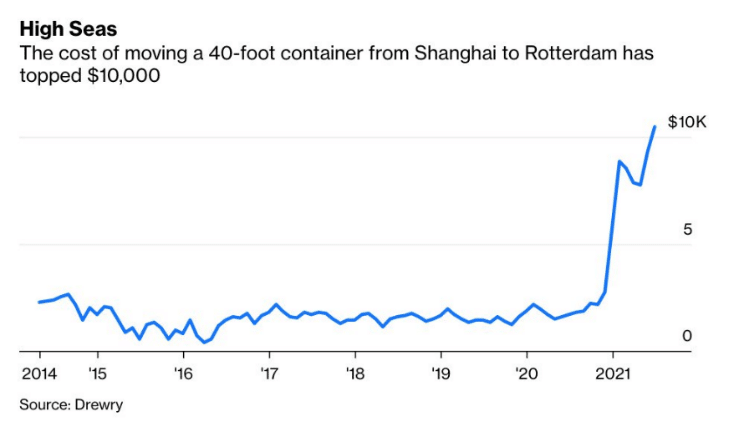

On the other hand, the supply chain disruptions we have talked about before that are causing the “transitory” inflationary pressures in the economy are still significant. We have all seen pictures of the big container ships coming into ports around the world to deliver goods in the global supply chain, but have you ever thought about how much one these cost to move? Because of the disruptions created over the past year, we are seeing the cost of these containers skyrocket as there is a buildup of empty containers in certain parts of the world and shortages in other areas. The chart below shows the cost of moving a 40-foot container from Shanghai to Rotterdam has increased 10-fold from its pre-Covid levels. Producers utilizing the shipping routes will need to raise prices to offset these costs or see their profits evaporate.

It is interesting to note on inflation that in the quarter where the Federal Reserve actually raised the idea that inflation was running hotter than they expected (at their June meeting), financial markets are moving in the opposite direction. Treasury yields, for example, have moved down from 1.77% at the end of March to 1.49% today. Similarly, the equity market has recently rotated away from those sectors that would benefit from inflation (Materials, Energy, Financials, Industrials) toward Technology and Healthcare. Rates and the sector performance will be important to watch going forward (see our Market Commentary for more discussion on these topics).

Government Spending

Moving on to Washington policy, I gave you a heads-up in last quarter’s letter that we would be talking about yet another fiscal package this time around and our good friends in Washington did not disappoint. We have a tentative deal on a bipartisan infrastructure package of approximately $590 billion. Rather small when compared to the trillion-dollar spending bills of the past year, but this bill is likely just a down payment on a larger budget and reconciliation deal yet to come in the fall. Recall that Democrats had proposed an additional $1.5 to $2 trillion in spending on various infrastructure and related projects. This additional spending is also likely to be accompanied by tax increases, including corporate and capital gains tax increase proposals that we discussed last quarter. While I know there is tremendous amount of interest and concern about what these new taxes will ultimately be, it is difficult to pinpoint what the rates might be and when they may become effective. Our best guess is that corporate and capital gains taxes will be in the 25% to 28% range. Corporate taxes likely go into effect next year, but capital gains could start this year. We are watching the process closely and will let you know as the outlook becomes clearer later this year.

The bottom line is, as we look ahead and think about 2022, it will be important to remember that despite the continued largesse provided by the Federal Government this year, the tailwind of fiscal spending will start to wane in the coming twelve months (see chart), eventually becoming a drag on growth.

Finally, as we move toward the fall, with the debate on these spending bills and the budget, watch for a discussion on extending the debt ceiling. This has been suspended for a while, but could become a problem as it is scheduled to come back into effect and technically expire at the end of July. The government can continue to operate into September and probably early October, but at some point, it will need to be addressed. The last big showdown we had on the debt ceiling occurred in 2011. That did not end well.

For the time being however, as John McAlhany highlights in our Market Commentary piece, the economic data in the US and globally continues to be robust. We know that the Delta variant of Covid has been raising some concerns about reopening, especially in the UK and Australia. Still, the early results here are that even as cases are accelerating in these areas, deaths and hospitalizations have not followed, as of now. We will watch these developments closely and note that this may have something to do with the recent weakness in rates and the reopening trade we discussed above.

Bitcoin & Blockchain

I ended the letter last quarter talking about some of the excessive speculation we were seeing in the form of SPAC’s / IPO’s, soaring prices in non-profitable companies and other assets like crypto currencies. While these areas have seen pullbacks of 25-30% from their highs and in the case of Bitcoin, over 40%, we are starting to see a bid come back into these markets in the past month, coinciding with the recent fall in interest rates.

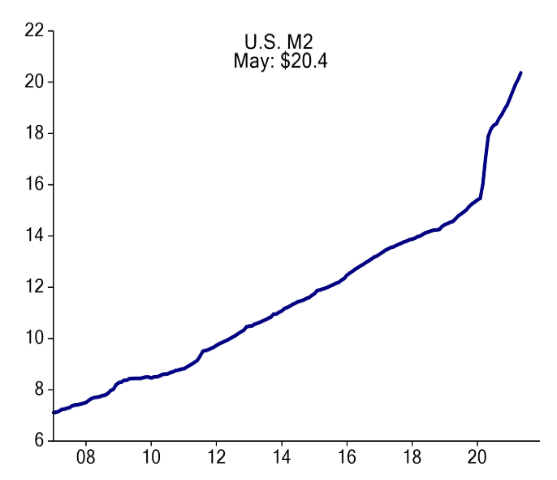

Going back to our discussion on inflation, it is traditionally defined as too much money chasing too few goods. I believe this is the case in certain areas of the financial markets. There is so much money in the system (chart, below right, quoted in trillions) from central banks and governments around the world that is looking for a home and finding it in ever more speculative corners of the market.

On this front, we are getting an increasing number of questions about crypto currencies, including Bitcoin and others. While there is no question that the blockchain technology behind Bitcoin is changing the technology landscape, the future of Bitcoin specifically may be more dependent on the regulations and scrutiny it faces as it becomes more popular – just look to the latest crack down from China and other countries as an example. I will certainly admit that I do not fully understand the subject, but what I do know is that countries will not quietly give up control of their sovereign currencies and their ability to tax their citizens. We will continue to endeavor to learn more and in the interim, feel free to call if you would like to discuss further. Justin Bartanus on our staff is our resident expert on the subject here at Greenwood Capital.

I will conclude my remarks there but, as always, please feel free to email or call if you have any questions or follow up. Please continue to look at the Insights section of our website for additional resources, including our recent video on transitory inflation. We are happy to report that we are back in the office now and welcome the opportunity to meet with you and reconnect in person if that is something you desire and are comfortable doing. Thank you as always for your continued trust in Greenwood Capital.

On behalf of all the employees at Greenwood Capital,

Sincerely,

Walter B. Todd, III

President/Chief Investment Officer

The information contained within has been obtained from sources believed to be reliable but cannot be guaranteed for accuracy. The opinions expressed are subject to change from time to time and do not constitute a recommendation to purchase or sell any security nor to engage in any particular investment strategy. Investment Advisory Services are offered through Greenwood Capital Associates, LLC, an SEC-registered investment advisor.

I hope that you are enjoying your summer playing golf or otherwise and that this letter finds you safe and healthy. As much as I would like to continue discussing the upside of life after 50, as always there is no shortage of financial market topics to cover,

so let’s get to it.

Inflation

I have to start our discussion this quarter talking about the topic we get the most questions about – inflation. Some of you may remember the “Whip Inflation Now” buttons from the 1970’s pictured below. While there are any number of individual year-over-year price increases you could point to that would rival this period of time (used cars, homes, lumber, etc.), the overall inflation picture (as measured by the Consumer Price Index or CPI) is not close to the double-digit levels we saw in 1974-75 and 1979-80. Still, I will admit that the last time the Core CPI measure (CPI less food and energy) was at this level (3.8%), I was finishing up my junior year in college. (You can do the math from my birthday mentioned above, i.e. a long time ago.)

So, prices are elevated as the economy reopens and demand outstrips supply in certain areas. However, we would agree with the Federal Reserve that many of the sharper price increases should start to moderate as supply catches up. Whether the time this takes to happen is “transitory” as the Federal Reserve likes to say, I guess depends on your definition of time. Some prices may take months to correct, others years and in some instances, may be permanently higher. Wages would be one example where recent increases seem unlikely to go in reverse.

As employers around the world fight to fill positions, the minimum wage in the US is moving higher, even as there is no federal mandate to do so. Supply and demand are working to create a higher equilibrium starting wage somewhere around $15/hr. It is hard to see this going back to $10/hr or lower. You can imagine that those businesses that can pass along higher prices will do so to offset these increased costs. Witness Chipotle Mexican Grill which hiked menu prices by about 4% recently. Yet part of the problem in the labor market has been the supply imbalance created by workers not seeking out jobs in the marketplace. There are a variety of factors at play here, but one that is often cited is the excess unemployment benefits that began last year during the pandemic, continuing to be paid.

These excess federal benefits are set to expire in September, but twenty-five states have announced plans to end them by the first week of July, with twelve of those ending them by June 19. It is early, but the chart to the left shows some evidence that removing these benefits is creating fewer initial unemployment claims in these states (i.e. more people are looking for and finding jobs). If this trend continues, we could see some alleviation of the supply/demand mismatch in the labor market. Time will tell.

On the other hand, the supply chain disruptions we have talked about before that are causing the “transitory” inflationary pressures in the economy are still significant. We have all seen pictures of the big container ships coming into ports around the world to deliver goods in the global supply chain, but have you ever thought about how much one these cost to move? Because of the disruptions created over the past year, we are seeing the cost of these containers skyrocket as there is a buildup of empty containers in certain parts of the world and shortages in other areas. The chart below shows the cost of moving a 40-foot container from Shanghai to Rotterdam has increased 10-fold from its pre-Covid levels. Producers utilizing the shipping routes will need to raise prices to offset these costs or see their profits evaporate.

It is interesting to note on inflation that in the quarter where the Federal Reserve actually raised the idea that inflation was running hotter than they expected (at their June meeting), financial markets are moving in the opposite direction. Treasury yields, for example, have moved down from 1.77% at the end of March to 1.49% today. Similarly, the equity market has recently rotated away from those sectors that would benefit from inflation (Materials, Energy, Financials, Industrials) toward Technology and Healthcare. Rates and the sector performance will be important to watch going forward (see our Market Commentary for more discussion on these topics).

Government Spending

Moving on to Washington policy, I gave you a heads-up in last quarter’s letter that we would be talking about yet another fiscal package this time around and our good friends in Washington did not disappoint. We have a tentative deal on a bipartisan infrastructure package of approximately $590 billion. Rather small when compared to the trillion-dollar spending bills of the past year, but this bill is likely just a down payment on a larger budget and reconciliation deal yet to come in the fall. Recall that Democrats had proposed an additional $1.5 to $2 trillion in spending on various infrastructure and related projects. This additional spending is also likely to be accompanied by tax increases, including corporate and capital gains tax increase proposals that we discussed last quarter. While I know there is tremendous amount of interest and concern about what these new taxes will ultimately be, it is difficult to pinpoint what the rates might be and when they may become effective. Our best guess is that corporate and capital gains taxes will be in the 25% to 28% range. Corporate taxes likely go into effect next year, but capital gains could start this year. We are watching the process closely and will let you know as the outlook becomes clearer later this year.

The bottom line is, as we look ahead and think about 2022, it will be important to remember that despite the continued largesse provided by the Federal Government this year, the tailwind of fiscal spending will start to wane in the coming twelve months (see chart), eventually becoming a drag on growth.

Finally, as we move toward the fall, with the debate on these spending bills and the budget, watch for a discussion on extending the debt ceiling. This has been suspended for a while, but could become a problem as it is scheduled to come back into effect and technically expire at the end of July. The government can continue to operate into September and probably early October, but at some point, it will need to be addressed. The last big showdown we had on the debt ceiling occurred in 2011. That did not end well.

For the time being however, as John McAlhany highlights in our Market Commentary piece, the economic data in the US and globally continues to be robust. We know that the Delta variant of Covid has been raising some concerns about reopening, especially in the UK and Australia. Still, the early results here are that even as cases are accelerating in these areas, deaths and hospitalizations have not followed, as of now. We will watch these developments closely and note that this may have something to do with the recent weakness in rates and the reopening trade we discussed above.

Bitcoin & Blockchain

I ended the letter last quarter talking about some of the excessive speculation we were seeing in the form of SPAC’s / IPO’s, soaring prices in non-profitable companies and other assets like crypto currencies. While these areas have seen pullbacks of 25-30% from their highs and in the case of Bitcoin, over 40%, we are starting to see a bid come back into these markets in the past month, coinciding with the recent fall in interest rates.

Going back to our discussion on inflation, it is traditionally defined as too much money chasing too few goods. I believe this is the case in certain areas of the financial markets. There is so much money in the system (chart, below right, quoted in trillions) from central banks and governments around the world that is looking for a home and finding it in ever more speculative corners of the market.

On this front, we are getting an increasing number of questions about crypto currencies, including Bitcoin and others. While there is no question that the blockchain technology behind Bitcoin is changing the technology landscape, the future of Bitcoin specifically may be more dependent on the regulations and scrutiny it faces as it becomes more popular – just look to the latest crack down from China and other countries as an example. I will certainly admit that I do not fully understand the subject, but what I do know is that countries will not quietly give up control of their sovereign currencies and their ability to tax their citizens. We will continue to endeavor to learn more and in the interim, feel free to call if you would like to discuss further. Justin Bartanus on our staff is our resident expert on the subject here at Greenwood Capital.

I will conclude my remarks there but, as always, please feel free to email or call if you have any questions or follow up. Please continue to look at the Insights section of our website for additional resources, including our recent video on transitory inflation. We are happy to report that we are back in the office now and welcome the opportunity to meet with you and reconnect in person if that is something you desire and are comfortable doing. Thank you as always for your continued trust in Greenwood Capital.

On behalf of all the employees at Greenwood Capital,

Sincerely,

Walter B. Todd, III

President/Chief Investment Officer

The information contained within has been obtained from sources believed to be reliable but cannot be guaranteed for accuracy. The opinions expressed are subject to change from time to time and do not constitute a recommendation to purchase or sell any security nor to engage in any particular investment strategy. Investment Advisory Services are offered through Greenwood Capital Associates, LLC, an SEC-registered investment advisor.

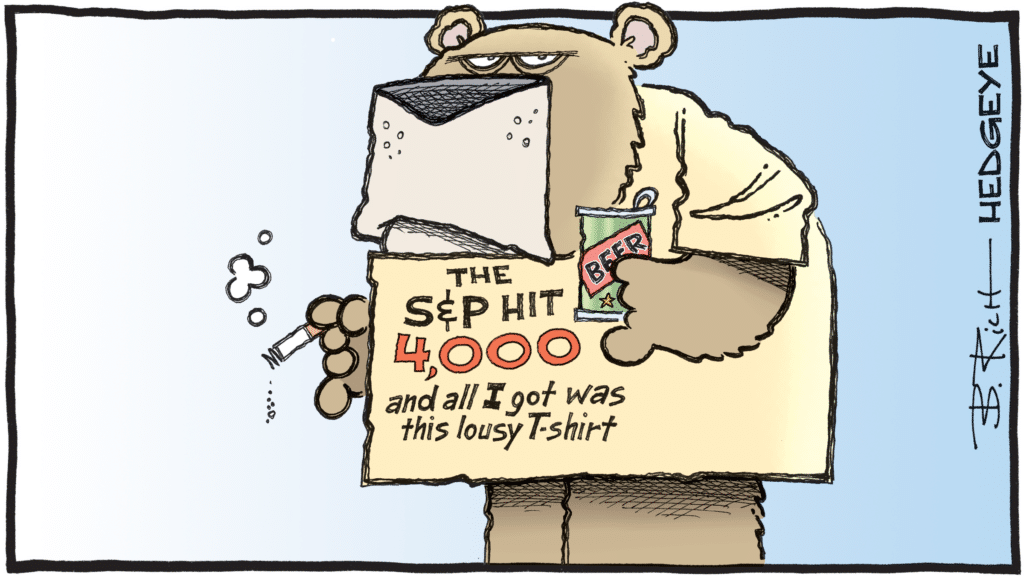

July 7, 2021

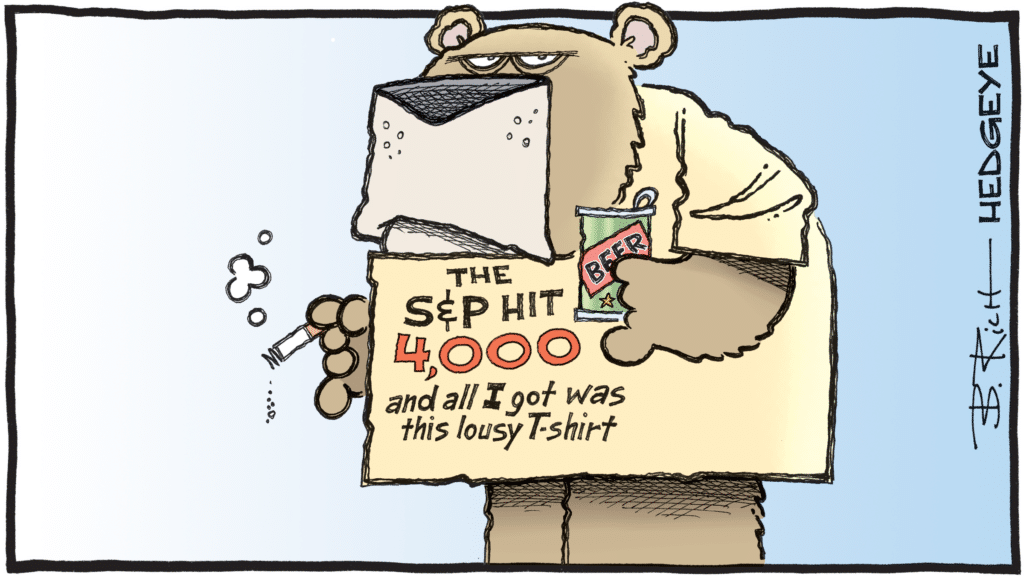

Fifty is the new thirty-five. At least that is what I am saying after Phil Mickelson became the first 50-year old player to win a major championship when he won the PGA Championship at Kiawah Island in May. Of course, the fact that I also turned 50 in May has nothing to do with me embracing this concept. I mean it, nothing. Phil likes to say, “I hit bombs,” referring to his affinity to hitting it a long way down the fairway. If the equity market could speak, it might say the same thing. Another quarter, another record, this time over 4,000 for the S&P 500. Of course, as the market keeps swinging for the fences, it just has to avoid those crazy, out-of-bounds shots that Phil loves to hit on occasion. Remember, drive for show and putt for dough ($$) they say.

I hope that you are enjoying your summer playing golf or otherwise and that this letter finds you safe and healthy. As much as I would like to continue discussing the upside of life after 50, as always there is no shortage of financial market topics to cover,

so let’s get to it.

Inflation

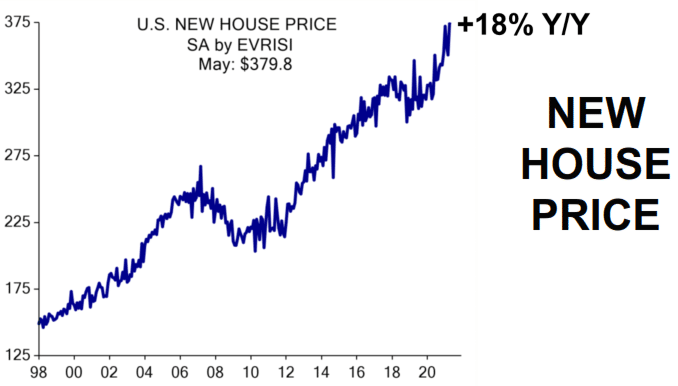

I have to start our discussion this quarter talking about the topic we get the most questions about – inflation. Some of you may remember the “Whip Inflation Now” buttons from the 1970’s pictured below. While there are any number of individual year-over-year price increases you could point to that would rival this period of time (used cars, homes, lumber, etc.), the overall inflation picture (as measured by the Consumer Price Index or CPI) is not close to the double-digit levels we saw in 1974-75 and 1979-80. Still, I will admit that the last time the Core CPI measure (CPI less food and energy) was at this level (3.8%), I was finishing up my junior year in college. (You can do the math from my birthday mentioned above, i.e. a long time ago.)

So, prices are elevated as the economy reopens and demand outstrips supply in certain areas. However, we would agree with the Federal Reserve that many of the sharper price increases should start to moderate as supply catches up. Whether the time this takes to happen is “transitory” as the Federal Reserve likes to say, I guess depends on your definition of time. Some prices may take months to correct, others years and in some instances, may be permanently higher. Wages would be one example where recent increases seem unlikely to go in reverse.

As employers around the world fight to fill positions, the minimum wage in the US is moving higher, even as there is no federal mandate to do so. Supply and demand are working to create a higher equilibrium starting wage somewhere around $15/hr. It is hard to see this going back to $10/hr or lower. You can imagine that those businesses that can pass along higher prices will do so to offset these increased costs. Witness Chipotle Mexican Grill which hiked menu prices by about 4% recently. Yet part of the problem in the labor market has been the supply imbalance created by workers not seeking out jobs in the marketplace. There are a variety of factors at play here, but one that is often cited is the excess unemployment benefits that began last year during the pandemic, continuing to be paid.

These excess federal benefits are set to expire in September, but twenty-five states have announced plans to end them by the first week of July, with twelve of those ending them by June 19. It is early, but the chart to the left shows some evidence that removing these benefits is creating fewer initial unemployment claims in these states (i.e. more people are looking for and finding jobs). If this trend continues, we could see some alleviation of the supply/demand mismatch in the labor market. Time will tell.

On the other hand, the supply chain disruptions we have talked about before that are causing the “transitory” inflationary pressures in the economy are still significant. We have all seen pictures of the big container ships coming into ports around the world to deliver goods in the global supply chain, but have you ever thought about how much one these cost to move? Because of the disruptions created over the past year, we are seeing the cost of these containers skyrocket as there is a buildup of empty containers in certain parts of the world and shortages in other areas. The chart below shows the cost of moving a 40-foot container from Shanghai to Rotterdam has increased 10-fold from its pre-Covid levels. Producers utilizing the shipping routes will need to raise prices to offset these costs or see their profits evaporate.

It is interesting to note on inflation that in the quarter where the Federal Reserve actually raised the idea that inflation was running hotter than they expected (at their June meeting), financial markets are moving in the opposite direction. Treasury yields, for example, have moved down from 1.77% at the end of March to 1.49% today. Similarly, the equity market has recently rotated away from those sectors that would benefit from inflation (Materials, Energy, Financials, Industrials) toward Technology and Healthcare. Rates and the sector performance will be important to watch going forward (see our Market Commentary for more discussion on these topics).

Government Spending

Moving on to Washington policy, I gave you a heads-up in last quarter’s letter that we would be talking about yet another fiscal package this time around and our good friends in Washington did not disappoint. We have a tentative deal on a bipartisan infrastructure package of approximately $590 billion. Rather small when compared to the trillion-dollar spending bills of the past year, but this bill is likely just a down payment on a larger budget and reconciliation deal yet to come in the fall. Recall that Democrats had proposed an additional $1.5 to $2 trillion in spending on various infrastructure and related projects. This additional spending is also likely to be accompanied by tax increases, including corporate and capital gains tax increase proposals that we discussed last quarter. While I know there is tremendous amount of interest and concern about what these new taxes will ultimately be, it is difficult to pinpoint what the rates might be and when they may become effective. Our best guess is that corporate and capital gains taxes will be in the 25% to 28% range. Corporate taxes likely go into effect next year, but capital gains could start this year. We are watching the process closely and will let you know as the outlook becomes clearer later this year.

The bottom line is, as we look ahead and think about 2022, it will be important to remember that despite the continued largesse provided by the Federal Government this year, the tailwind of fiscal spending will start to wane in the coming twelve months (see chart), eventually becoming a drag on growth.

Finally, as we move toward the fall, with the debate on these spending bills and the budget, watch for a discussion on extending the debt ceiling. This has been suspended for a while, but could become a problem as it is scheduled to come back into effect and technically expire at the end of July. The government can continue to operate into September and probably early October, but at some point, it will need to be addressed. The last big showdown we had on the debt ceiling occurred in 2011. That did not end well.

For the time being however, as John McAlhany highlights in our Market Commentary piece, the economic data in the US and globally continues to be robust. We know that the Delta variant of Covid has been raising some concerns about reopening, especially in the UK and Australia. Still, the early results here are that even as cases are accelerating in these areas, deaths and hospitalizations have not followed, as of now. We will watch these developments closely and note that this may have something to do with the recent weakness in rates and the reopening trade we discussed above.

Bitcoin & Blockchain

I ended the letter last quarter talking about some of the excessive speculation we were seeing in the form of SPAC’s / IPO’s, soaring prices in non-profitable companies and other assets like crypto currencies. While these areas have seen pullbacks of 25-30% from their highs and in the case of Bitcoin, over 40%, we are starting to see a bid come back into these markets in the past month, coinciding with the recent fall in interest rates.

Going back to our discussion on inflation, it is traditionally defined as too much money chasing too few goods. I believe this is the case in certain areas of the financial markets. There is so much money in the system (chart, below right, quoted in trillions) from central banks and governments around the world that is looking for a home and finding it in ever more speculative corners of the market.

On this front, we are getting an increasing number of questions about crypto currencies, including Bitcoin and others. While there is no question that the blockchain technology behind Bitcoin is changing the technology landscape, the future of Bitcoin specifically may be more dependent on the regulations and scrutiny it faces as it becomes more popular – just look to the latest crack down from China and other countries as an example. I will certainly admit that I do not fully understand the subject, but what I do know is that countries will not quietly give up control of their sovereign currencies and their ability to tax their citizens. We will continue to endeavor to learn more and in the interim, feel free to call if you would like to discuss further. Justin Bartanus on our staff is our resident expert on the subject here at Greenwood Capital.

I will conclude my remarks there but, as always, please feel free to email or call if you have any questions or follow up. Please continue to look at the Insights section of our website for additional resources, including our recent video on transitory inflation. We are happy to report that we are back in the office now and welcome the opportunity to meet with you and reconnect in person if that is something you desire and are comfortable doing. Thank you as always for your continued trust in Greenwood Capital.

On behalf of all the employees at Greenwood Capital,

Sincerely,

Walter B. Todd, III

President/Chief Investment Officer

The information contained within has been obtained from sources believed to be reliable but cannot be guaranteed for accuracy. The opinions expressed are subject to change from time to time and do not constitute a recommendation to purchase or sell any security nor to engage in any particular investment strategy. Investment Advisory Services are offered through Greenwood Capital Associates, LLC, an SEC-registered investment advisor.