July 7, 2023

Happy July 4th to you and yours.

I hope that you enjoyed a nice, mid-week holiday and were able to stay cool. We have many exciting firm updates for you this quarter, but of course we will start things off with an around-the-horn look at what is happening in the world today and the impact on financial markets.

I recently heard someone describe this market environment as “the most intellectually challenging” they could recall. I think I would agree with that analysis. I think it is appropriate because if you could have told me future events ahead of time at the beginning of the year, I don’t think I would have been able to predict the outcomes we have halfway through.

During the first half of 2023, we had the 2nd, 3rd, and 4th largest bank failures in US history in March, the Fed continued to hike rates to 5.25% (and counting) and we ended it with a mercenary army speeding toward Moscow to potentially overthrow Putin. If you had given me those facts on January 1, 2023, I can honestly say I would not have predicted the S&P 500 to be up double digits, the volatility index (VIX) to be near multi-year lows and the unemployment rate to be close to 50-year lows.

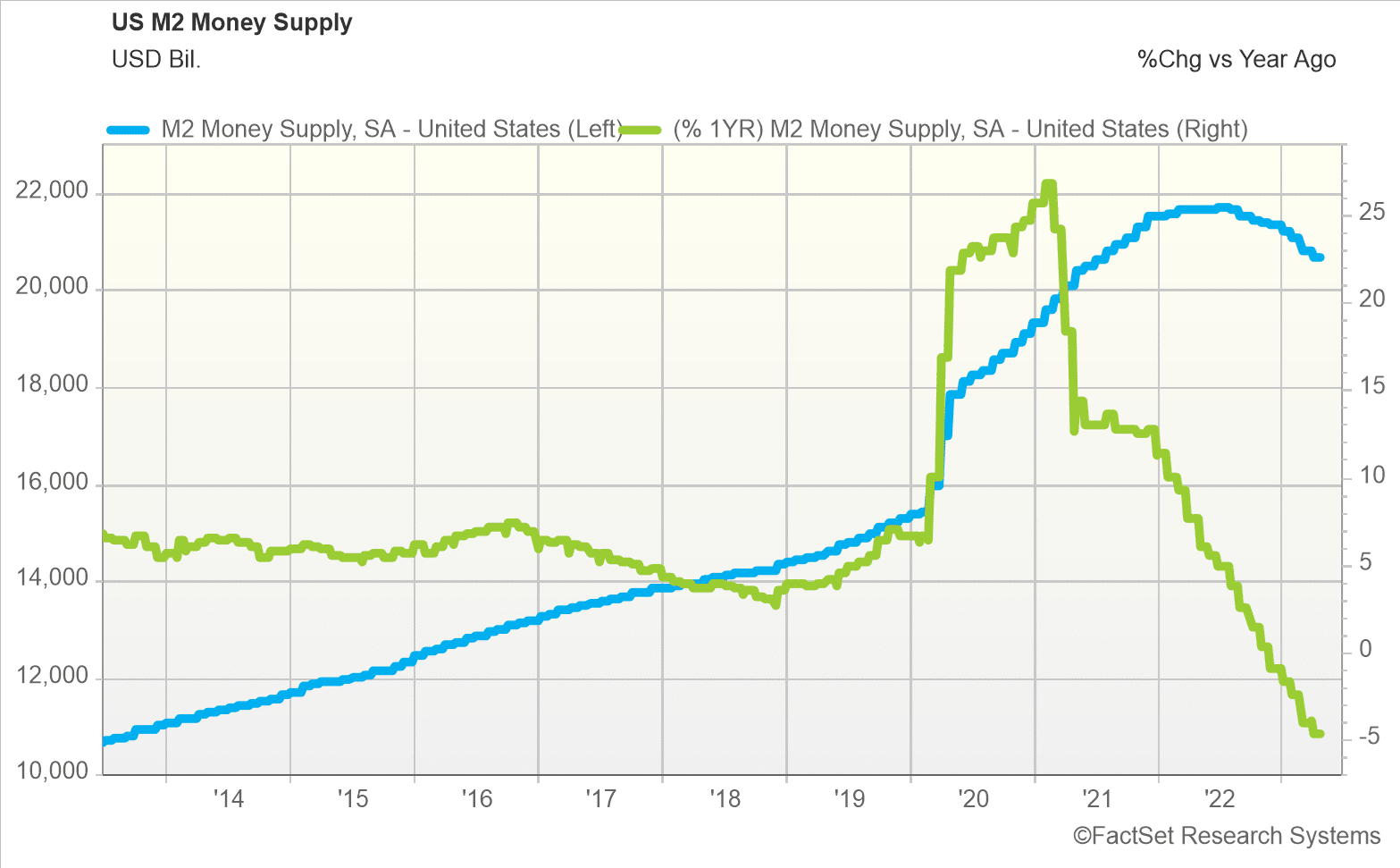

So why is that the case? Perhaps it is largely explained by one chart. The chart to the left shows the money supply in the US as measured by M2.

Like many others, we have focused on the green line in this chart, which shows the year-over-year growth rate in the money supply tied to the right-hand axis. It is down nearly 5%, which is not something we have seen since the 1930s. This would normally create significant headwinds for financial markets and economic growth.

However, the solid blue line may be more important, showing the absolute level of money supply. Comparing this line to the dashed blue one (the pre-pandemic trend), you can see we still have about $3 to $4 trillion in “excess money” in the system – a reminder of the extreme actions taken during the pandemic in 2020 and 2021. This excess is helping consumers continue to spend, is being used by private markets to help offset credit tightening in the traditional banking system and is finding its way directly into public financial markets. That is the best explanation I have for what has happened so far this year.

The A.I. Obsession

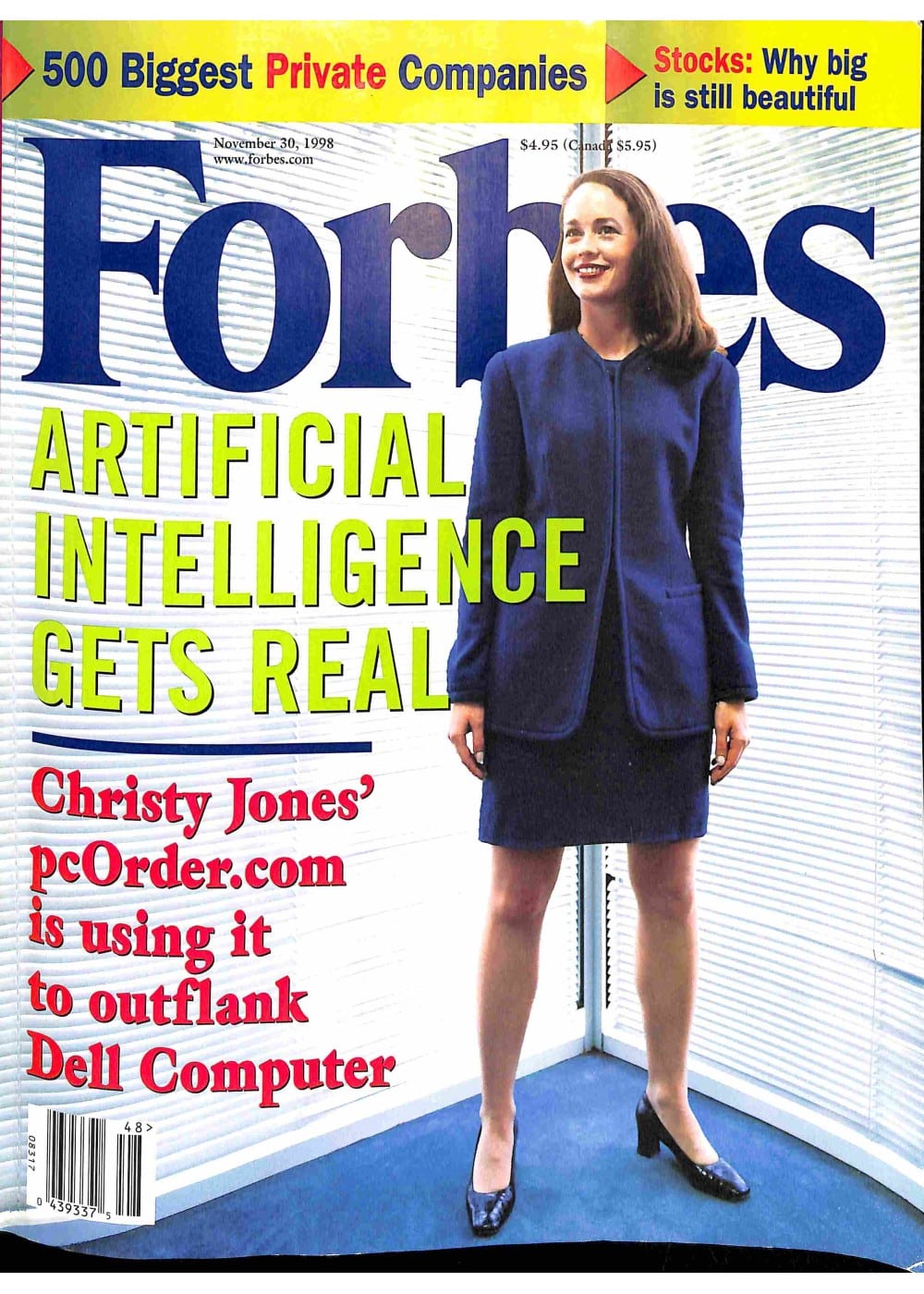

As we move on to explore other topics, we probably need to start with the buzz term of the day – A.I. or Artificial Intelligence. As the magazine cover on the following page (from November 1998) shows, this has been a topic of conversation for quite some time.

However, the launch of the application ChatGPT on a large scale earlier this year propelled the discussion into the stratosphere. This is probably a good place to note that ChatGPT did not write this letter. The former college professor now on our staff can vouch for this fact (more on this later). Anyway, just as the market was struggling with bank failures in March, A.I. took over as a narrative and catapulted certain industry areas and stocks higher despite uncertainty created by weaker economic data and higher rates. Companies are falling over themselves to mention A.I. on their earnings calls and in their marketing materials (even the grocery store Kroger mentioned A.I. on their most recent call).

There is no question that A.I. has the potential to improve productivity in the economy in the future, but, at least in the short term, it seems that much of the potential upside is already priced into certain assets. There are, of course, downside risks from this technology as well, including potential job displacements and industry disruptions. Similar to other technological breakthroughs, like the internet, we believe this shift will play out over a multi-year period. Our strategies have exposure to this theme, but we also feel opportunities will emerge in the future as markets digest the implications of this “new” technology over time.

Labor Market Disruption

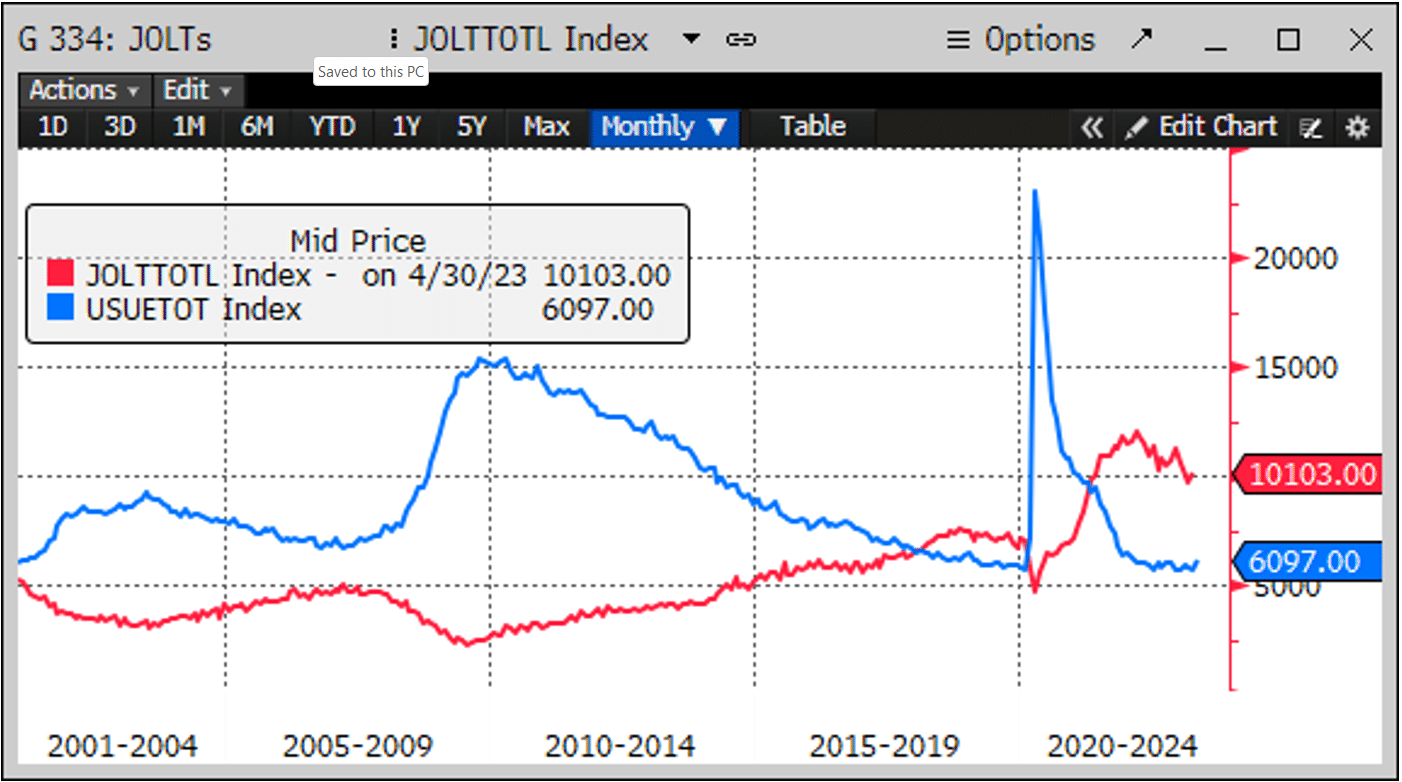

Speaking of labor market disruption, we certainly have seen some of this already due to the pandemic. It is a topic we have touched on before, but one worth revisiting given the more resilient economy and financial markets we mentioned on the first page. Despite seemingly daily headlines from companies announcing layoffs and cutbacks (witness Challenger Job Cuts Announcements up 286% year-over-year), the unemployment rate in the US stands at just 3.7%, near a 50-year low.

At the same time, we have over 10 million job openings in the US according to the monthly JOLTS report and only 6.1 million unemployed people (see chart, above left). Or put another way, the US has 1.6 job openings for every unemployed person (down from 2.0). What is going on?

Well, several factors are at work here. First, during the pandemic we had a significant number of people leave the labor force. This included baby boomers that were close to retirement and decided to step away and have not come back. In addition, we had parents that could not find childcare during the pandemic and so were forced to leave the labor force and have not been able to fully reenter given continued challenges with childcare. Finally, we also had some government policies in place that may have encouraged individuals to remain out of the labor force. All of these dynamics have created a “tight” labor market for many employers at the same time that certain industries are reducing headcount.

This backdrop, combined with higher wages that became the norm during the pandemic have contributed to individuals being relatively confident in their current conditions and willing to continue to spend, even if it means taking on more debt. This is yet another reason that the US economy has remained more robust than expected. This is also why we are watching the labor market carefully for any changes in trend. One final point here on consumer spending that is not associated with the labor market is the reinstatement of student loan payments later this year that could present a headwind for certain segments of the population as we move into 2024.

Debt Ceiling

Recall we talked last quarter about a potential showdown over raising the debt ceiling. As has happened in several prior instances, it came down to the wire, but a crisis was ultimately averted with a suspension of this limit until 2025. Another instance of kicking the proverbial can down the road by the government. While the near-term financial disruptions were avoided through this action, there will be other potential consequences as the cost of servicing our debt increases significantly in the months ahead.

Given the fact that nearly 50% of US debt will have to be refinanced in the next two years at much higher rates than the previous ten years, the percentage of tax revenues being spent on interest costs is set to jump to levels not seen since the late 1990s. We have already experienced a jump in this statistic from approximately 10% in 2022 to over 13% at the latest reading.

To emphasize what we have said in multiple commentaries in the past, some combination of spending cuts and/or higher taxes is coming in the future to deal with this issue. The debate over these issues also raises the likelihood of a government shutdown at some point, even as early as this fall. Not the end of the world, but nevertheless something else to add to the wall of worry the financial markets seem to be climbing.

Valuations Here & Abroad

Outside of the US economy and financial markets, there continues to be a mixed picture. Whether it is the internal battles that seem to be emerging in Russia or the recent violent protests in France, we are often reminded we live in a world that is constantly changing and evolving.

As markets outside the US failed to keep up in the rush to the technology-heavy US indices, Japan stood out as an exception. The county’s main stock index, the Nikkei 225 Index, rose nearly 30% in the first half of 2023 (about half that on a currency neutral basis) and now stands about 15% away from its all-time high reached in … December 1989. Yes, it has been over 34 years and counting since Japan’s equivalent of the Dow Jones Industrial Average hit a new high. Suffice it to say valuations were a bit extreme in Japan back then.

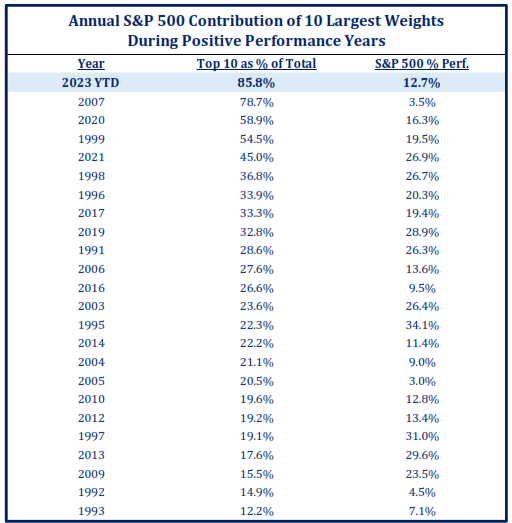

Did I mention extreme valuations? There is much more on this topic in our accompanying Market Commentary, but I did want to mention that the performance in the US stock market (as measured by the S&P 500) was extremely concentrated in the first half of the year. The table to the right in fact shows that the top 10 names in the index accounted for over 85% of the performance YTD, the most in over 30 years. This has led to some “interesting” valuations in certain of these larger names.

Firm News

We are excited to make several announcements regarding the firm. First, from a personnel standpoint, we are thrilled to have Dr. Mark Pyles join our team here at Greenwood Capital on a permanent basis. Mark has been with us in a consultant capacity since October 2021 and started full-time in June of this year. Mark brings a wealth of knowledge and experience to the investment team at Greenwood Capital. You can read more here.

Second, June 30, 2023, does not just mark the halfway point of this year, but importantly the 40th-anniversary milestone for Greenwood Capital. On that day in 1983, Greenwood Capital Associates, Inc. opened for business with three employees, Bruce Sigmond, Bill Allin and Shirley Logan.

As I reflect on the past 40 years, I am grateful for the foundation that was laid by these individuals and the others that came after them. Thank you to our clients, without whom we would not have made it to this milestone. Our anniversary logo can be seen on the header of this page, and we will be celebrating this occasion in the coming year with a variety of articles, posts, and events – so be on the lookout for those.

While we honor the past, we also want to celebrate the evolution of Greenwood Capital over this period of time as we look toward the future. We have assembled a talented and experienced team of investment professionals to provide a full suite of wealth management and asset management services to our clients. I am truly honored and humbled to be leading this firm and this team as we embark on the journey of the next 40 years.

On behalf of all the employees at Greenwood Capital,

Sincerely,

Walter B. Todd, III

President/Chief Investment Officer

The information contained within has been obtained from sources believed to be reliable but cannot be guaranteed for accuracy. The opinions expressed are subject to change from time to time and do not constitute a recommendation to purchase or sell any security nor to engage in any particular investment strategy. Investment Advisory Services are offered through Greenwood Capital Associates, LLC, an SEC-registered investment advisor.