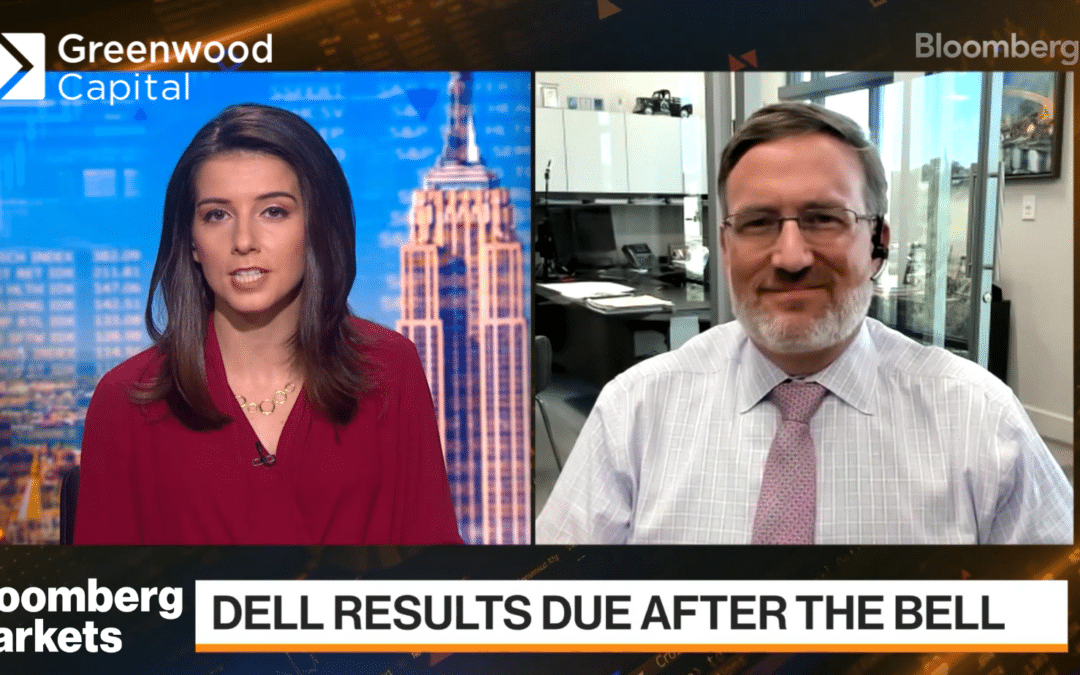

Dr. Mark K. Pyles Joins Investment Team

Greenwood Capital Hires New Director of Multi-Asset Strategies

GREENVILLE S.C. – Greenwood Capital is pleased to announce the addition of Dr. Mark K. Pyles, CFA® to the investment team as the Director of Multi-Asset Strategies. Dr. Pyles first joined Greenwood Capital as an external consultant and member of the Investment Committee in 2022. In his new role, he will continue to contribute to the Investment Committee while overseeing multiple investment strategies and providing analysis on portfolios, performance, securities, and risk management.

“In Greenwood Capital, I have found a firm that I trust,” said Dr. Pyles. “I am continually impressed by the balance they display in remaining true to their 40-year heritage while simultaneously ensuring continuous improvement in their service to clients. My goal is simply to lean into the former while helping to drive the latter. I am humbled by their trust conveyed in taking a chance with me. I very much look forward to the new challenges to come.”

Dr. Pyles joins Greenwood Capital after an 18-year career in academics at the College of Charleston, where his primary teaching roles include corporate finance, investments, and financial modeling at both the undergraduate and graduate levels. He founded and served as Director of the highly successful Investment Program at CofC, which hosts the Strategic Investment Symposium, an annual conference run by students that has become a national draw for finance professionals. During his time at the College, Dr. Pyles published over 40 articles in peer-reviewed journals and is the author of a textbook titled Applied Corporate Finance, with the second edition currently in print.

“We are truly honored and humbled to have Mark choose Greenwood Capital for the next chapter of his professional career. We have had the good fortune to work with him on a consultant basis for over a year now. I can say that, in addition to his extensive knowledge of finance and investments, Mark is a pleasure to work with. I look forward to his contributions to the growth of our firm and our clients in the future.“

Walter Todd, President and CIO

Dr. Pyles obtained a B.B.A in Finance from Eastern Kentucky University, an M.S. in Economics, and a Ph.D. in Finance from the University of Kentucky, completing the latter in 2005. He also holds the Chartered Financial Analyst (CFA®) designation, along with the Certificate in Performance Measurement (CIPM®) and the Certificate in ESG Investing from the CFA Institute.

About Greenwood Capital: Founded in 1983 in Greenwood, South Carolina, Greenwood Capital specializes in institutional asset management and wealth management. With specialized teams for Wealth and Investment services, Greenwood Capital offers a variety of services for the individual as well as institutional clientele. Using a top-down approach and direct experience in managing proprietary investment strategies, Greenwood Capital has been recognized as one of the largest independent investment firms in the Southeast, managing more than $1.4 billion in assets nationwide.

Greenwood Capital is an SEC registered investment advisory firm. This material has been prepared for information purposes only, and is not intended to provide, and should not be relied on solely for tax, legal or accounting advice.