The timing of Social Security benefits is one of the most frequent questions we get from pre-retirees. The time at which you choose to draw benefits can impact your financial plan throughout retirement. For some, it is a great safety net for fixed expenses while for others it may be the bridge to help them retire early. For married individuals deciding when to begin receiving is even more crucial as your decision may also affect your spouse’s benefit.

To make an educated decision you will need the following information:

How is Social Security Benefit Calculated?

Four things will ultimately affect how much your benefit will be:

- How long you worked

- How much you earned

- Inflation, and,

- When you decide to take your benefits

Your Social Security benefit is calculated by taking the highest 35 years of earnings. The earnings are capped by how much was subject to social security taxes. If you are unsure of your Social Security benefit, you may:

- Utilize the Social Security estimator tool : https://www.ssa.gov/benefits/retirement/estimator.html

- Request your Social Security Benefit Statement: Get Your Social Security Statement | my Social Security | SSA

Full Retirement Age (FRA) FRA is 67 for those born after 1960. If you were born prior to 1960, the FRA is reduced by 2 months every year until 1955. Once you reach your FRA, benefits are adjusted for inflation through Cost of Living Adjustments (COLA) once you reach age 62. The COLA is measured annually by the (CPI-W) Consumer Price Index for Urban Wage Earners and Clerical Workers.

How Delaying or Taking Benefits Early Affect the Amount

You may receive an 8% increase in your monthly benefit for each year you delay drawing your Social Security benefits past your personal FRA. You may postpone drawing your benefit until age 69; once you reach age 70, this is the maximum age allowable for drawing your Social Security benefit.

On the other hand, taking your benefits at age 62 (5 years early if your FRA is 67), you will recieve a full 30% reduction in your annual benefit.

As you can see timing matters.

It is also important to note that a spouse is allowed to receive the greater of their benefit or half of their spouses benefit. This is helpful for spouses who do not qualify based on their own earnings record or has accrued minimal benefits.

Determining When to Take Social Security

It is important to run a break-even analysis to determine how long someone needs to draw a benefit in order to break-even between drawing now or delaying. If you have longevity in your family and you do not need the income currently, it may make sense to delay benefits.

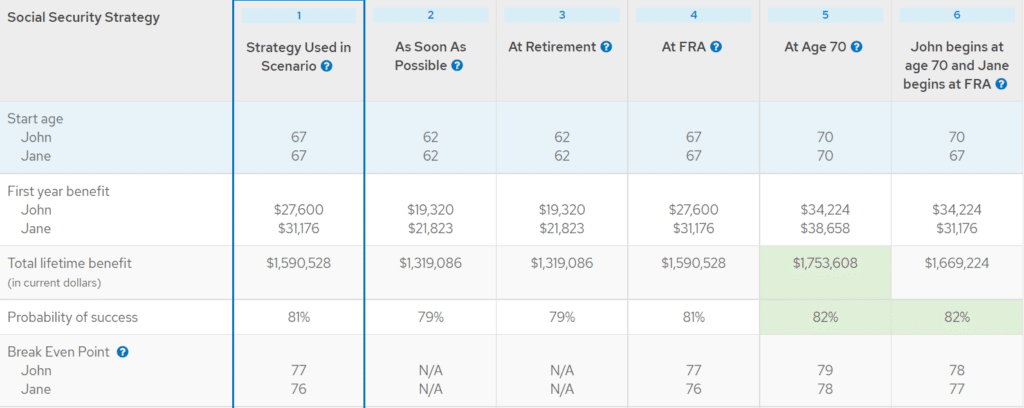

The chart below highlights the fact that each individual would have to live an additional 2 years (79 and 78) to break-even if they delayed drawing benefits until age 70.

It also highlights that they would receive nearly $200,000 more over their lifetime if they live to their life expectancy.

The decision should ultimately rest on how this income helps you achieve your financial goals.

Greenwood Capital is an SEC registered investment advisory firm. This material has been prepared for information purposes only, and is not intended to provide, and should not be relied on solely for tax, legal or accounting advice.

Image Credit: jorge-salvador-y36NKahybhg-unsplash