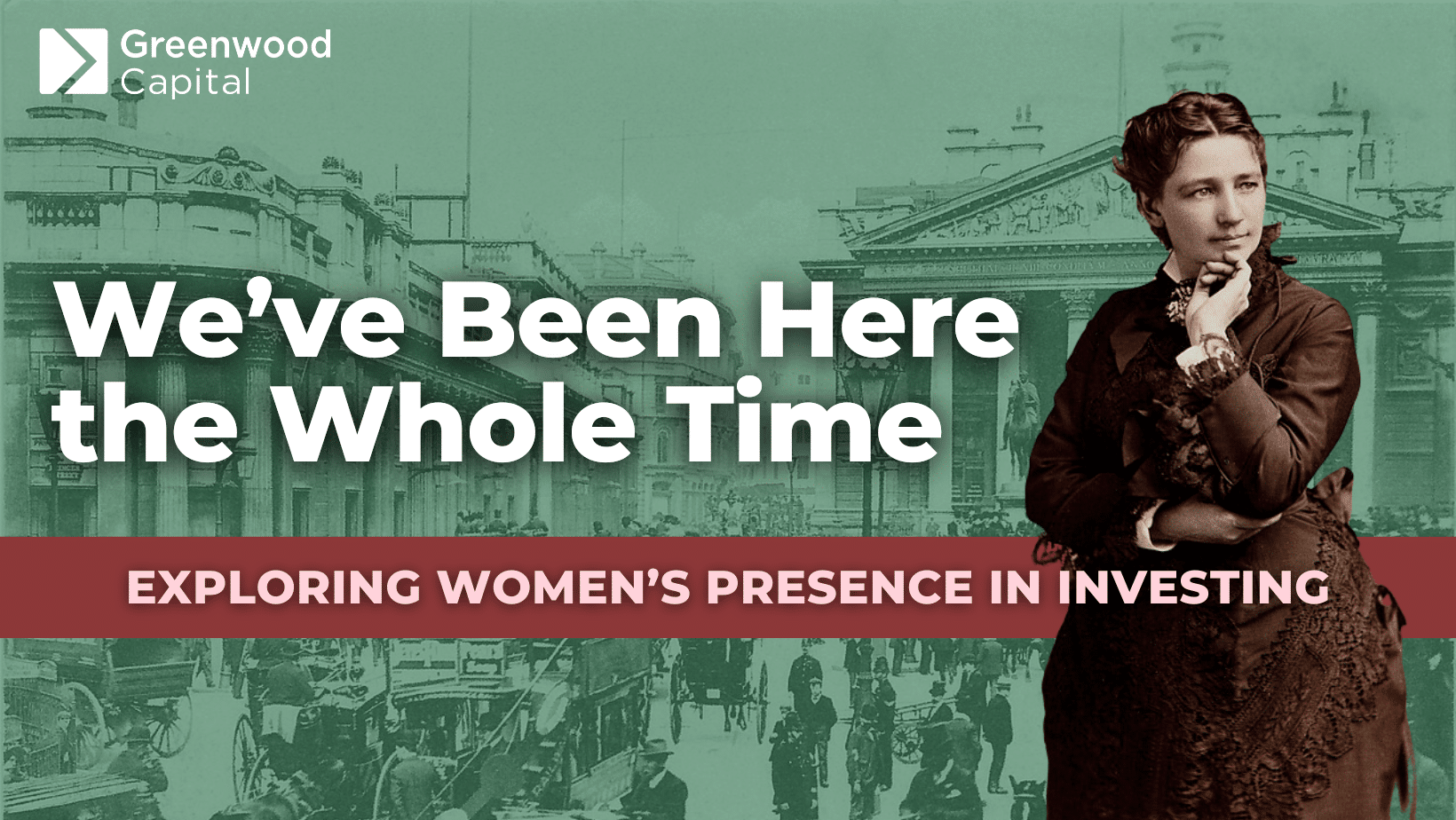

March is Women’s History Month, and a great opportunity to look back at the history of women as investors and shareholders. Despite the stereotypical image of an investor as a man, women have been significantly involved since the dawn of the stock market.

From the Start: 1600s – 1800s

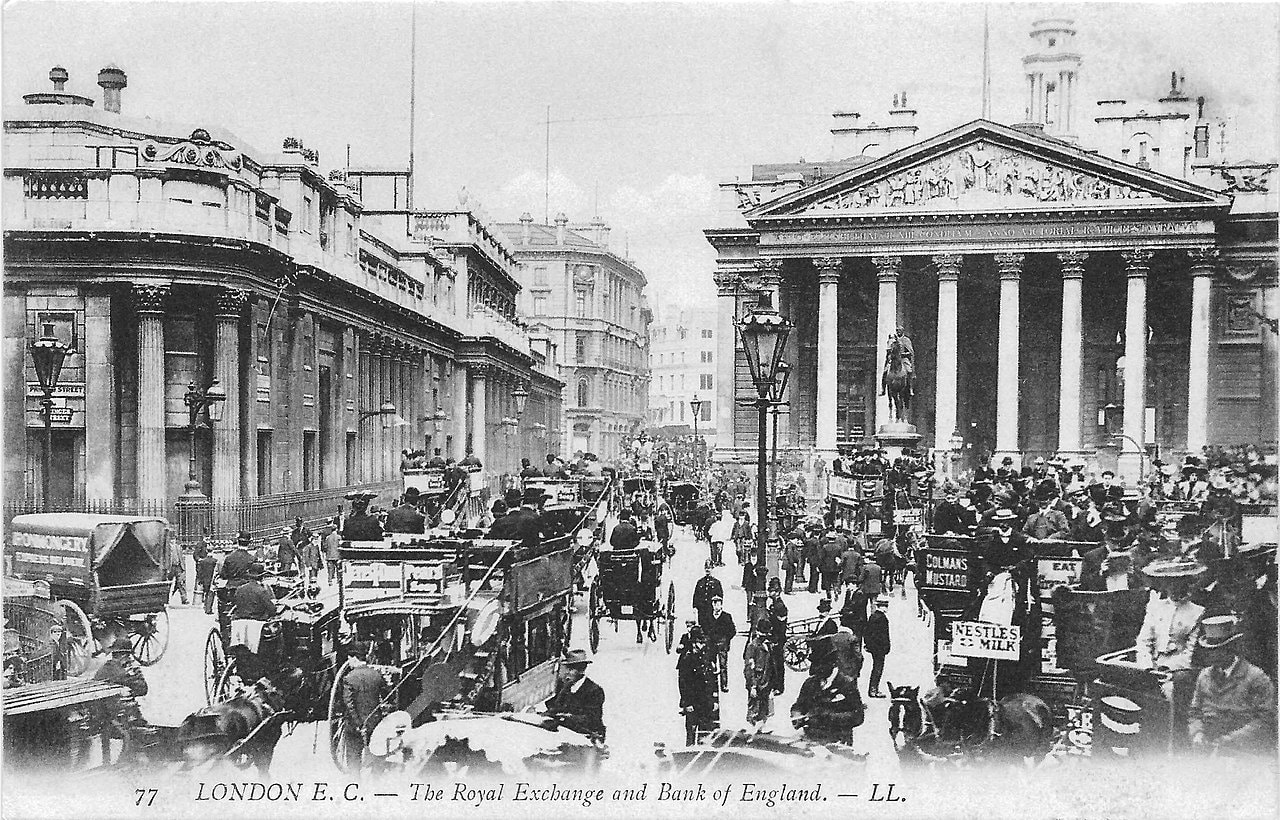

When the precursor to the London Stock Exchange, the Royal Exchange, first emerged in the 1690s, women were among the initial investors. Both married and single women invested in major companies, the Bank of England, and government debt. Surveys at the time put the number of female investors between 25-30%.

Across the pond, women were also key to the start of America as a nation. Women were shareholders of the Virgina Company which funded the initial Jamestown settlement.

Postcard LL London, Public domain, via Wikimedia Commons

Victoria Woodhall

by Mathew Benjamin Brady, Public domain, via Wikimedia Commons

Throughout the Victorian period, women “made up a significant portion of investors during the nineteenth century, especially in such key areas of the economy as banking, railways and insurance.” Single women, especially, were dependent on invested capital as they had limited access to the workforce and opportunities to earn a living.

By 1870, the first woman stockbrokers in the US, Victoria Woodhall and Tennessee Claflin, opened a brokerage firm on Wall Street that catered to female investors. The firm “reportedly made $700,000 in the first six weeks” which would be the equivalent of over $16 million today.

Majority Rule: 1900s

By the start of the twentieth century, women made up a small, but notable, portion of shareholders in American publicly traded companies. Prior to the 1929 stock market crash, women outnumbered men as shareholders in some of the largest companies such as General Electric and the Pennsylvania Railroad. That trend would continue for decades.

“Over the first half of the twentieth century, the percentage of women among individual shareholders at American public companies continuously grew until, sometime between 1952 and 1956, women became the majority. The trend was documented over six decades in ad hoc studies conducted by government agencies, journalists, investment firms, and eventually the New York Stock Exchange (NYSE). In 1956, the NYSE published the first comprehensive study finding that women constituted a majority of shareholders across the U.S. public capital markets.”

Throughout the fifties and sixties, women outnumbered men as individual shareholders.

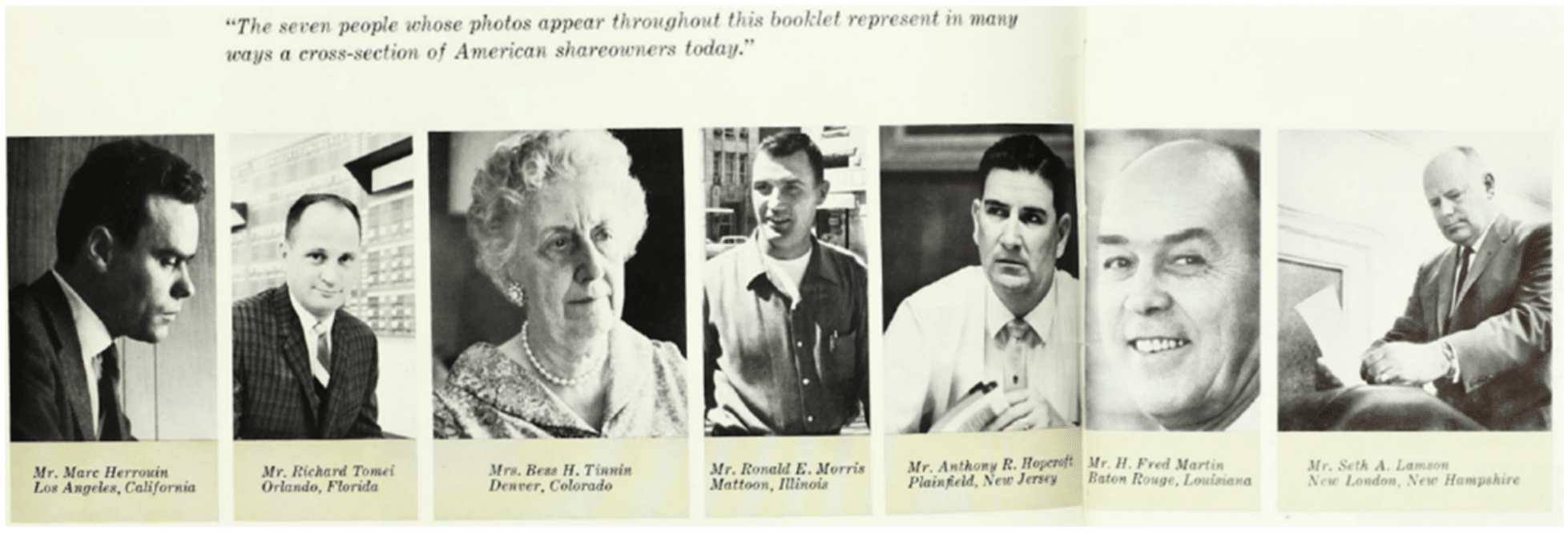

This surprising statistic was well-documented at the time, but many companies and organizations still focused on investing as a man’s world. For example, in the NYSE’s 1962 shareowner census published images (below) to show a “cross-section of American shareholders”.

While female shareholders were still the majority that year, the publication photographed six men and only one woman.

Despite the public image depicting investing as a men’s activity, women have been involved and intrinsic to capital markets from the beginning.

N.Y. STOCK EXCH.,THE 17 MILLION, supra note 224, from Haan, S. C. (2022). Corporate Governance and the Feminization of Capital.

Quality Investors: 2000 – Present

As the investment market shifted from retail shareholding to products such as mutual funds and ETFs, it became difficult to track the specific demographics of shareholders. However, surveys and studies can track the number of women who self-report as investors.

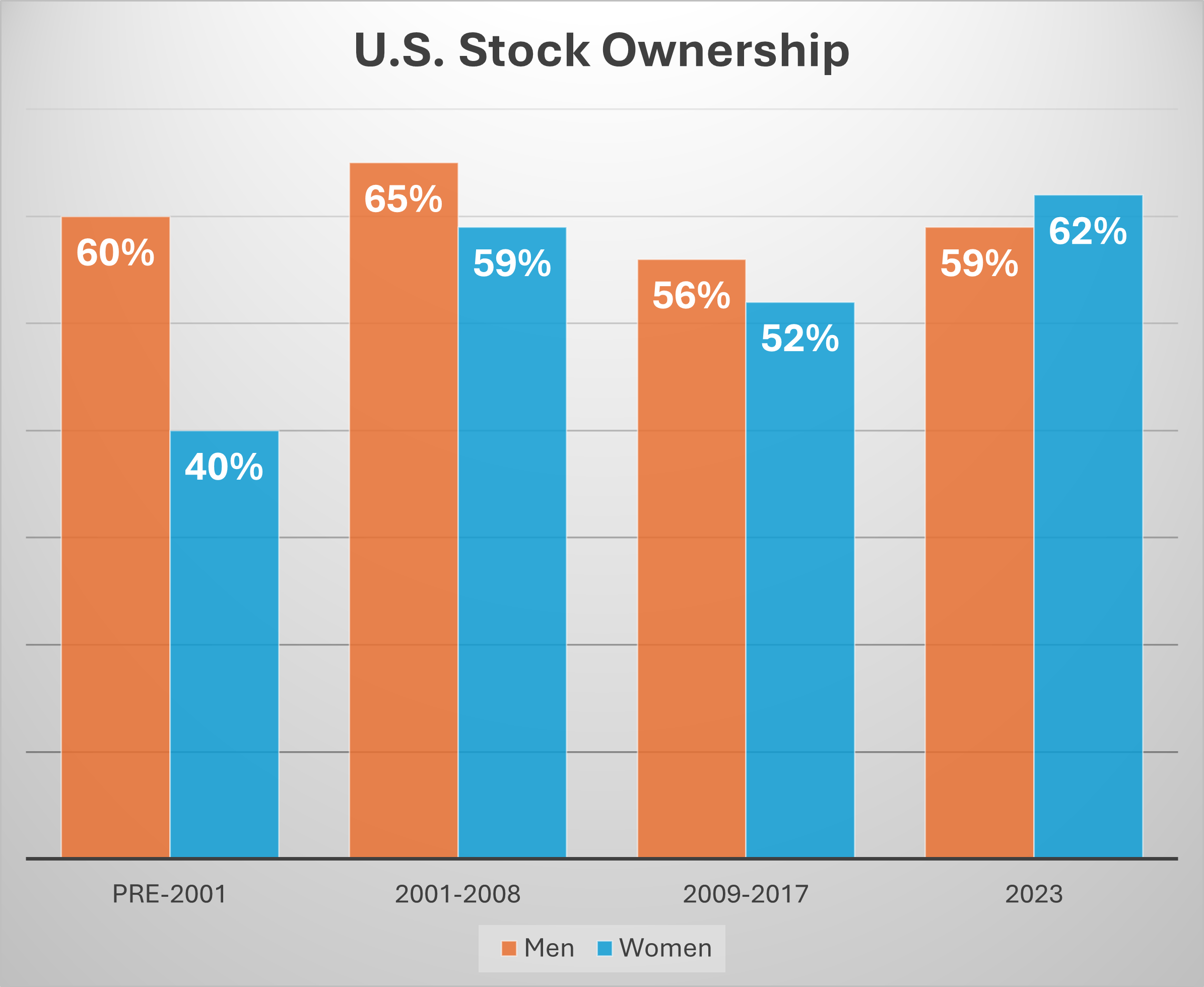

Historically, according to the CFI institute, about 40% of American women were invested in the stock market, compared to 60% of men. That gap has been consistently closing over the past 20 years. From 2001 to 2008, 59% of women owned stocks. In 2023, that number had increased to 62% of women.

Today, younger women are taking the lead in investing. Millennial women are more likely to hold investments and more likely to take the lead on financial decisions than their mothers and grandmothers.

However, studies from BNY Mellon and Fidelity found that only 1 in 10 women globally felt they fully understood investing and less than a third felt confident about investing their own money.

While women may be hesitant, multiple studies have shown that, as far as performance goes, women are better investors than men. In multiple studies (from institutions including Fidelity, University of California-Berkeley, Warwick Business School, and Wells Fargo) found that women’s portfolios outperformed men’s by 0.4% to 1.8%. (If this performance continued for 30 years, women would end up with a 25% bigger portfolio.)

The data behind these findings suggest women are less impulsive and more likely to remain calm during market volatility. (As we often say, time IN the market will outperform trying to time the market.) Women also tend to hold less risky securities, invest for longer periods of time, and are more likely to diversify their portfolios.

Serving Women: 2024 – Onward

For the modern investor, research has shown common themes on the specific priorities that women have when making investment decisions.

Goal-Driven

Women often plan for different financial journeys, such as possible maternity leave or a longer life expectancy. In addition, many women see wealth as means to an end, using investments to fund specific goals, such as growing a small business, supporting retirement, or leaving a legacy. If this is a priority for you, we can help you reach your goals by creating a customized financial plan. Our team of Certified Financial Planners® will consider your specific journey and address what challenges you might face.

Facts-Driven

Some studies suggest that women also are more likely to make investment decisions based on data, rather than gut-instinct or headlines. Our in-house investment team utilizes a disciplined, repeatable approach when building portfolios. In addition, our advisors are available to answer your questions about your financial plan, investments, or the market in general.

Guidance-Driven

Women are more likely to seek advice and guidance from a financial advisor. However, almost half of women who do seek out this advice feel that they are treated differently than if they were a man. When surveyed, women shared that they felt patronized and pushed out of conversations. They also felt like their advisor was less likely to listen to ideas from a woman.

Everyone deserves to work with an advisor who values their input and understands their goals.

At Greenwood Capital, the majority of our direct clients are women (52%). Our advisors provide tailored advice and personalized service to all our clients, whatever their demographic.

For investors who prefer to work with female finance professionals, one of our Senior Private Client Advisors, Melissa Bane, is one of the only women in the state who has obtained both her CERTIFIED FINANCIAL PLANNER® and Certified Public Accountant licenses.

Of course, women are not a homogenized group. Even two people of the same age, gender, and background will have different goals and priorities. That is why we prioritize getting to know you and your specific needs and concerns.

As we celebrate women’s accomplishments this month, we want to acknowledge the steady presence of female shareholders throughout investment history. From funding Jamestown to the modern ETF portfolio, women’s involvement has shaped today’s financial landscape.

Sources & Further Reading

Corporate Governance and the Feminization of Capital | Stanford.edu

A Brief History Of Women And Investing In America | Forbes Advisor

U.S. Stock Ownership Down Among All but Older, Higher-Income | Gallup.com

Insights: Financial Capability—A Snapshot of Investor Households in America | Sec.gov

Women & Investing Study 2021 | Fidelity.com

The Equality Equation: Three Reasons Why the Gender Investing Gap Is Closing | CFA Institute

Women and Investing | WellsFargoAdvisors.com)

Are Women Better Investors Than Men? | Warwick Business School

Froide, Amy M., ‘Introduction: Women as Public Investors in England’, Silent Partners: Women as Public Investors during Britain’s Financial Revolution, 1690-1750 (Oxford, 2016; online edn, Oxford Academic, 17 Nov. 2016), https://doi.org/10.1093/acprof:oso/9780198767985.003.0001, accessed 4 Mar. 2024.

Ewen, Misha. “Women Investors And The Virginia Company In The Early Seventeenth Century.” The Historical Journal 62, no. 4 (2019): 853–74. https://doi.org/10.1017/S0018246X19000037.

Michie, Ranald C., ‘From Market to Exchange, 1693–1801’, The London Stock Exchange: A History (Oxford, 2001; online edn, Oxford Academic, 1 Nov. 2003), https://doi.org/10.1093/0199242550.003.0002, accessed 4 Mar. 2024.

Robb, George. “WOMEN AND WHITE-COLLAR CRIME: Debates on Gender, Fraud and the Corporate Economy in England and America, 1850—1930.” The British Journal of Criminology, vol. 46, no. 6, 2006, pp. 1058–72. JSTOR, http://www.jstor.org/stable/23639477. Accessed 7 Mar. 2024.

Gabriel, M. Notorious Victoria: The life of Victoria Woodhull, uncensored. (1998) Workman Publishing.

The information contained within has been obtained from sources believed to be reliable but cannot be guaranteed for accuracy. The opinions expressed are subject to change from time to time and do not constitute a recommendation to purchase or sell any security nor to engage in any particular investment strategy. Investment Advisory Services are offered through Greenwood Capital Associates, LLC, an SEC-registered investment advisor.

Excerpts from or links to this article on the Greenwood Capital Insights page have been included in Greenwood Capital social media pages and distributed Greenwood Capital newsletter. As is the nature of social media, the general public is able to post comments and/or “likes” in response to these excerpts and/or links. These comments are unsolicited and are posted by either clients or non-clients, which could be interpreted as client testimonials or public endorsements, respectively, and no cash or non-cash compensation is provided. A conflict of interest could exist related to unsolicited posts as Greenwood Capital and its investment adviser representatives could indirectly benefit from these posts.