Establishment and Early Growth (1983-1997)

Greenwood Capital was established in Greenwood, South Carolina in 1983. [1] Our roots go back to the 1960s when the textile industry was flourishing, and Greenwood Mills was one of the leading manufacturers in the world. As the in-house pension fund manager of Greenwood Mills, we began with managing the retirement incomes of hard-working families through turbulent times. When the investment division spun off in 1983 and began offering investment services to the public as Greenwood Capital, the first $215 million in our portfolio included the pensions of those thousands of South Carolina-based employees. It shaped our investment convictions from the start: leaning on lessons from the past and keeping an eye on the future to develop a decidedly disciplined approach. From the beginning, we offered both Large Cap Equity and Fixed Income investment portfolios, starting off forty years of continuous portfolio management.

Throughout our first decade, Greenwood Capital began to attract clients and steadily expand our portfolio. In 1992, we became an inaugural member of the Association for Investment Management and Research Performance Presentations Standards. Known as Global Investment Performance Standards® (or GIPS) today, this organization upholds ethical and consistent performance reporting. Our early adoption of these principles set the standard for our approach to compliance and federal regulations: above and beyond.

Greenwood Capital encountered a significant opportunity in 1994 after the news broke that the Greenwood County Electric Capital Fund had suffered a $3 million loss, risking the initial principal of the fund.[2] The then-treasurer had been misled into investing in risky mortgage-backed securities, and the Greenwood County Council turned to Greenwood Capital for advice on addressing the rapidly declining investment. Recognizing the potential to turn the situation around, Greenwood Capital was brought in to manage the fund. Through diligent efforts to restructure the fund (while still providing income) Greenwood Capital fully restored the Electric Capital Fund within a remarkable three-year timeframe, achieving the 10-year target ahead of schedule.[3] This accomplishment not only showcased our practiced skill in managing investments but also solidified our reputation as a reliable and trustworthy financial partner.

Strategic Expansion and Accolades (1998-2008)

The late 1990s marked a period of growth and recognition for Greenwood Capital. By 1998, our assets under management (AUM) had soared to $500 million, solidifying our position as a leading financial firm, not just in South Carolina, but nationally. At a time when investment firms were still primarily operated out of financial centers like New York City, our team was presenting at conferences of industry leaders and serving as resources to news publications.

Our dedication to excellence earned various accolades and recognition. In 2001, Pensions & Investment Magazine first included Greenwood Capital among the Top 1000 Money Managers of Domestic Tax-Exempt Institutions, a testament to our ability to compete with larger national firms. In 2003, we ranked in the top 500, and by 2004 we were ranked #171.

In 2004, Greenwood Capital was also recognized with the Award of Excellence in South Carolina’s Fastest-Growing Companies, a ranking sponsored by the South Carolina Chamber of Commerce. This award was based on employment increases and revenue growth, in addition to our achievements on behalf of our clients.

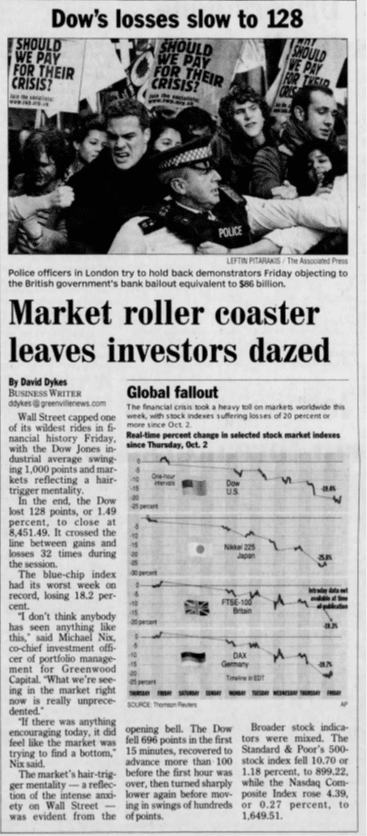

The financial crisis of 2008 presented obvious challenges to the entire industry. Greenwood Capital had already weathered the recession of the early 90s and the collapse of the dot-com bubble in 2001. We applied the same level-headed response to the subprime mortgage crisis. Our reputation for dependability was recognized, not only by our clients, but by Forbes Magazine after Goldline Research named us among the Most Dependable Wealth Managers in the Southeast that year. This award acknowledged the culture of trust, stability, and integrity our firm has remained committed to, even while navigating turbulent market conditions.

Resilience and Innovation (2009-2022)

In 2009, we showcased our adaptability by expanding our services to offer innovative Global ETF strategies. While exchange-traded funds (ETFs) are seemingly ubiquitous today, they were not widely utilized then. By broadening our team and expanding our investment offerings, we enabled our clients to benefit from portfolios managed using these instruments.

We also began offering financial planning, which became a core part of our wealth management philosophy. For our clients, a financial plan became the foundation on which to build, understand, and achieve their goals. Recognizing the importance of specialization, the firm made a strategic decision in 2013 to separate our wealth management and investment management functions. This allowed Greenwood Capital to streamline our operations and provide a more focused and tailored approach to client services.

By 2014, Greenwood Capital’s AUM had surpassed $1 billion as members of both the investment and wealth teams became reoccurring presences as reliable experts on broadcast media such as BBC, Bloomberg, CNBC, Fox News, NPR, and CNN. In addition, we officially opened our downtown Greenville office in 2017, solidifying our presence in the Upstate.

Our clients have relied on us through the years as a voice of reason during market turbulence. When the COVID-19 pandemic hit, we remained a resource, answering any questions and meeting virtually while providing regular video and written updates. Our focus was to disseminate helpful, reliable information centered around timely research from our team, trusted contacts, and third-party providers. During this time, Greenwood Capital reached $1.5 billion in AUM.

We continued to adapt to the rapidly changing market by narrowing our product list in 2020 and introducing passive models in 2021. Not only did this increase our operations team’s efficiency, but it allowed us to offer enhanced customization options for clients. The new system allowed for open allocation structures to all the investment strategies, as well as access to alternative investment solutions. These tailored investment solutions, rather than the pre-set strategy mixes, continued to set us apart and provided our clients with portfolios that were as unique as their needs.

Looking to the future, Greenwood Capital remained committed to leveraging cutting-edge technology. In 2022, the firm rolled out new trading and client service processes, utilizing industry-leading software to further enhance the client experience and operational efficiency.

Reliability and Beyond (2023 – )

From our establishment as a pension fund manager to the full-service wealth and asset management firm we are today, our goal has remained the same: to provide the highest level of service and investment expertise to our clients and their families. The culture of trust we have cultivated is evident in our many long-term clients, whom we consider the strongest measure of our success. As we reflect on the changes the markets and the firm have weathered over the last four decades, we are also looking forward to the next 40 years of building wealth across generations.

[1] Prior to 2001, Greenwood Capital Associates and the term “Firm” refers to Greenwood Capital Associates, Inc. (GCAI) which was established in 1983. On or about June 29, 2001, Greenwood Capital Associates, LLC acquired substantially all the assets of GCAI, a sub-chapter S corporation. Greenwood Capital Associates, LLC registration dates back from 2001.

[2] “County Council Addresses Declining Investment Issue.” The Index-Journal, 14 Dec. 1994, pp. 1–2.

[3] “Electric Capital Fund Back to Former Levels.” The Index-Journal, 7 Jan. 1998, pp. 1–2.

The information contained within has been obtained from sources believed to be reliable but cannot be guaranteed for accuracy. The opinions expressed are subject to change from time to time and do not constitute a recommendation to purchase or sell any security nor to engage in any particular investment strategy. Investment Advisory Services are offered through Greenwood Capital Associates, LLC, an SEC-registered investment advisor.