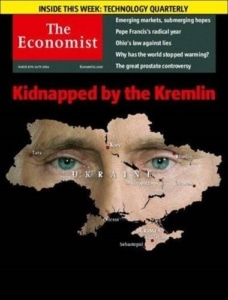

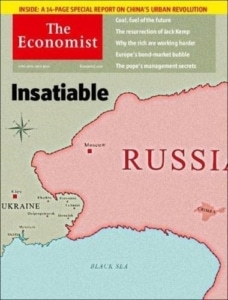

There are decades where nothing happens and then there are weeks where decades happen.” Ironically, this quote is attributed to Vladimir Lenin. I used this quote back in March of 2020 at the outbreak of Covid and I believe it seems appropriate now given what we are witnessing. Not so much Russia invading Ukraine – the magazine covers below from 2014 demonstrates how history is repeating itself.

Rather, it is the global response and “financial warfare” being waged by corporations and countries in response to Russia’s actions that is so different. Before we go any further with this thought, I want to again acknowledge the significant human tragedy that is unfolding in Ukraine. As we said in our video last week, our thoughts and prayers are with the brave citizens of Ukraine and also with the unwitting Russian citizens that are being dragged along on what appears to be Putin’s ideological crusade.

Over the past four to five days, we have seen company after company announce they are no longer doing business in Russia or with Russian companies –Nike, BP, Exxon, UPS, Apple, Maersk, FedEx. The list goes on and on. In addition, the US and other countries announced plans to freeze Russian Central Bank assets held outside the country, which account for approximately 50% of that country’s reserves. We are witnessing in real time the weaponization of financial markets and the use of financial sanctions on an unprecedented scale. In response, the Russian economy is in the process of collapsing. The Russian stock market has remained closed for the week, but we can get an idea of the hit from the Russian ETF, RSX, traded in the US. This security is down 68% in the past seven trading days. The Russian currency, Ruble, has depreciated 44% relative to the US dollar over the same time period. Despite Putin being in power for over 20 years in Russia, the economy had become fairly integrated into the global financial system. It appears to be well on its way to the isolated days of the old Soviet Union with the current trajectory.

Despite all of these actions and headlines, believe it or not the S&P 500 is up nearly 4% from the close the day before Russia Invaded last Wednesday night. The small-cap Russell 2000 Index is up over 5% over the same time period, as money flows into US focused areas. In addition, investors are anticipating the Federal Reserve will be less aggressive with raising rates given the uncertainty related to Ukraine. Within our investment strategies, we are mindful of heightened risks this dynamic situation presents. After all within the past three to four months, we have had a upheaval of monetary, fiscal and geopolitical dynamics. Of course, each client’s allocation and personal needs are different and unique. Your advisor is ready to answer any questions or concerns you might have. Please do not hesitate to reach out via email or phone.

Walter B. Todd, III President, Chief Investment Officer, Greenwood Capital

The information contained within has been obtained from sources believed to be reliable but cannot be guaranteed for accuracy. The opinions expressed are subject to change from time to time and do not constitute a recommendation to purchase or sell any security nor to engage in any particular investment strategy. Investment Advisory Services are offered through Greenwood Capital Associates, LLC, an SEC-registered investment advisor.