July 10, 2024 Press Release: Greenwood Capital Celebrates 40 Years of Service

GREENVILLE S.C. – On June 30, 2024, Greenwood Capital marked 41 years of business and officially wrapped up a year of celebrating four decades of client service to South Carolina. Greenwood Capital is a premier wealth management and asset management firm headquartered in Greenwood. The company serves families, financial advisors, and institutional investors such as foundations and endowments, by providing a comprehensive and consultative approach to financial planning and investment management.

“It is an honor to work for a company that carries such a well-respected legacy within South Carolina,” said John Cooper, Senior Private Client Advisor at Greenwood Capital, “In fact, I have current clients who are the 2nd and 3rd generations of Greenwood Capital’s early investors. I think that speaks volumes about the “client first” mentality at Greenwood Capital.”

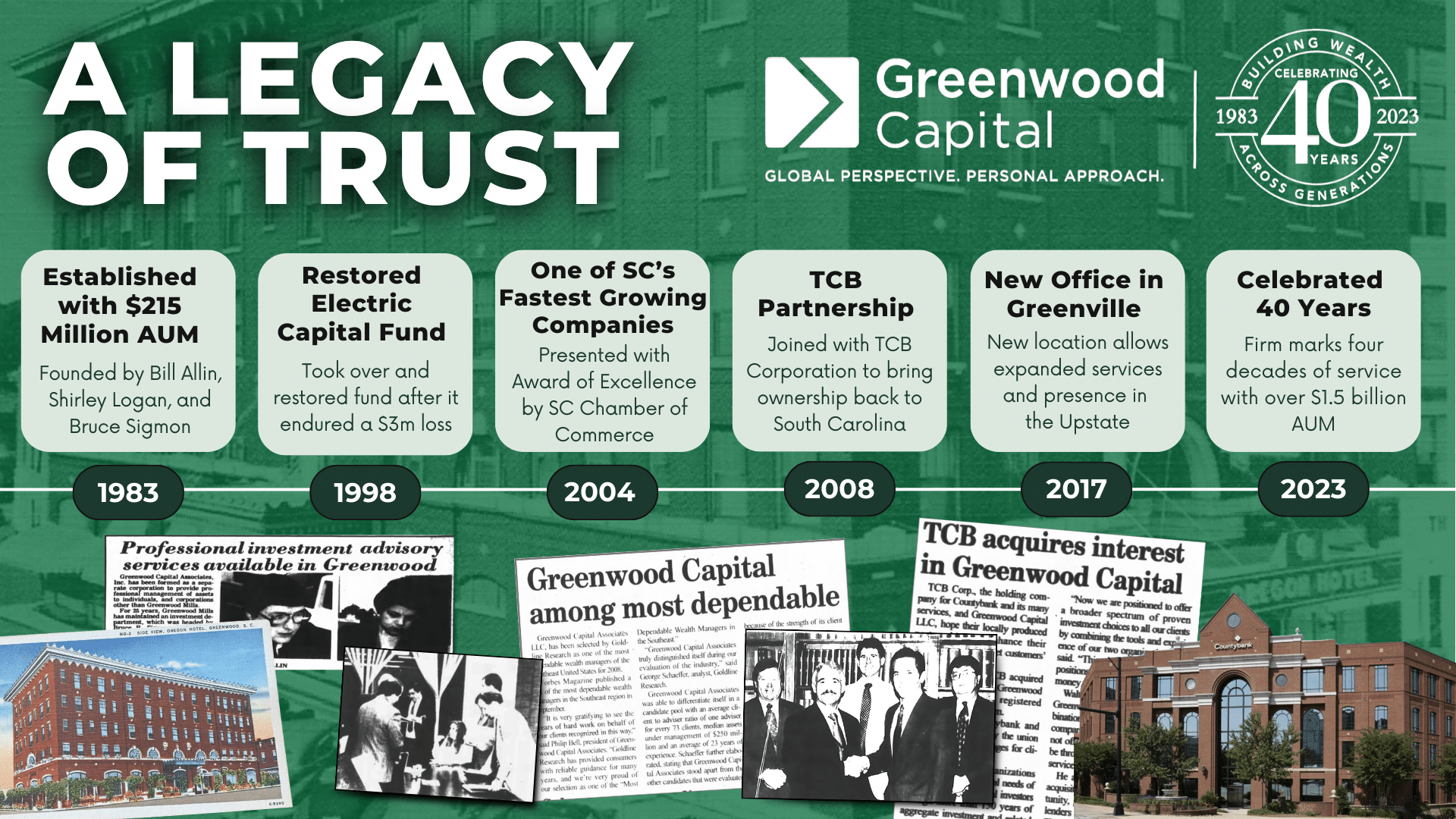

Greenwood Capital’s roots go all the way back to the sixties. The firm originated as the in-house pension fund manager of Greenwood Mills. In 1983, the investment division spun and began offering investment services to the public as Greenwood Capital.

Throughout the first decade, Greenwood Capital began to attract new clients and steadily expanded the portfolio, including restoring the Greenwood County Electric Capital Fund after the fund suffered a $3 million loss from risky mortgage-backed securities.

By the late 1990s, Greenwood Capital’s assets under management (AUM) had reached $500 million, solidifying its position as a leading financial firm, not just in South Carolina, but nationally. At a time when investment firms were still primarily operated out of financial centers like New York City, the Greenwood-based team was presenting at conferences of industry leaders and serving as resources to news publications.

By 2014, Greenwood Capital’s AUM had surpassed $1 billion as members of both the investment and wealth teams became reoccurring presences as reliable experts on broadcast media such as BBC, Bloomberg, CNBC, NPR, and CNN. In addition, the company officially opened a second location in downtown Greenville office in 2017.

Today, Greenwood Capital is a full-service wealth and asset management firm with clients in 23 states and $1.7 billion in assets under management.

In addition to growing as a firm, over the last four decades, Greenwood Capital has prioritized supporting the community. This includes donating over $1,000,000 to local non-profits across the state, such as the Self Foundation and the Greenwood Genetic Center. In addition to contributing funds, the firm regularly sponsors fundraisers, supports local events, and lends expertise to boards and foundations. Since 2008, Greenwood Capital has been partnering with the Countybank Foundation to expand its philanthropic footprint.

“It is inspiring to work for an organization that regularly invests, both physically and financially, to the communities it serves,” said Melissa Bane, Senior Private Client Advisor for Greenwood Capital.

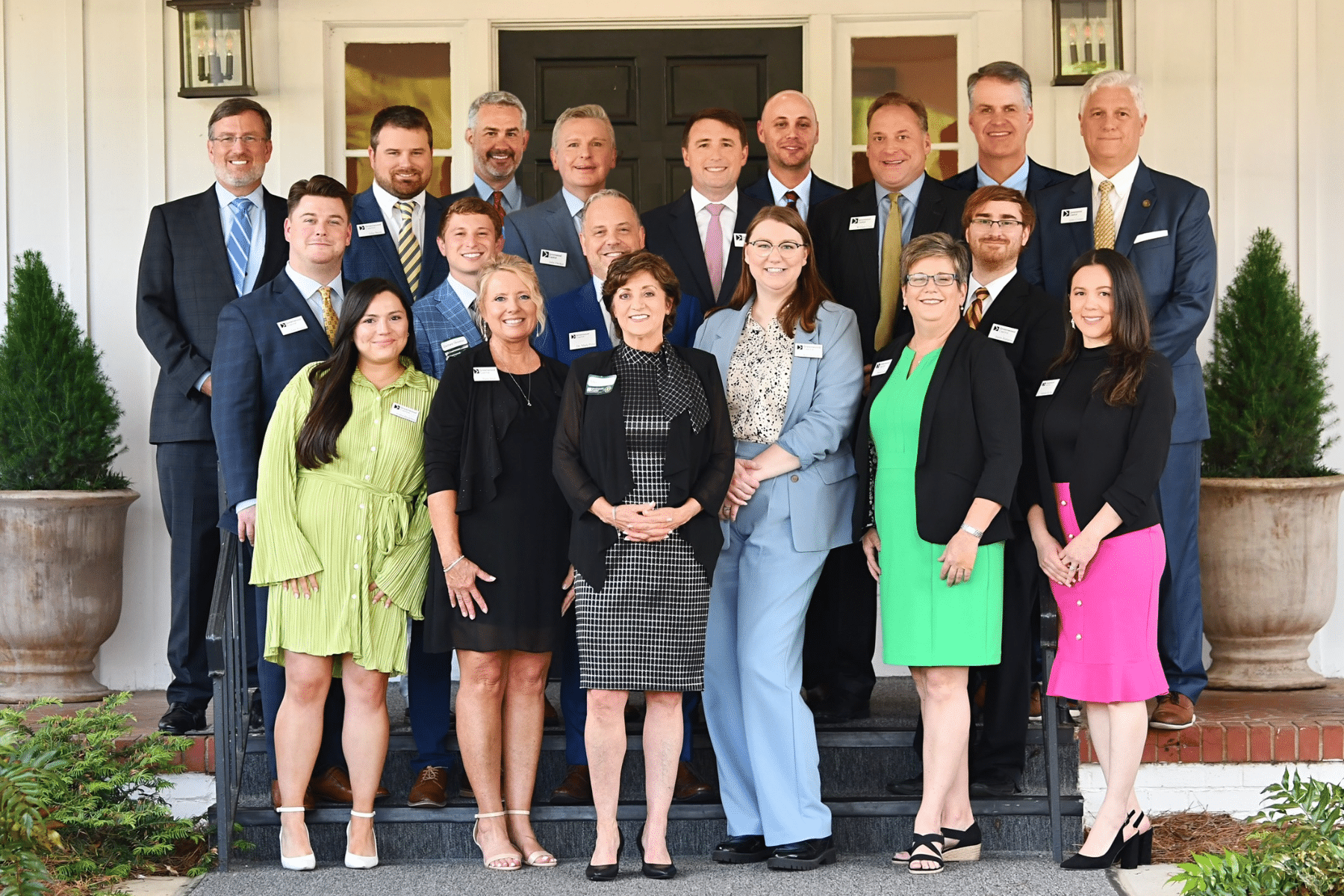

This April, Greenwood Capital commemorated its success with clients and community leaders at a celebration at the Greenwood Country Club.

At the event, President and Chief Investment Officer Walter Todd spoke about the firm’s resilience:

“According to the Small Business Administration, only 5% of small businesses make it to 30 years and beyond, so it is really incredible to be able to be here talking to you tonight.

In the Registered Investment Advisor world, there are over 14,000 RIA firms—but only 93 of those have reached an age of 50 or more.

Now we are not quite at 50, but hopefully we will be having another celebration down the road for that milestone.”

40th ANNIVERSARY CELEBRATION

Walter Todd went on to highlight the individuals who have contributed to the firm’s growth and success.

“I am grateful to those founders and employees that came before me and laid the foundations for our firm to make it to this great milestone,” Todd concluded. “I am immensely proud to be leading this wonderful team of experienced professionals as we embark on the journey of the next forty years.”

About Greenwood Capital: Founded in 1983 in Greenwood, South Carolina, Greenwood Capital specializes in institutional asset management and wealth management. With specialized teams for Wealth and Investment services, Greenwood Capital offers a variety of services for the individual as well as institutional clientele. Using a top-down approach and direct experience in managing proprietary investment strategies, Greenwood Capital has been recognized as one of the largest independent investment firms in the Southeast, managing more than $1.6 billion in assets nationwide.

Greenwood Capital is an SEC registered investment advisory firm. This material has been prepared for information purposes only, and is not intended to provide, and should not be relied on solely for tax, legal or accounting advice.