January 4, 2023

Happy New Year! I hope this letter finds you well and that you enjoyed a pleasant holiday season with family and friends. Reflecting on 2023 is an interesting experience for me. I keep coming back to the class quote from Mark Twain that many of you have heard me reference before – “It ain’t what you don’t know that gets you into trouble. It’s what you know for sure that just ain’t so.” I feel like this nearly perfectly captures the essence of financial markets in 2023. Traditional economic and financial market models and relationships that have been very useful in the past have seemed largely unhelpful over the past several quarters. As I stated in a previous quarterly letter, had I been given a perfect window into the economic, financial, and geopolitical events over the past year, I would still never have predicted the outcomes that we witnessed in financial markets.

Well, except for one event that is. If I had been given the heads up that Federal Reserve Chairman Jay Powell would step to the podium on December 13th and do a 180 degree turn from the “no rate cuts” narrative he had been espousing for months, I think I could have guessed risk assets would move significantly higher (as they did). To be clear, we are all happy when asset prices increase. However, to me this certainly casts doubt on the predictability and credibility of the Fed.

Prior to this meeting, the Fed was steadfast in their requirement that the data be printed in order to take action upon it; now apparently the trend is evidence enough. Put it this way, if you read the Market Commentary from last quarter, you can imagine I was staring at the TV watching Powell and muttering “inconceivable.” Thankfully, I did not start writing this letter until after his press conference, because it certainly changed how we are ending this year and impacts what may happen in 2024 as well. You will hear about this dynamic as you read the commentary from Mark Pyles about the economy and John Wiseman on the fixed income market. As for me, while the rationale for a dramatic narrative pivot seems unclear, it really does not matter.

One of our begrudging realizations of the current market and economic environment of recent years is that it doesn’t have to make sense. Our job is to assess the implications for the economy, financial markets, and assets. This includes considering many variables that may influence these areas, including fiscal dynamics and geopolitics, all of which are moving about as we speak. We will touch on each of these in this writing.

More of the Same in Washington

Let’s start with Washington because it is the gift that keeps on giving. To quickly recap, when we were writing this letter last quarter, we did not have a Speaker of the House and were staring at a possible government shutdown. Today, we have a new Speaker of the House, Mike Johnson, and we are (you guessed it!) looking at the possibility of another government shutdown.

The deal struck in October pushed out the deadlines to two dates, one in mid-January and one in mid-February. This is happening with the backdrop of the 2024 election shifting into focus with Iowa Caucus on January 15th and New Hampshire Primary on January 23rd. Super Tuesday is March 5th, when 17 different states will hold a primary or caucus. We will likely see a much narrower Republican field as we enter February, although in the current political climate, we have learned to never over-anticipate the obvious.

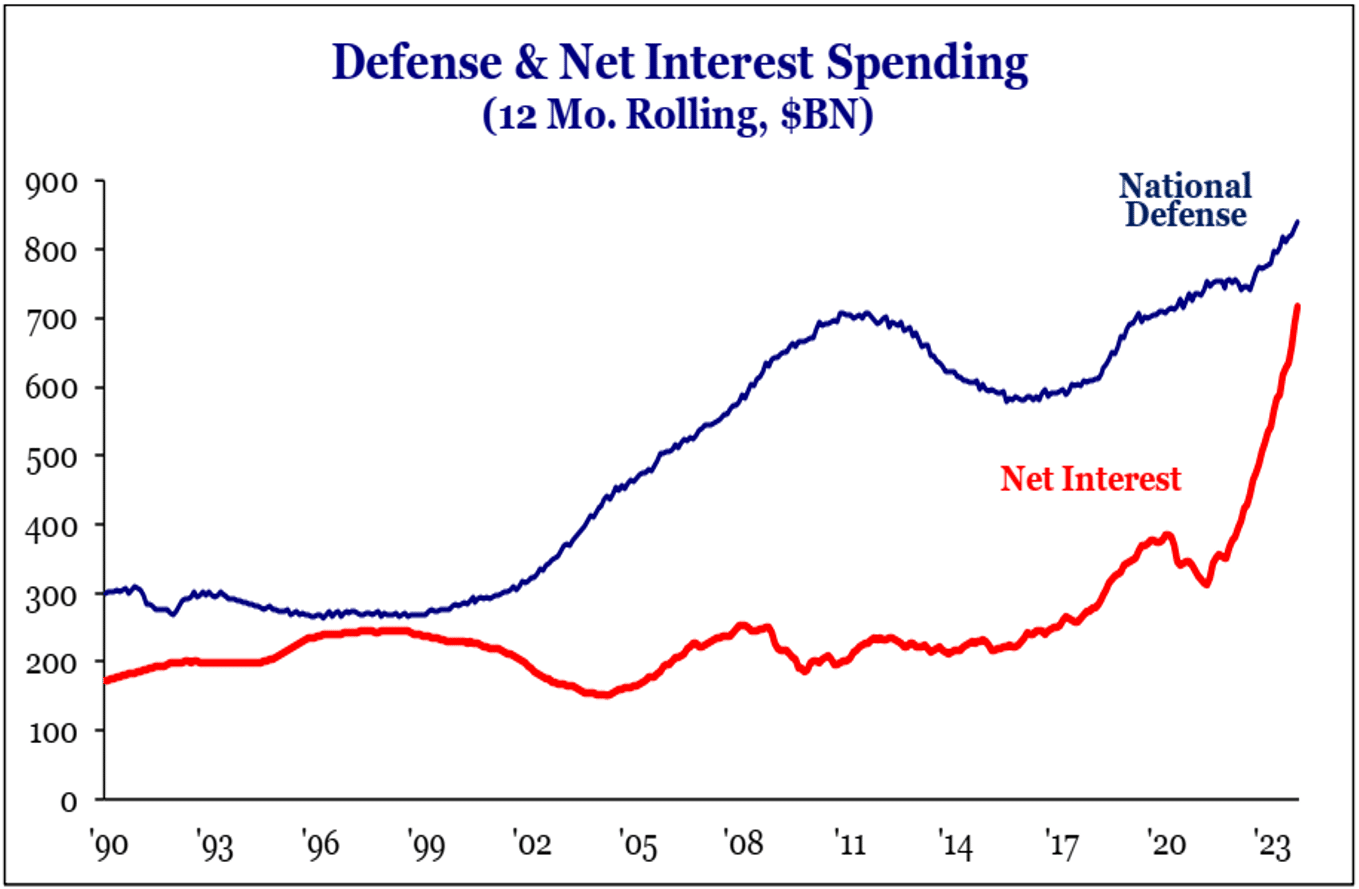

On deficit spending, which we have discussed at length in these pages this year, there is really no change. The government continues to run significant deficits with an economy at near full employment and growing in excess of 3%. If we look at spending on interest to service our debt it is quickly approaching (and will likely soon surpass) what we are spending on National Security (see chart at right). Houston (or should I say Washington?), we have a problem!

However, amazingly, 10-year Treasury rates have fallen dramatically since our last writing from close to 5% to under 4%. This seems like a Christmas miracle of sorts. Janet Yellen, former Fed Chair and now Treasury Secretary, pulled a neat little trick out of her pocket in early November. She moved the funding of all these deficits from longer-term Treasuries to the short-term market thereby easing pressure on the 10-year and longer part of the yield curve. Funding long-term liabilities with short-term debt is generally not a great plan, but it has induced the desired response of lower yields, relieving many of the pressures we discussed in our last quarterly letter – at least temporarily.

Impact of Wars Globally

Unfortunately, on the geopolitical front, there is still plenty to discuss. We have two wars now ongoing. Ukraine remains active since early 2022 and there seems little indication of a resolution in the short term. The war in Israel broke out just after we published our last letter and has been raging ever since. Beyond a terrible humanitarian crisis, this war runs the risk of expanding beyond Israel and Palestine. Recent events in the Red Sea and Persian Gulf related to attacks on civilian maritime cargos are threatening to snarl supply chains again, just as many had returned to normal from the pandemic. Any threats to close the Straits of Hormuz in the Persian Gulf would likely spike the price of oil, despite the US producing record amounts. Approximately 1/5th of world’s oil consumption passes through this area per day (20.5 million barrels).

Outside of the Middle East, tension with China remain elevated, but Washington and Beijing are at least talking again. In his latest conversation with Biden, President Xi again reiterated China’s intent to unify Taiwan with the mainland, but this is nothing new in their rhetoric. I would say relations with China are no worse than they were last quarter, and I believe China has enough on their domestic plate right now to be leery to start any additional conflict with us.

The US Economy

Despite dysfunction in Washington and multiple wars and the highest Fed Funds rate since 2006, the economic engine of US continues to hum, growing at nearly 5% in the latest quarter reported. The question we were asking at the beginning of 2023 and throughout the year was whether the Fed can land the plane softly during this tightening cycle. Dr. Pyles discusses this at more length in the economic commentary but suffice it to say that we have been on quite the adventure this year, ranging from “no landing at all, enjoy the ride” to “hard landing, get your helmet and buckle up” and back again.

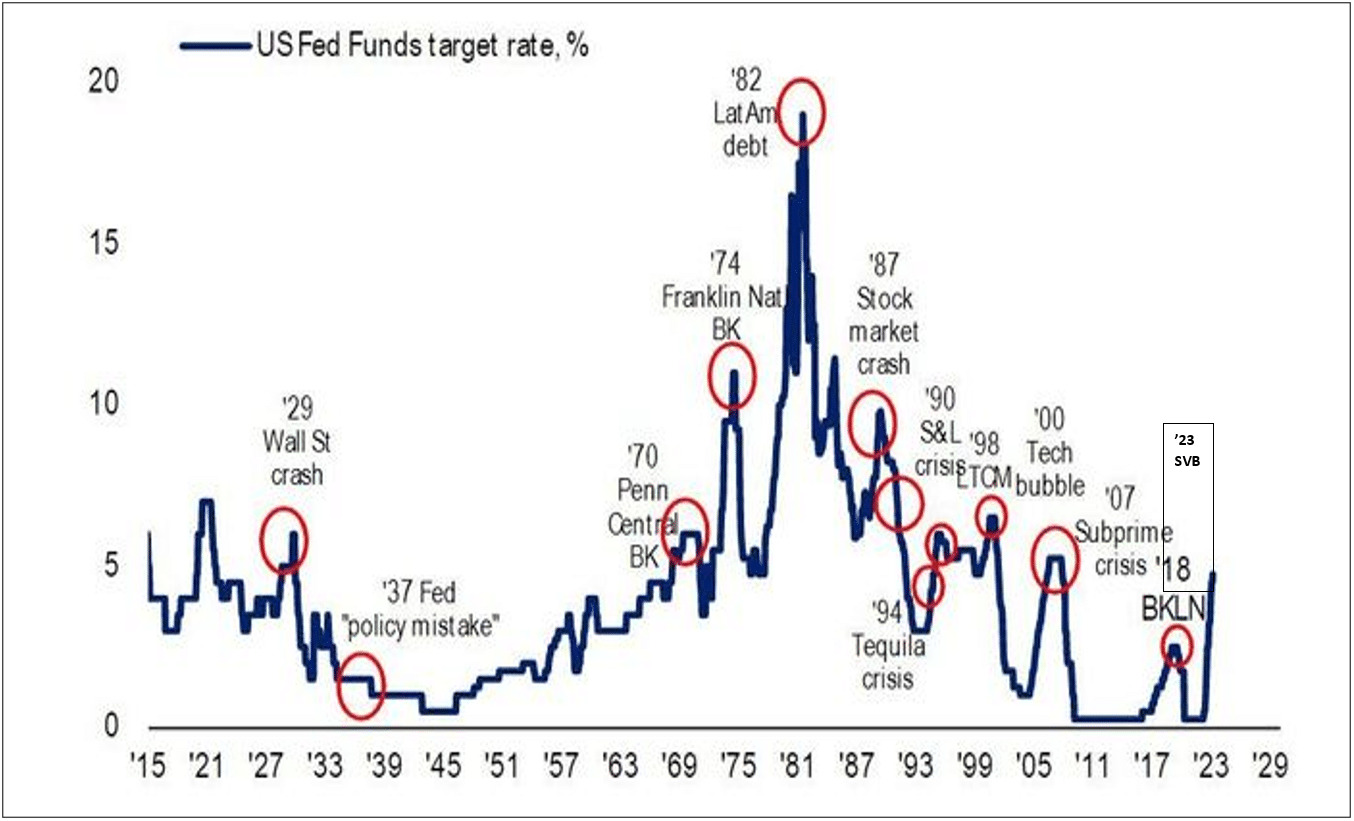

The chart on the left is full of economic “accidents” that occurred at the end of past Fed tightening cycles. We honestly believed that the bank failures that occurred in March/April this year (’23 SVB on chart) were the accident for this cycle. This was proven clearly incorrect as the Fed’s injection of liquidity and private sources of funding filled the gap as banks tightened credit. With Powell’s pivot in December, financial markets have clearly embraced the soft landing (or perhaps even “no landing”) narrative.

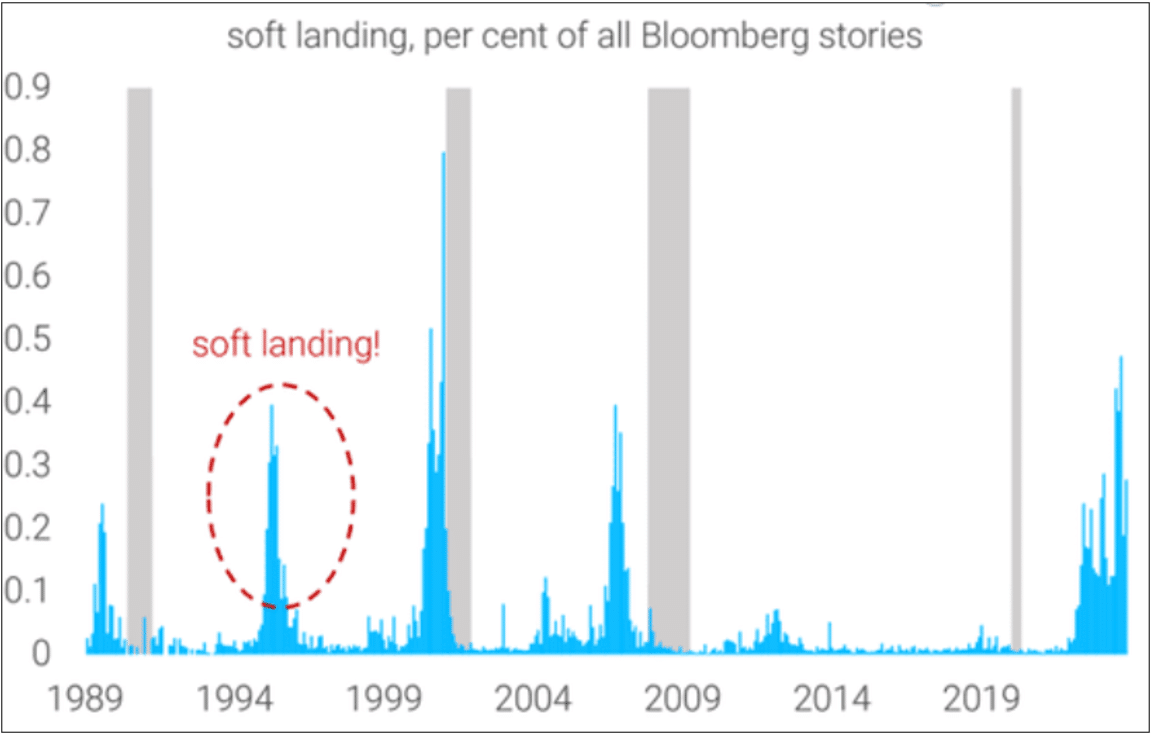

This has largely driven the market response we have seen over the past six weeks, including higher equity prices, lower bond yields, and lower US dollar. You can see evidence of this in the chart to the right which captures the percentage of news stories mentioning a soft landing. I think it’s worth noting this same phenomenon occurred before the recessions in 1990, 2001, and 2008 – all hard landings. An actual soft landing did occur in 1995 as the Fed was able to ease rates after sharp increases in 1994.

This could provide a template for 2024 if the Fed can thread the needle and ease rates without causing a reacceleration in inflation. While certainly a tantalizing narrative to embrace, a combination of continued mixed economic data and recent reports from the likes of FedEx and Nike commenting on a slowing consumer and muddled macro backdrop lead us to be hesitant to fully let our guards down. However, we acknowledge that this outcome is a much higher probability scenario than it seemed throughout much of this year (and last!). Regardless, markets are probably a bit ahead of themselves in discounting a negative outcome.

Equity Market

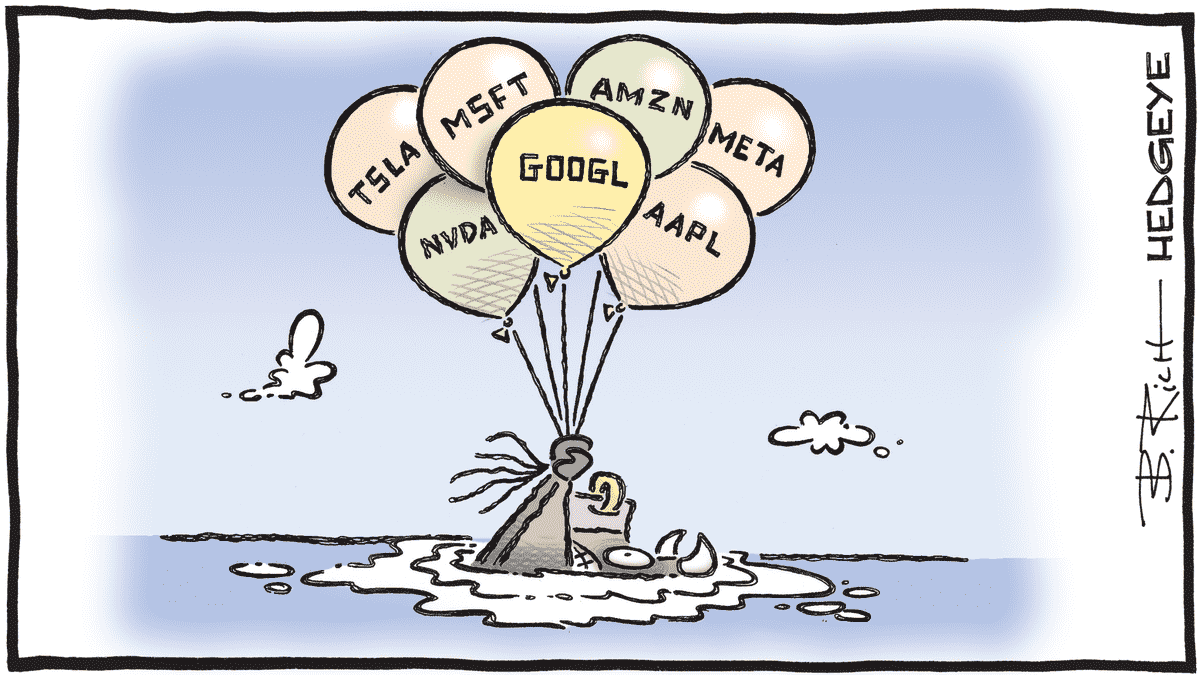

We speak to this more in depth in our market commentary, but we wanted to touch one more time on the unbalanced performance in the equity market as 2023 comes to close.

For the year the market-cap-weighted S&P 500 has outperformed the S&P 500 equal-weighted Index by over 1200 basis points (12%). While we have seen some improvement since mid-November in this metric, this is still the largest spread since 1998. If we are truly headed for a soft-landing scenario, then we should continue to see performance broaden beyond the very largest names in the Index. That is certainly where the most value in the equity market remains.

Firm News

In firm news, we are excited to announce that Kalisse Evert has been promoted to Marketing Manager at Greenwood Capital. Hopefully you have all seen our presence on social media via Facebook, LinkedIn, or Instagram and also our resources section here on our website. Kalisse has been integral in developing these for us and now will be focused on these areas full time. Keep your eyes out for more to come.

We are also excited to welcome a new addition to our team, replacing Kalisse’s spot up front in our Greenville office. Please welcome Germein De Sario as our new Private Client Administrator. Germein has a background in administration and financial services and for those linguistically inclined beyond English, she is happy to have a conversation in Spanish, French, or Italian. We are excited to continue to grow in 2024.

As always, we appreciate your support and confidence in Greenwood Capital. Please do not hesitate to reach out to us via email, phone, or in person at the office. We look forward to hearing from you.

On behalf of all the employees at Greenwood Capital,

Sincerely,

Walter B. Todd, III

President/Chief Investment Officer

The information contained within has been obtained from sources believed to be reliable but cannot be guaranteed for accuracy. The opinions expressed are subject to change from time to time and do not constitute a recommendation to purchase or sell any security nor to engage in any particular investment strategy. Investment Advisory Services are offered through Greenwood Capital Associates, LLC, an SEC-registered investment advisor.