October 6, 2023

I hope this letter finds you well and that you are enjoying the seasonal changes in the air and perhaps some football (not really great for this Gamecocks fan).

I’m sure most of you saw the news that Jimmy Buffet passed away last month. While I certainly don’t qualify as an official “Parrot Head”, I did enjoy his music. I don’t know about you but given all the goings on in the world today, a Cheeseburger in Paradise sounds pretty good. As I was thinking through writing this commentary, his song, “Changes in Latitudes, Changes in Attitudes,” kept popping in my head. Specifically, the chorus:

“It’s those changes in latitudes,

changes in attitudes,

nothing remains quite the same.

With all of our running and all of our cunning,

if we couldn’t laugh, we would all go insane.”

Perhaps not bad advice these days. With that being said, let’s get into it, starting with the timeliest discussion, if certainly not the most pleasant – that being the state of affairs in Washington (remember to laugh).

Another Debt Crisis

We mentioned in the last quarterly letter about the possibility of a showdown over the debt ceiling. We avoided that and kicked the can to 2025. Most recently, we narrowly avoided a government shutdown over the budget by also kicking the can, but not very far. We created a new deadline of November 17. Lurching from one deadline / crisis to the next is not a great way to run any type of organization, much less a country with the largest economy in the world. Over the past 10-15 years, financial markets provided politicians with a pass of sorts for this behavior. With the cost of debt near zero, the lack of fiscal responsibility had few long-term consequences as the cost of servicing our national debt continued to go down even as the level continued higher.

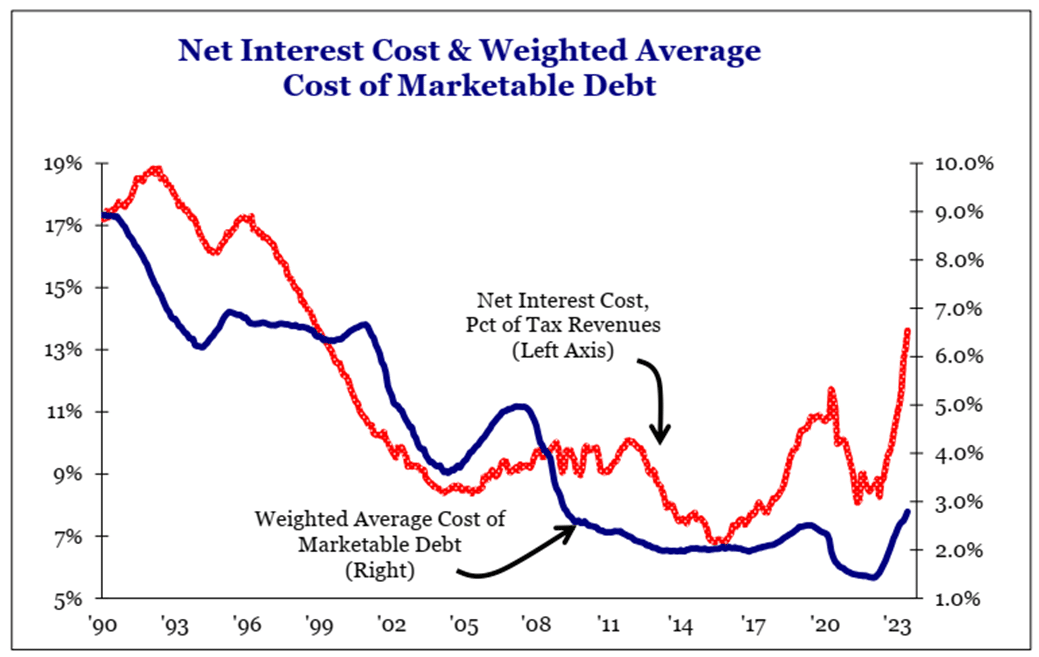

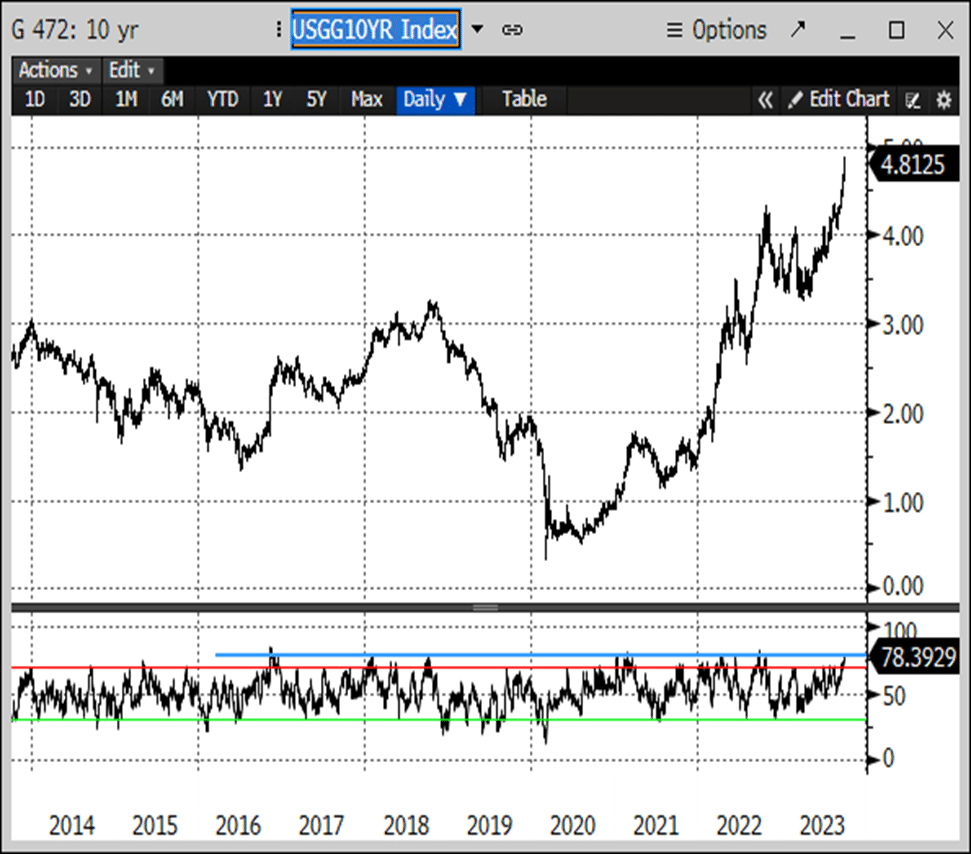

That backdrop has definitively changed in the past 12 to 24 months as the Federal Reserve has raised interest rates rapidly, pushing interest costs on our debt (as a % of tax revenues) to levels not seen since the 1990s (see red line in chart to the left, left axis). With 30% of US government debt coming due in the next 24 months, this will continue to move higher. The bond market has started to respond with 10-year yields rising nearly 100 basis points to levels last visited in 2007 (Click here for John Wiseman’s broader discussion on the fixed income market).

The bottom line in all of this is that we are reaching levels on interest costs that require spending to be curbed in other areas. The market is trying to send a signal to politicians to start getting the house in order. Let’s hope they get the message.

As we write this note, House Speaker Kevin McCarthy has been voted out of that role. This is the second time a vote of this nature has occurred (previously in 1910) but the first time it has been successful. This further complicates the situation described on the previous page as no business can be conducted until another speaker is elected. You also might be interested to learn that the Speaker of the House does not have to be a member of Congress. We’ll see what happens next.

“We are reaching levels on interest costs that require spending to be curbed in other areas. The market is trying to send a signal to politicians to start getting the house in order. Let’s hope they get the message.”

Higher Interest Rates

The dysfunction in Washington and the lack of progress on spending controls are two of the dynamics at play in the recent significant move higher in longer-term interest rates. Deficits in the budget are also creating significant supply from the Treasury to fund and demand from several traditional sources is waning. More supply, lower demand equals lower prices for bonds, which equates to higher yields. That’s the math of it. Recall the Federal Reserve was once a large purchaser of Treasuries but is now a net seller as they work to shrink their balance sheet. Foreign countries such as China and Japan have been buyers historically but are now net sellers. China has been shrinking their holdings since 2018 and they are currently at levels last seen in 2009.

Japan had largely offset China by buying Treasury securities but has recently been a net seller as the government there needed cash to support the currency (Yen) and to purchase their own government securities. Finally, institutions like banks here in the US have less appetite for these holdings as they deal with deposit run-off. The knock-on effects of higher rates are a higher US dollar, tighter financial conditions and, as we have seen recently, lower stock prices. In the short term, this move higher in rates seems stretched and due for at least a pause. Rates have only been this overbought three times in the past 10 years (see the bottom of the chart to the left). Each time they subsequently pulled back roughly 23% from the peak. This would equate to around 3.8% on the 10-year Treasury based on recent levels.

Labor Market

I know…all that is enough to make you want to take a trip to Margaritaville. Moving to more positive news, despite some softening, we continue to have a labor market that remains relatively healthy. Last quarter, we discussed some of the structural changes that had occurred over the past several years to create a tighter labor market in the US. This circumstance is playing out in the multiple work stoppages (or threats thereof) so far this year, including the ongoing UAW strike. As a counterbalance to these disruptions, we have started to see the participation rate pick up, now at 62.8%, as more people enter the workforce. While this remains below the pre-Covid level of 63.3%, it is moving in the right direction. Encouragingly, the rate of the prime working age population, ages 25-54, is 83.5%, exceeding the pre-Covid level of 83.1%. This increased labor pool along with moderating economic growth should begin to ease some wage pressures moving forward.

At the same time, the combination of inflation coming down and the pay increases implemented over the past several years, have led real wages (wages above inflation) to turn positive for the first time in years. This puts more money in the pockets of consumers. We continue to watch labor market statistics closely because the probability of the economy achieving a so-called “soft landing” is critically dependent on employment holding up. Another positive in the current environment is the excess income created from higher rates. We talked last quarter about the excess money supply remaining in the system. While this supply is shrinking, the excess capital is earning higher returns with rates (on savings) moving to more normal historical levels over the past year. Higher income and stable employment are especially important as gas prices increase and student loan payments restart this month.

Where is the Economy Going?

Thinking through the implications of the macro backdrop discussed above, it should lead to slower economic growth in the US. This in turn should allow the Federal Reserve to avoid hiking rates further. How long they keep rates at these elevated levels will be dictated by how quickly the economy and inflation respond to them. (We talked last quarter about the reasons for economic resilience in the face of higher rates.)

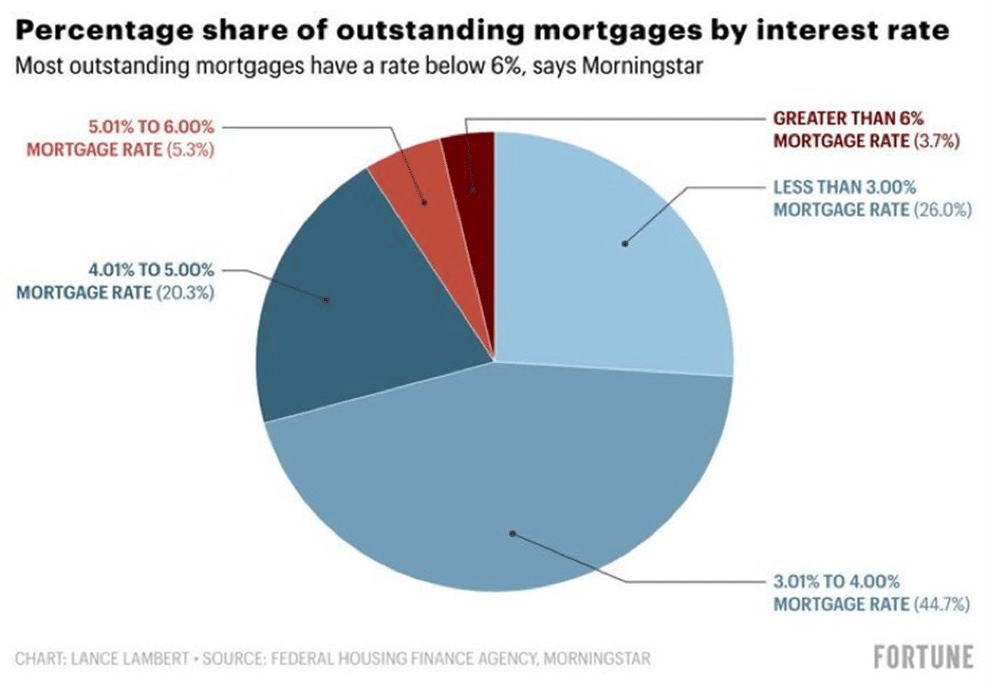

Another factor at play is that homeowners have not felt the impact as much as you might think. The chart to the right shows that 71% of homeowners have mortgage rates locked in at 4% or less. Of course, this has created a very tight housing market as anyone with these mortgages is reluctant to move, leading to new homes accounting for over 30% of total home sales (vs. a 40-year average of roughly 15%). Still, with the 30-year mortgage approaching 8%, overall housing activity is likely to slow. In addition, corporate borrowers locked in low rates during the pandemic and will not see a major wave of refinancing until 2025.

Perhaps these dynamics are one reason why economic growth in the third quarter that just ended is estimated to be above 4%. Nevertheless, given the other areas where higher rates are taking effect such as autos, C&I loan demand, and credit cards, slower economic growth seems in the cards for 2024. This will likely lead to the Fed cutting rates at some point during the year ahead. Of course, they are not going to say that publicly but that is our belief.

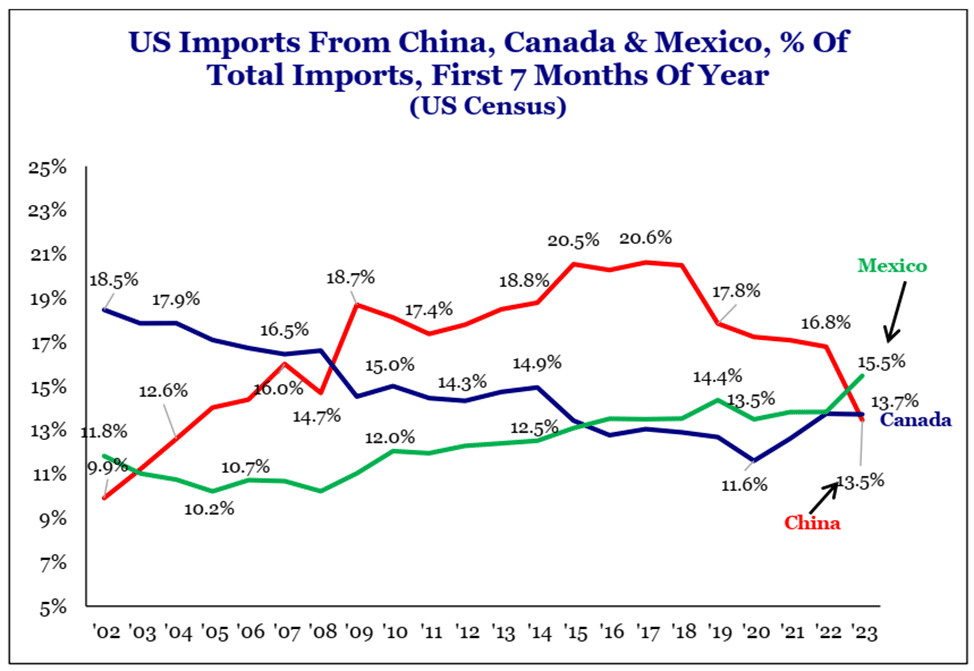

Looking beyond the domestic economy, we see continued elevated tensions with China. This dynamic has significantly impacted trade flows as you can see in the chart to the left. Imports from both Mexico and Canada now exceed China for the first time in 15 years. This speaks to both the reshoring dynamic we have discussed before, and the new priority of economic security over lower-cost production, which has resulted in jobs moving back to the US and North America. This is another good news story ultimately for the US as high-quality jobs and infrastructure investment promote long-term growth for our economy.

This is particularly favorable for the Southeast region which is seeing significant in-migration and investment. I think I will end on that positive note. There’s no question we face significant challenges ahead and volatility is likely to increase in financial markets as we deal with these in the coming months and quarters. This will create opportunities to be taken advantage of and we will endeavor to seek these out.

In firm news, we continue to celebrate our fortieth anniversary and encourage you to continue to visit the website for new stories and updates. We opened with Jimmy Buffett and it seems fitting to close with more of his lyrics.

“According to my watch,

the time is now,

past is dead and gone,

don’t try to shake it,

just nod your head,

breathe in, breathe out, move on.”

As always, we appreciate your support and confidence in Greenwood Capital. Please do not hesitate to reach out to us via email, phone, or in person at the office. We look forward to hearing from you.

On behalf of all the employees at Greenwood Capital,

Sincerely,

Walter B. Todd, III

President/Chief Investment Officer

The information contained within has been obtained from sources believed to be reliable but cannot be guaranteed for accuracy. The opinions expressed are subject to change from time to time and do not constitute a recommendation to purchase or sell any security nor to engage in any particular investment strategy. Investment Advisory Services are offered through Greenwood Capital Associates, LLC, an SEC-registered investment advisor.