October 5, 2022

As always, I hope this letter finds you well and enjoying the start to some cooler fall weather and college football. Given the turmoil in financial markets this year, I know that you are probably expecting me to start there, but I’m going to throw you a bit of a curve ball. If you are like me, in today’s 24-hour news cycle, it is easy to get transfixed on the day-to-day or minute-to-minute things that are occurring and lose the perspective that time, history and experience provide. The death of Queen Elizabeth II this past month provided me and the world a rare opportunity to step back and reflect on an event that one could argue marked the end of the Post WWII era, at least from a leadership perspective.

I was fortunate enough to be interviewed by BBC radio on the day of her funeral (September 19), not because I am some expert on the monarchy, but I happened to be scheduled that day and the producers decided it would be a good idea to get an American perspective on the event and the Queen’s legacy.

As I brushed up on my history ahead of the interview, I was amazed at what I found. In a world where the only constant seems to be change, Queen Elizabeth was a beacon of consistency and stability for her over 70 years in power. Her reign started with Truman as President in 1952 and ended 13 Presidents later in 2022 with President Biden. Although technically just a figurehead in the modern monarchy of the U.K., she was a sterling example of strong, female leadership for generations. Her relatively understated profile and guarded personality are a stark contrast to many global leaders of today. I’ll end this section with a quote from Queen Elizabeth’s address to her country (and the world) on April 5, 2020, during the height of Covid – “We should take comfort that while we may have more still to endure, better days will return: we will be with our friends again; we will be with our families again; we will meet again.”

As we turn our attention to financial markets and the economy, I’ll paraphrase a quote from the Queen’s 1992 speech commenting on the failure of three of her children’s marriages – “1992 (2022) is not a year on which I shall look back with undiluted pleasure. In the words of one of my more sympathetic correspondents, it has turned out to be an ‘annus horribilis’.” A horrible year, indeed. Let’s tick down just a few of the “milestones” we have so far: worst 9-month start to the year since 2002 and 1974; worst year for a 60/40 portfolio (S&P500/10-year Treasury) since 1931; worst year for bonds, measured by Bloomberg Barclays Aggregate Index, in the history of the data. You get the picture. Part of the problem for financial markets in 2022 has been that the distributions of possible outcomes are so wide given the variables that it breeds volatility. Take the war in Ukraine – the range of outcomes spans from Putin using a tactical nuclear weapon to Putin being deposed in Russia and a peace agreement. Yes, that’s a pretty dramatic set of outcomes to digest.

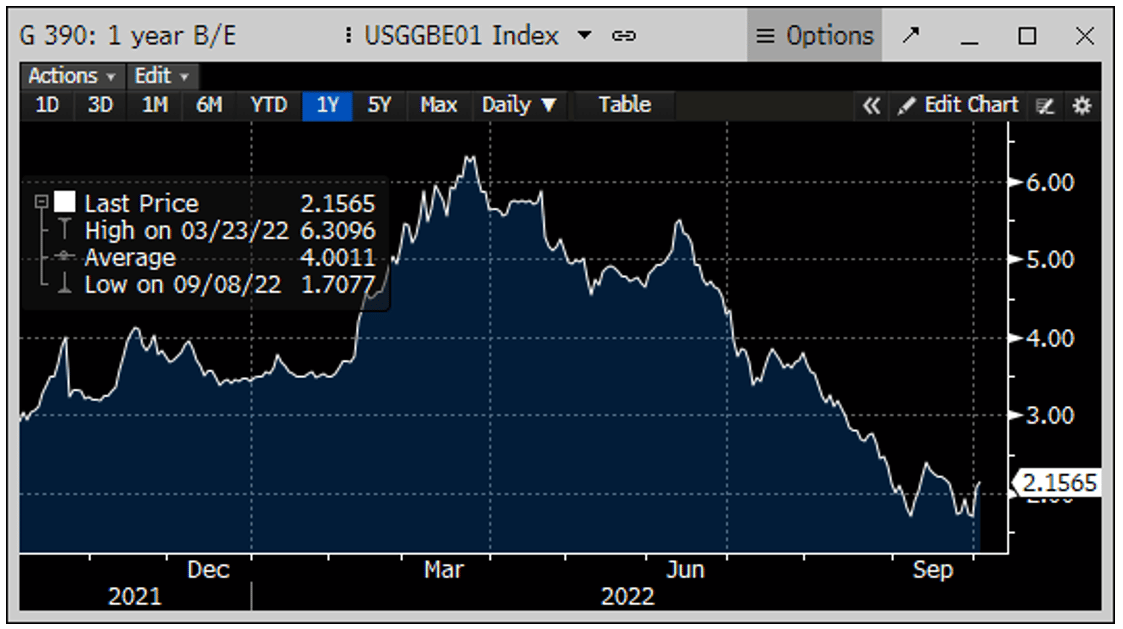

However, as we look at all the variables at play, including the Federal Reserve, inflation, recession risks, etc., I believe we can say the distribution of outcomes is starting to narrow for some of these items. Is the Fed done tightening? Probably not, but I would say we are certainly closer to the end of the cycle than the beginning. Has inflation peaked? I think it has and forward-looking market indicators are saying the same thing. The chart on the right shows the 1-year Treasury breakeven rate, essentially a market measure of where inflation will be in one year. It has fallen from over 6% to 2% in the last six months.

We have also seen money-supply growth (M2), a leading indicator of inflation, slow from over 25% last year to just over 4% today. Bottom line, a narrowing of possible outcomes could lead to less volatility. That would be a welcome development in a year that has seen 88% of trading days in the S&P 500 with a greater than 1% range (the highest since 2009).

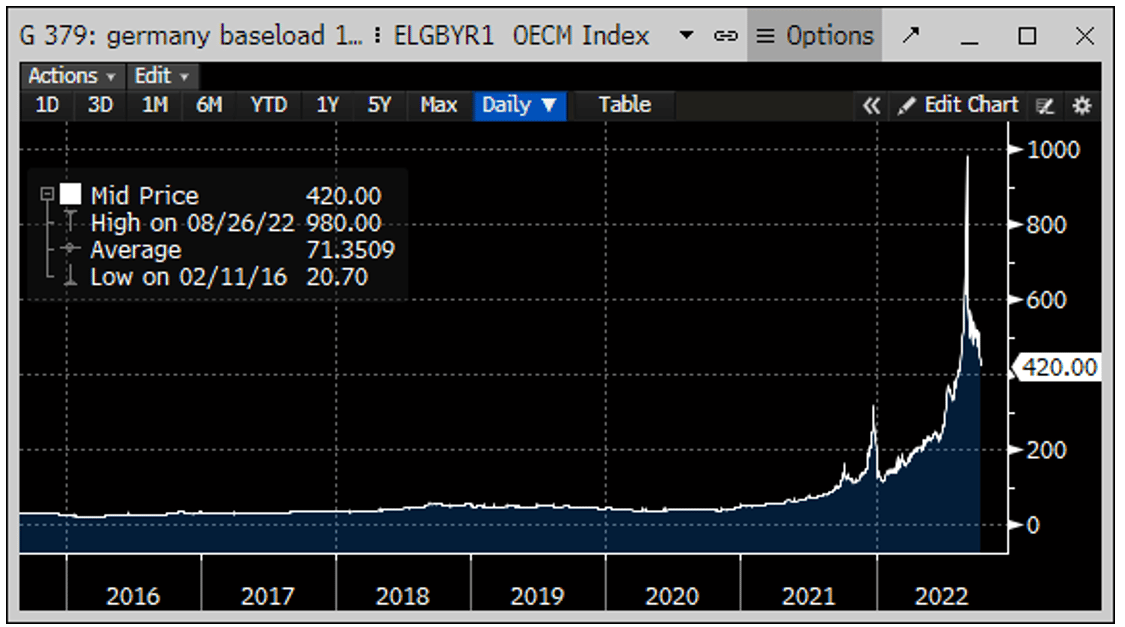

While this development would be welcomed with open arms, the reality is we are navigating a world – and associated markets – full of uncertainty. If Ukraine were to be resolved tomorrow, what about China and the tensions with Taiwan? If the Fed stopped raising rates this month, what about the European and UK economies and elevated commodity prices? If you think we have sticker shock here, just look at the chart (bottom left) for the cost of power in Germany (in Euros per megawatt hour). Yes, it is down 57% from the peak, but it’s still up 150% from the beginning of the year and higher by 750% from the average cost pre-Covid. Deep breath. When Queen Elizabeth II started her reign on 2/6/1952, the S&P 500 was trading at 24.18, today (10/4/2022) it closed at 3790.93. This equates to a compound annual return of 10.8% per year. Over that time, we have had multiple wars around the globe, assassinations, nuclear threats, political and social unrest, natural disasters, etc.

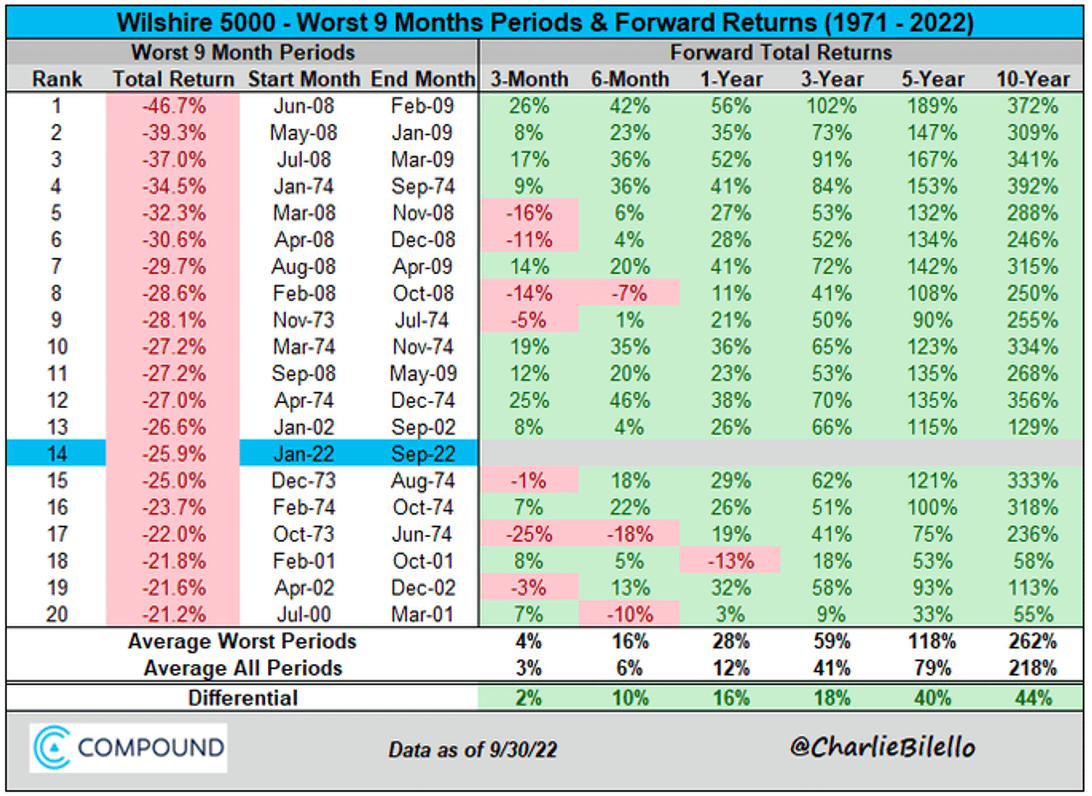

Of course, we know there were multiple periods during this span when returns were much less than this average and negative for multiple years. From 1971 to 1979, the S&P barely made any progress. It took seven years to reclaim the highs from March 2000 after the Tech Bubble burst. With 2022 down 20-25% in most indices, it may take an extended period to get back to the highs reached earlier in the year. While recent history has admittedly been a difficult time to be invested, there is strong reasons to believe now is an excellent time to invest. The table (above right) provides some perspective on this idea. This table looks at a broader index than the S&P 500, the Wilshire 5000, and shows the 20 worst 9-month periods over the past 50 years. The data reflects you have a 95% chance of being higher 1 year from now by an average of 28% and a 100% probability of being higher 3, 5 and 10 years from now.

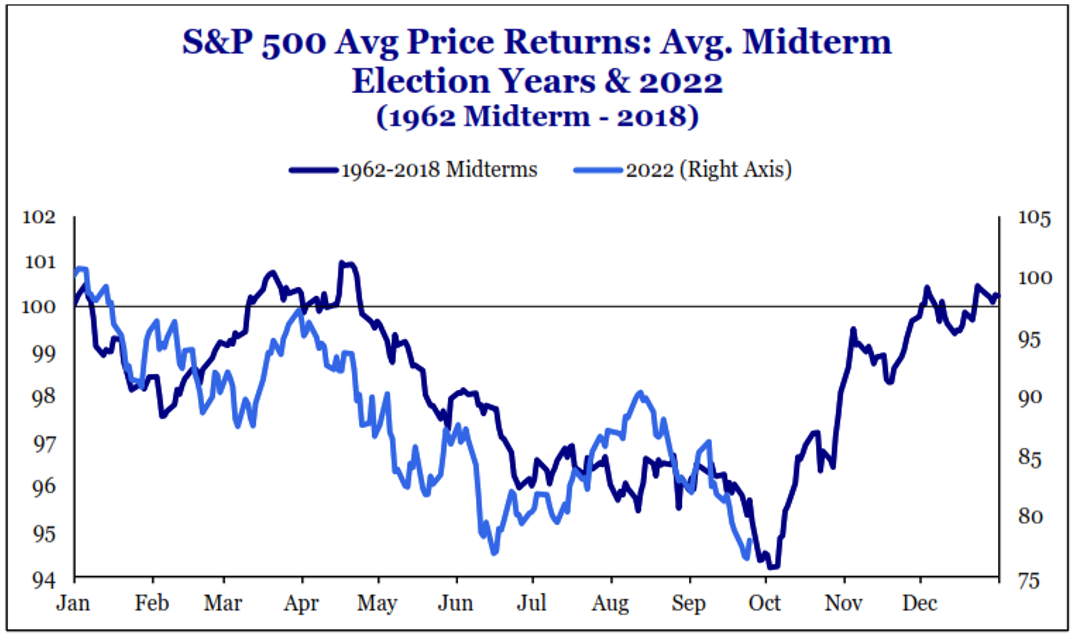

Shifting gears to look at the upcoming mid-term election on November 8, there are several dynamics to discuss. First, as you can see in the chart above left from Strategas Research, we are actually tracking a very similar pattern in price progression to prior mid-term years which tend to bottom in early October and rally in the fourth quarter. Second, we also know historically that years following mid-terms are positive (center chart above). And finally, we know that markets like divided government. The third chart, above right, demonstrates this fact.

Based on the betting markets today, it appears we are likely headed for the second option (from the chart above right) of a Democratic Senate, Republican House with a Democratic White House. I would highlight that earlier in the year we were tracking for a Republican sweep of Congress. However, the Supreme Court decision in the spring and lower gas prices have changed the dynamic in the Senate and narrowed the seats projected to be lost in the House (although still above 20).

If this outcome holds (and of course in five weeks anything can happen in politics) then Dan Clifton from Strategas believes we could have a very active lame-duck session of Congress. He is comparing this to the 2010 mid-term year under Obama which resulted in the extension of Bush tax cuts and a doubling of the estate tax exemption, among other things. This year, we could see action on defense spending, a debt ceiling extension, energy permitting, R&D tax credit and others. If we are headed for gridlock in 2023, these 6 weeks after the election will be the last chance to “horsetrade” for deals.

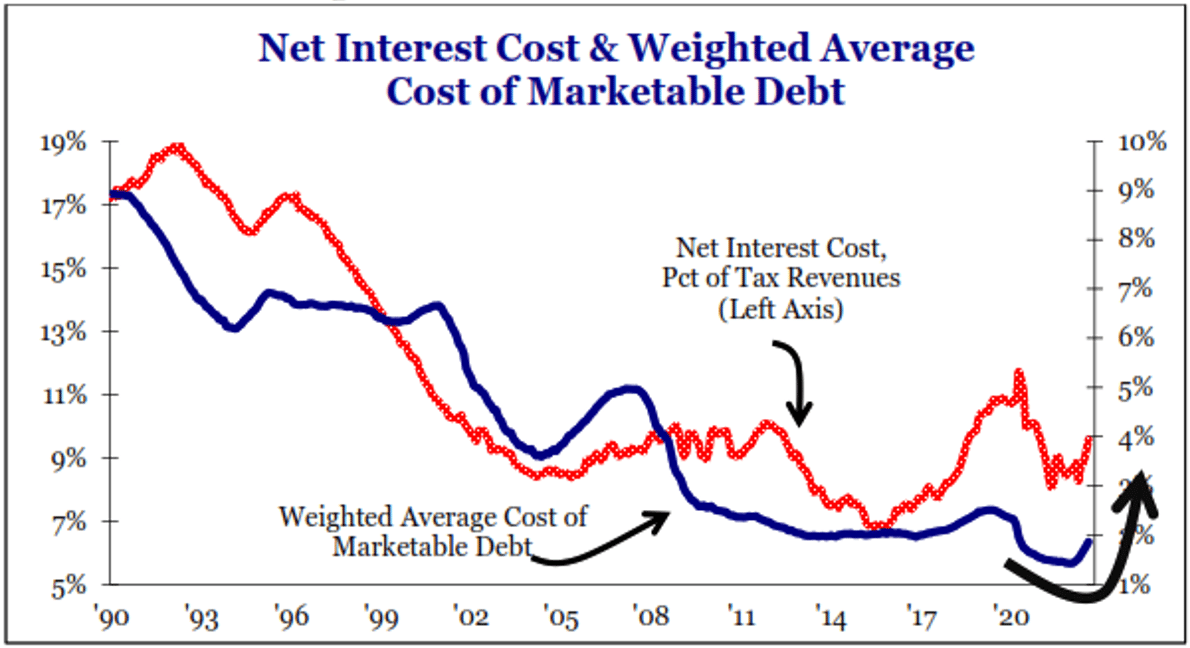

Finally, before we leave the political discussion, we do have to highlight an increasing risk going forward and that is the cost of US debt obligations. We get asked about this often and given the normalization of rates in the past year, we are going to begin to see interest expense increase going forward. As the chart on the right shows, it will be manageable for the time being, but as these new rates get incorporated into CBO projections, it is going to force a much harder discussion about spending and potential tax increases to keep this under control in the future.

As we are writing this letter, the S&P 500 is having back-to-back +2% days. The last time that happened coming off of a 52-week low was 11/24/08 and before that 9/19/08. Having lived through those two dates in market history, I can tell you we do not want to replicate the forward 6-month performance from those times. However, similar circumstances occurred in October 1990, October 2002 and December 1987, all excellent entry points for stocks.

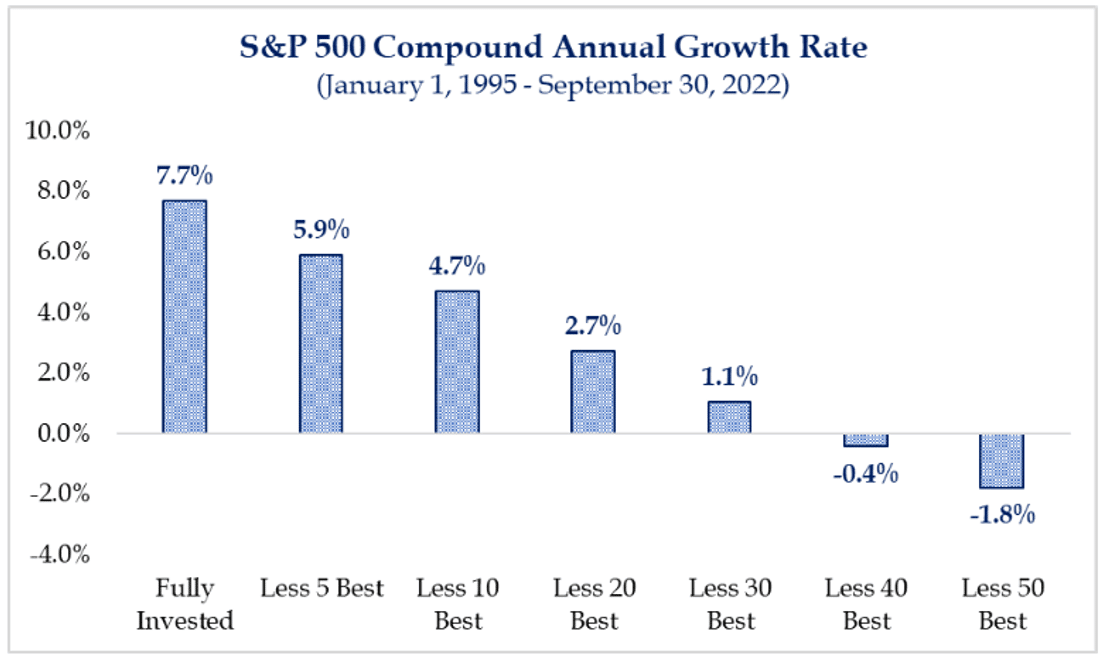

While it is very difficult to predict the short-term, we will close with the chart to the left from Strategas showing that it is very difficult to time the market and missing just a few of the best days (such as the last two), can really impact long-term performance. We have emphasized perspective in this letter today and this provides another example and why we think it is important as a long-term financial partner for our clients. There are no guarantees in this business, but perhaps we can move from an “annus horribilis” to an “annus mirabilis” (wonderful year) in the months ahead. As an aside, my high school Latin teacher, Mrs. Fineout, is smiling somewhere right now.

In firm news, we are happy to welcome the newest member to our team, Callie Bradshaw, who joins us as a Private Client Specialist in Greenville. Also, we are excited to announce Kalisse Evert, who many of you know well, is transitioning to become our Marketing & Events Specialist at the firm. You can view the press releases for these announcements on the Insights page. In addition, this area provides other firm resources and information, such as our recently launched series on Woman & Money, with Melissa Bane. Check these and other items out when you have a chance. Perhaps most important to you, the Greenwood Capital Calendars are in and we will be sending those out to you in November.

To close, I know that past nine-month period in financial markets may have resulted in concern and anxiety for you given the volatility we are experiencing. We are here to help in any way we can. Please reach out if you have questions or concerns or would like to sit down and have a conversation about your financial situation. As always, we appreciate your continued confidence in our team and the support of our firm.

On behalf of all the employees at Greenwood Capital,

Sincerely,

Walter B. Todd, III

President/Chief Investment Officer

The information contained within has been obtained from sources believed to be reliable but cannot be guaranteed for accuracy. The opinions expressed are subject to change from time to time and do not constitute a recommendation to purchase or sell any security nor to engage in any particular investment strategy. Investment Advisory Services are offered through Greenwood Capital Associates, LLC, an SEC-registered investment advisor.