January 6, 2023

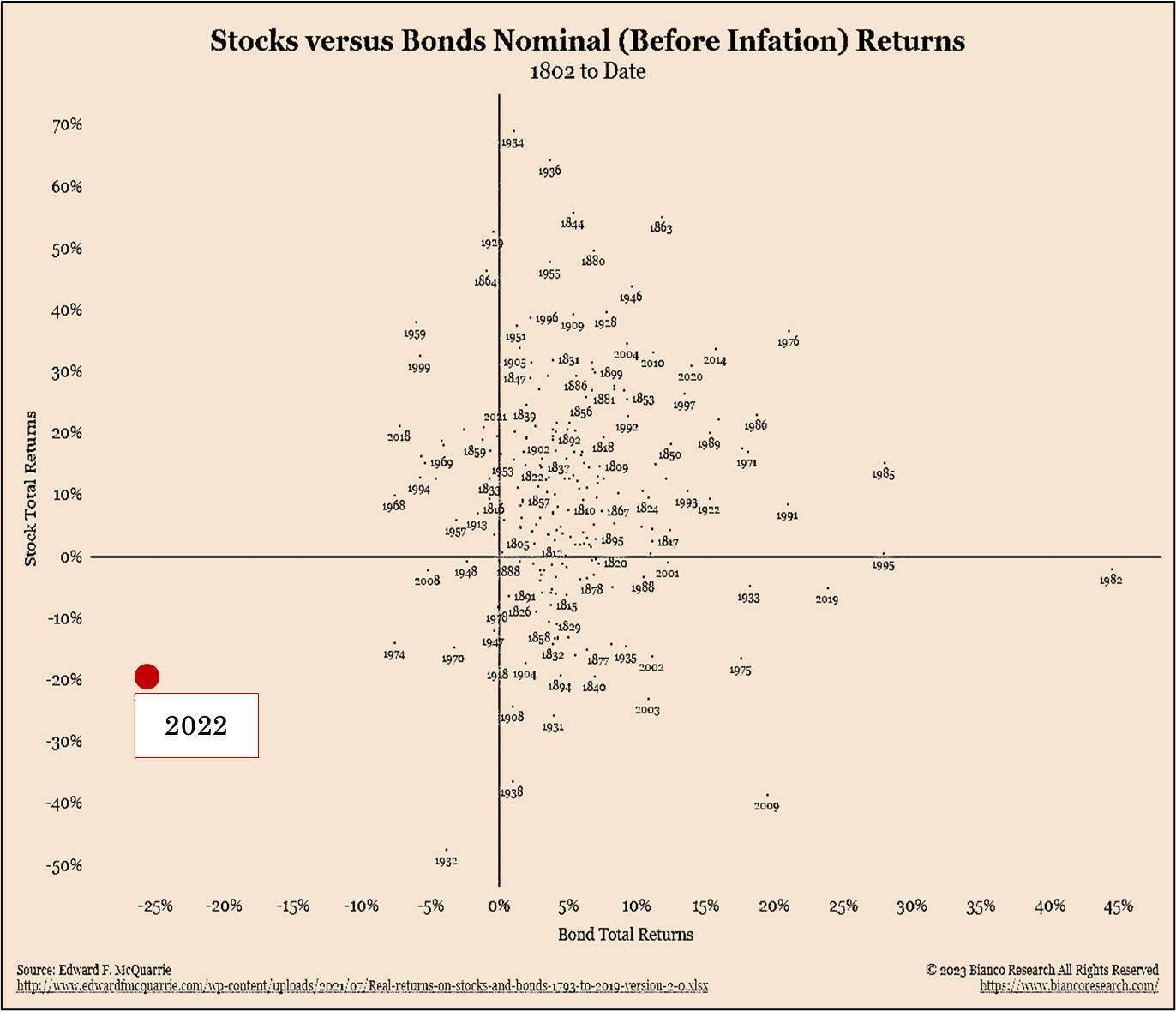

The greeting of Happy New Year takes on a new meaning as we enter 2023. Happy to be here, first and foremost, but also truly happy to start a new year after the year in financial markets that was 2022. How bad was it? Well, the scatter graph to the right shows the past 220 years of bond and stock returns. While challenging to read, the important thing to see is the red dot way off to the left. The combination of stocks down nearly 20% and bonds (in this case long-term corporate bonds) down over 25% has never been seen before, not even close. So, when I say Happy New Year, I definitely mean it. I hope this letter finds you well and that you survived the late December “ice-age” without a burst pipe. Let’s get to it.

For those that have been reading my letters over the years, you know I have a fondness for magazine covers. I believe they capture the sentiment of the day in a very succinct way. We started January 2022 with the yellow cover below on the left talking about the titans of tech and their ambitions. We ended 2022 with the cover on the far right entitled “Searching for Returns” and the Technology sector having its worst performance in the past twenty years. In between these two bookends we had no shortage of drama and turmoil, from rates jumping higher thanks to the Fed and inflation, to war in Europe, to a crypto currency meltdown. All captured in the pictures below. What will be on the covers in 2023? Time will tell, but let’s explore the implications of what happened in 2022 and what that may portend for the future. As Yogi Berra famously said, “it’s hard to make predictions, especially about the future,” but here we go.

Impact of War in Ukraine

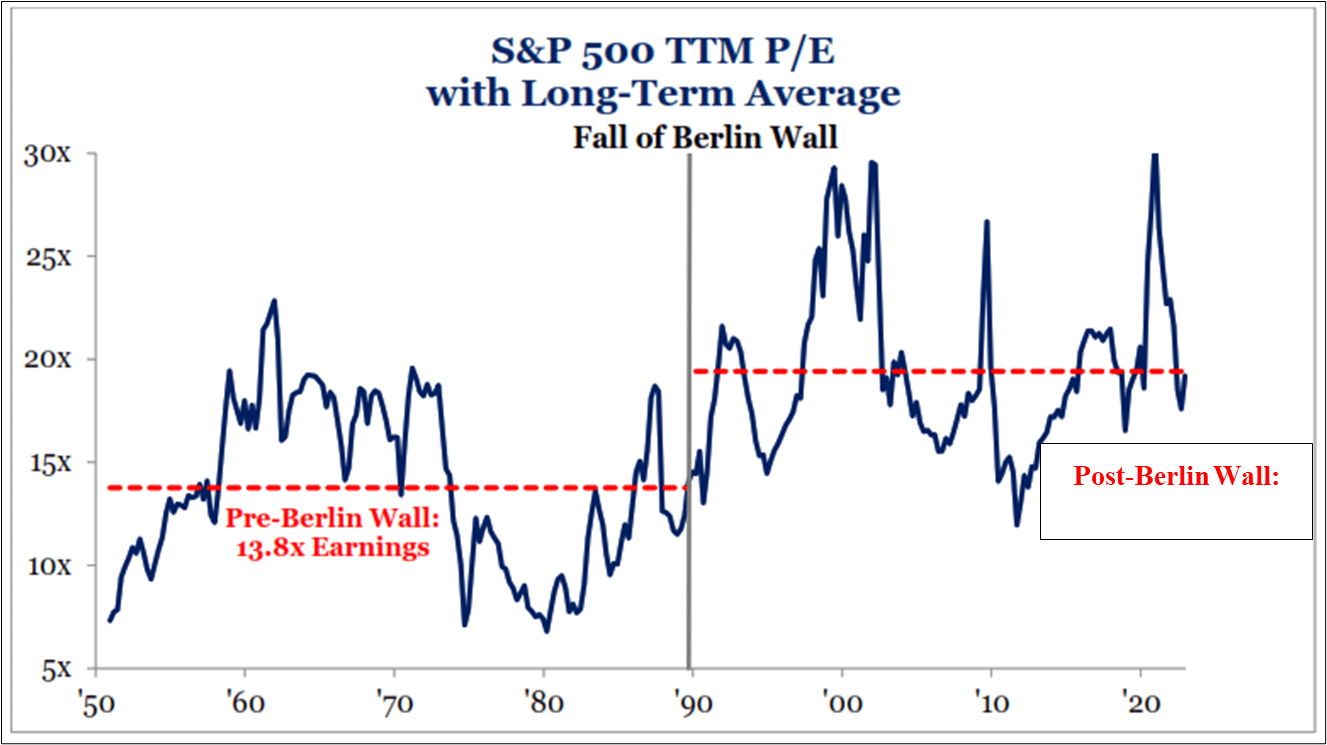

While inflation and the Fed grabbed many of the headlines in 2022, the implications of the war in Ukraine may be longer lasting. We spoke in our first quarter 2022 letter about moving from the post-Cold War world that followed the fall of the Berlin Wall in 1989 and ushered in a wave of globalization that lasted for the past 30-years. This resulted in a “peace dividend” in the form of lower overall inflation and lower interest rates as companies moved supply chains to the low-cost producer and geographies. While the protectionist tariffs and policies under the Trump administration started the movement away from this globalization, the invasion of Ukraine by Putin sealed the deal.

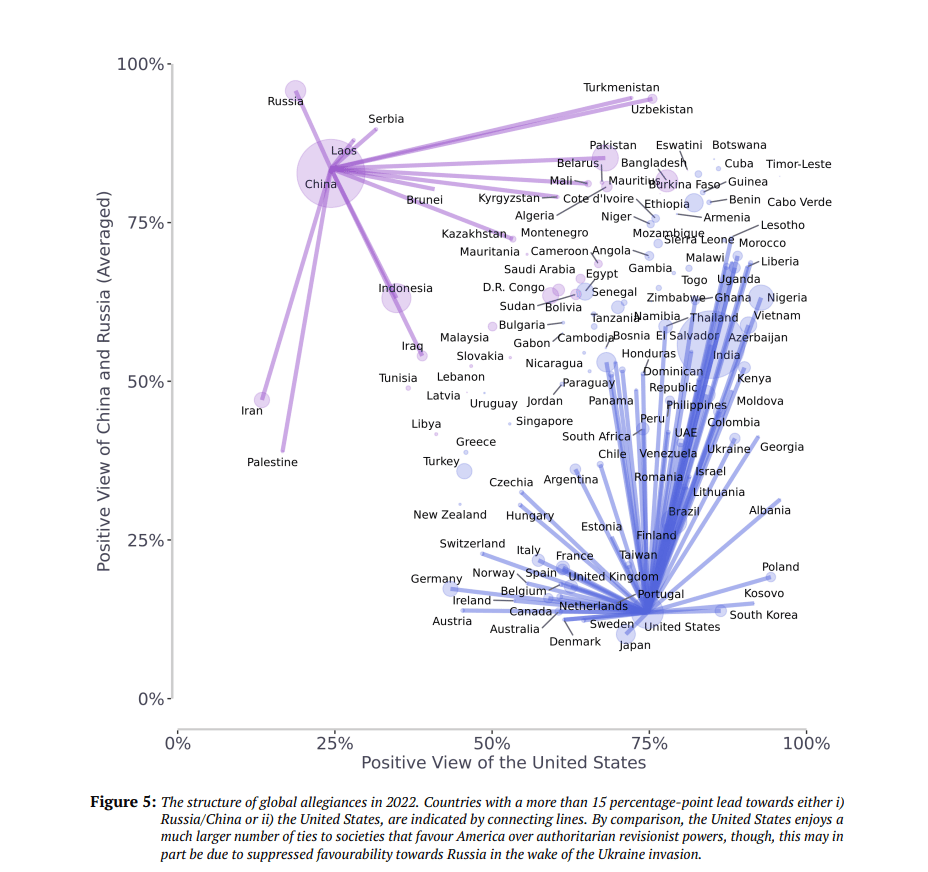

This will move the world toward regionalization and back toward the “East vs. West” dynamic that prevailed after WWII ended. The chart to the bottom left demonstrates this dynamic of allegiances between China and Russia from a recent survey by UK researchers. Combine this dynamic with disruptions we saw in global supply chains from the Covid pandemic, and we have the makings for a world where inflation is set to be higher over time (albeit down significantly from the current reading of 7.1%). The 1.5% to 2% range post the financial crisis is likely to reset to 2.5% to 3.5% in this framework. This equates to likely lower valuations for stocks and higher rates over time. The chart bottom left demonstrates this by highlighting the average P/E ratio pre- and post-Berlin Wall. While this is a good proxy for the overall market, there will be some “winners” from this new world order – defense stocks, for example, may be the new growth industry.

RIGHT: The Structure of Global Public Allegiances, Based on Nationality-Representative Public Opinion Surveys

Source: “A World Divided: Russia, China, and the West.” Cambridge, United Kingdom: Centre for the Future of Democracy, October 2022, Roberto Foa et al.

Inflation

Speaking of inflation, that was certainly a main topic of focus for financial markets in 2022. Dr. Mark Pyles details this in his Economic Overview in the Market Commentary piece. Perhaps even more impactful than the inflation numbers themselves is the Federal Reserve’s reaction function to these elevated prices, raising interest rates at a pace not seen in 40 years, including four consecutive increases of 0.75%. However, we believe strongly that inflation peaked in the middle of 2022 and is on pace to come down expeditiously in 2023.

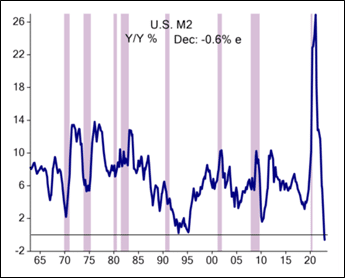

The main reason for this belief is incapsulated in one chart, featured right. This is the year-over-year (YOY) growth in Money Supply or M2. After exploding higher during the pandemic thanks to government stimulus checks and a $4 trillion increase in the Fed’s balance sheet, M2 growth has collapsed over the past 12 months and looks slated to fall during a calendar year for the first time since the statistics began in 1959. Further, as we look at the past six month-over-month readings in CPI (including an estimated 0.1% for December), annualized, we see inflation tracking around 2.3%, down from a high of nearly 12% by the same measure earlier in 2022. While the Fed has not yet admitted to this reality, we feel they will come around to it in early 2023.

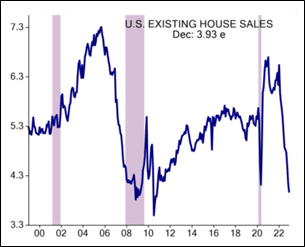

So, if the Fed stops hiking interest rates, does that mean we are in the clear? Not necessarily. The rapid pace of financial tightening that occurred in 2022 will have ramifications long into the future. Look no further than the housing market. The chart left depicts existing homes sales, which have fallen below the levels seen during the pandemic. Home prices in the hottest markets during the pandemic are starting to fall, but with mortgage rates doubling over the past year, prices will need to come down further to make purchasing a home attractive and affordable to many. Higher interest rates have caused similar slowdowns in other big-ticket items as well, including new and used cars, appliances, etc. The slowdown in economic data brought on by the Fed’s tightening campaign can also be seen in other recent readings, such as regional Fed Surveys, Purchasing Managers Indices (PMIs) and Leading Economic Indicators (LEIs).

Impending Recession

These data points, along with an inverted yield curve (short rates higher than long rates), seem to indicate a recession is in the cards in the coming quarters. The market impact of such an event will depend on its depth and duration. The down 25%+ low in the S&P in 2022 may have discounted a mild recession in the US. And let’s not forget the other 75% of the world’s GDP outside the US. China is moving from a zero-Covid policy and opening back up. This will be an uneven process to be sure, but it should prove to ultimately be a boost to world growth later in the year. Europe is learning to live with a war in Ukraine and higher energy prices. China demand will help an export focused Germany. In addition, slowing US growth and a moderation in Fed rate hikes should create a top in the US Dollar, boosting international markets and US-based companies selling goods overseas.

2023 Markets

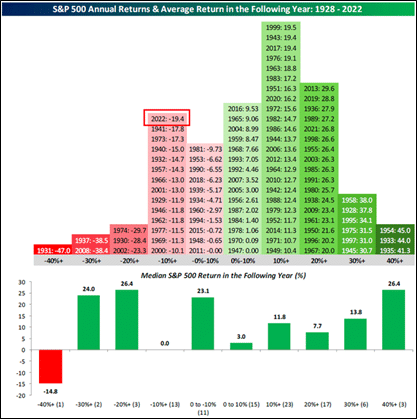

As for what 2023 holds for the US stock market, the chart left is interesting. Looking at the last 95 years of price returns on S&P 500, we see that approximately 68% of the time, we have a reading that is positive. 2022 fell into a relatively narrow category (14% of time) of down more than 10% but less than 20%. The bottom part of the chart displays the median S&P 500 return in the following year in each return basket. It is flat in the case of 2022 subsequent return, but the range is wide, from +44% to -30%. As I write this letter, we started 2023 with a down day, but are rallying on January 4 and putting us above the level from December 22, 2022, of 3822 on the S&P 500 and qualifying as a Santa Claus rally (last 5 trading days of year and first two of new year). We’ll take it.

Finally, before I wrap up this letter, let me take just a moment to comment on what is happening in the House of Representatives and the vote for the Speaker. Kevin McCarthy has lost 3 ballots to be Speaker of the House, making him the first Speaker to not be elected on the first ballot since 1923. Hopefully this does not go to the 133 ballots that it took in 1856, but in all seriousness, this failure to quickly elect a speaker for the newly controlled Republican House highlights the fractures in the party (and the country) and has possible implications for several important events that will occur later in 2023, including a showdown on the Debt Ceiling that looks set to happen sometime this summer. Stay tuned.

40th Anniversary

In firm news, we are excited for Greenwood Capital to enter 2023 and its 40th year in business. Only 25% of small businesses make it beyond 15 years, so we were fortunate to have a strong foundation developed by past owners and employees over our history. From our start as an independent RIA in 1983, we have become a full-service investment advisory firm serving individuals and institutions today. We look forward to celebrating our anniversary milestone and legacy throughout the year while also highlighting the Greenwood Capital of today. We could not have reached this “age” as a firm without the tremendous support provided by our clients and business partners and the hard work and dedication of the employees (past and present) of Greenwood Capital. We will share more details in the coming months regarding our anniversary celebration in 2023.

To close, while we cannot control the seemingly random and often unexplainable machinations of financial markets day to day, we can control the client service and support we provide to you. I hope that you have found that to be more than satisfactory over the past year. Feel free to reach out with any feedback you may have. As always, we appreciate your continued confidence in our team and the support of our firm.

On behalf of all the employees at Greenwood Capital,

Sincerely,

Walter B. Todd, III

President/Chief Investment Officer

The information contained within has been obtained from sources believed to be reliable but cannot be guaranteed for accuracy. The opinions expressed are subject to change from time to time and do not constitute a recommendation to purchase or sell any security nor to engage in any particular investment strategy. Investment Advisory Services are offered through Greenwood Capital Associates, LLC, an SEC-registered investment advisor.