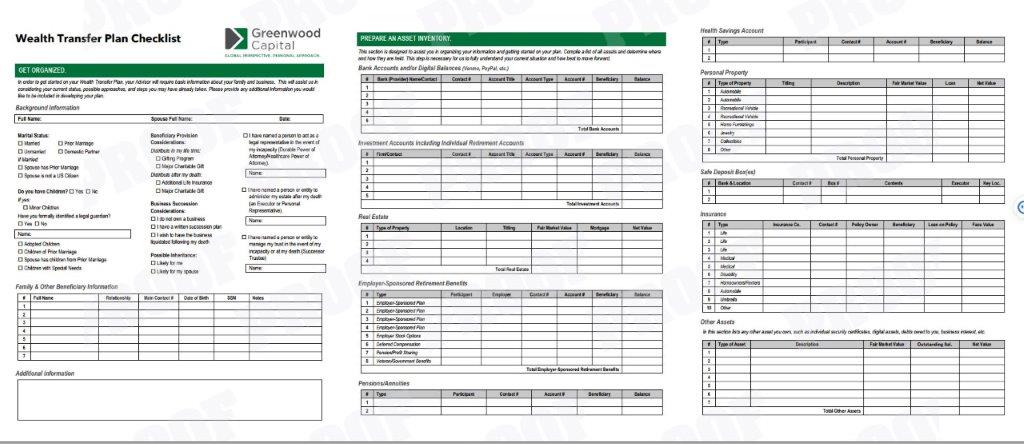

Generational Wealth Transfer Checklist

Preparing your Wealth Transfer Plan can initially seem very overwhelming. To help you get started we have created a Checklist to guide you through the main steps:

- Getting Organized

- Preparing an Asset Inventory

- Consulting an Attorney

- Reviewing & Filing Documents

Using the checklist, you will note your current situation, detail your wishes, and compile a list of your assets in one document. This will provide a framework for meaningful discussions with your financial advisor, attorney, accountant, and other trusted advisors.

Thinking through your situation will help you consider current decisions (such as potentially gifting assets during your lifetime), as well as future situations (such as titling assets to minimize probate). Lastly, you may use the document list section to prepare a central file for reference during your lifetime, and information-gathering for your loved ones in the future.

Click image to see an expanded view.

Wealth Management Team

Melissa D. Bane

CPA, CFP®, PFS®, ChFC

Senior Client Private Advisor

John W. Cooper

CFP®

Senior Private Client Advisor

Denise H. Lollis

CPFA®

Chief Operating Officer

Chief Compliance Officer

Callie Bradshaw

Private Client Specialist

Germein De Sario

Private Client Administrator

K. Diane Smith

Private Client Administrator

William M. Coxe, Jr.

CRPC™

Private Client Advisor

Brian L. Disher

CFP®

Director of Wealth Management