When it comes to investments, understanding what inning of the game you are in is important.

If you have turned on the news or checked your investment account balances in the past 3 weeks, you may have felt a wave of anxiety. Although recent headlines such as, 7% inflation, a Russian invasion of Ukraine, 4 possibly 5 interest rate hikes, and the possibility a looming recession cannot be shrugged off, we must also realize the media’s livelihood depends on getting our attention.

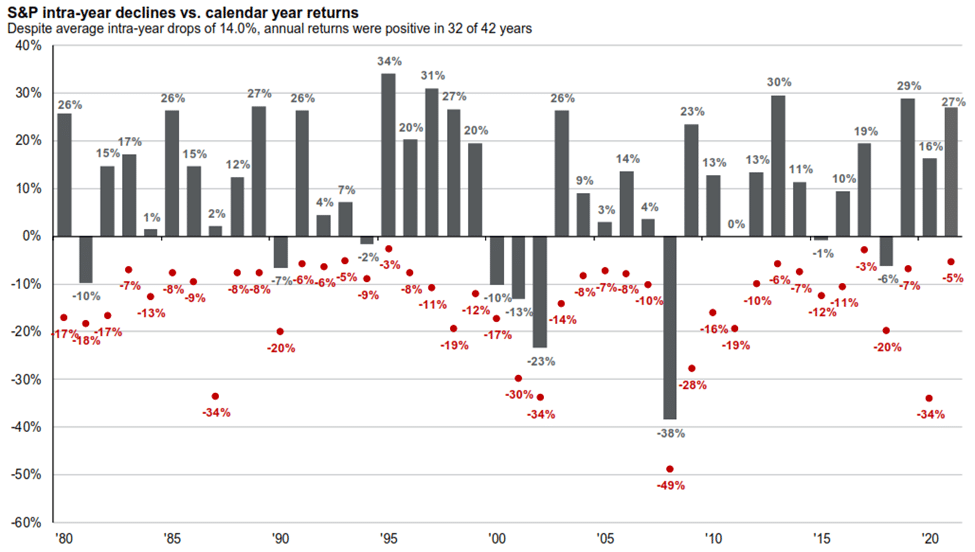

First things first. Understand stock market corrections of 10% or more are perfectly normal, as the chart below visually demonstrates. When they do occur, it is important to understand what inning of the ballgame you are in and your investment plan should align with it.

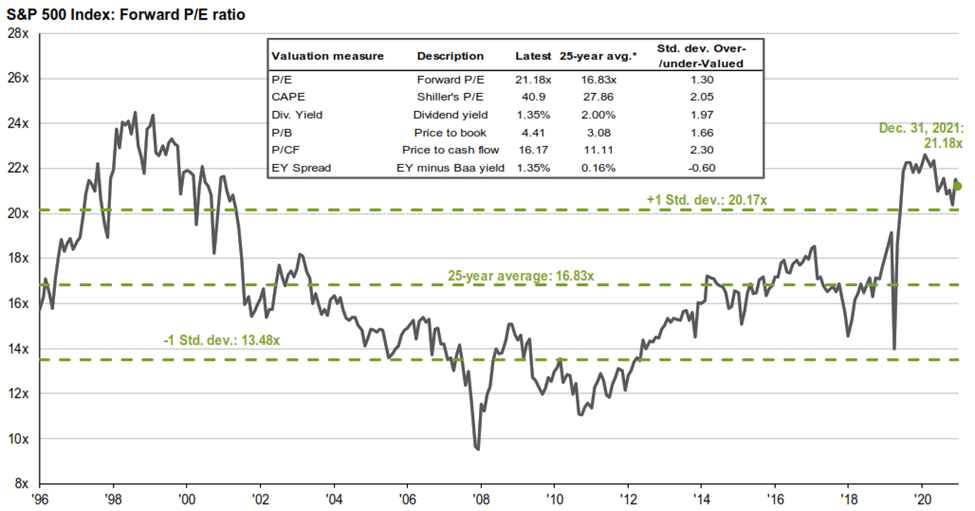

The U.S. stock market has been a massive winner over the past 3 years. The U.S. stock market (S&P 500) was up 31.29% in ‘19, 18.25% in ‘20, & 28.59% in ‘21. The long-term average since 1928 for the S&P 500, which tracks the 500 largest companies in the US, has returned 10-11% per year. The recent success has pushed stock market valuations to high levels (see chart below).

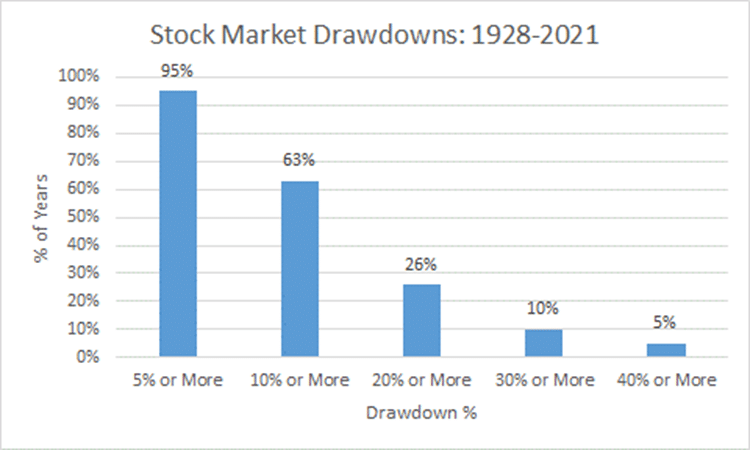

We know the stock market does not move up in a straight line (although it may have felt that way since the March 2020 lows). Volatility is normal. It is the price we pay for long-term returns. Looking at the market since 1928, the average sell-off is 16.3% per year. This occurs for a variety of reasons; however, if you study the long-term data, it can be viewed as a reversion back to the mean total return of 10-11% average annual returns. While you may not find comfort in the chart below by itself, let’s continue.

Since 1928, there have been 23 years that the S&P has had double digit drawdowns, yet finished with double digit returns. Crazy right? Volatility has been around forever and it is not going away anytime soon. Trading has never been cheaper and accessible, and data has never flown faster. This is another reason markets can move so violently these days.

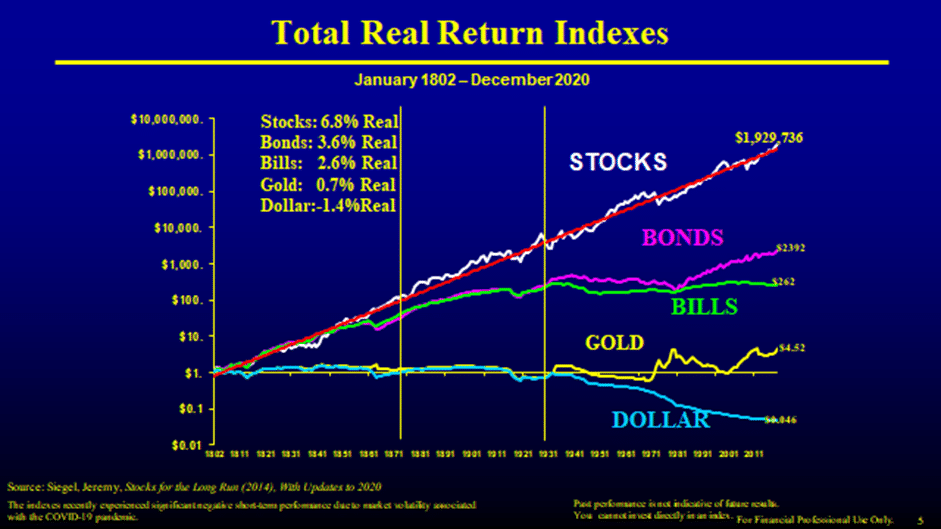

If you look at stock market returns over the long run (as featured in the chart below from Professor Jeremy Siegel), which is how we should view our investment strategy because our time horizon typically exceeds a decade, the data is also quite compelling to continue to own and purchase equities.

Volatility is simply the price of admission.

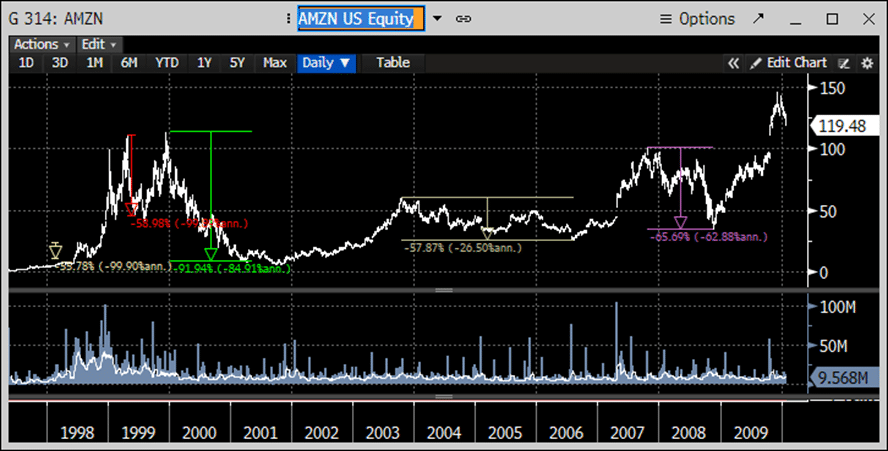

Although the drawdowns are painful to endure, it is actually necessary for the market to make longer term advances. Speculative market participants get flushed out and the disciplined, long-term investors are rewarded for their patience. It is incredibly tough to watch those making speculative bets be rewarded for recklessness (The GameStop saga, crypto currencies, NFTs, SPACs, tech stocks in 2000, real estate in 2008, the list goes on…); however, history has a funny way of repeating itself.

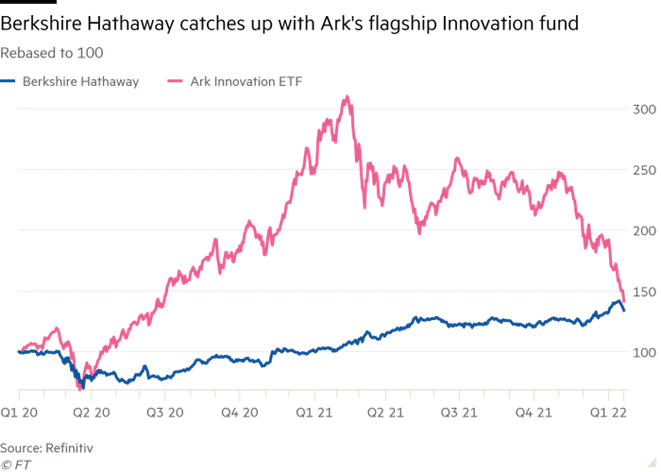

Let’s take a look at how Warren Buffett has now outperformed Cathy Woods’ speculative ARKK innovation fund. Buffet is known for his simple and patient investment strategy of purchasing good companies at great valuations, while Cathy is known for her speculative bets on disruptive/mostly unprofitable businesses.

This chart has only gotten worse for Cathy as this week has gone on. Buffet took the stairs, while Cathy appears to have investors on a rollercoaster.

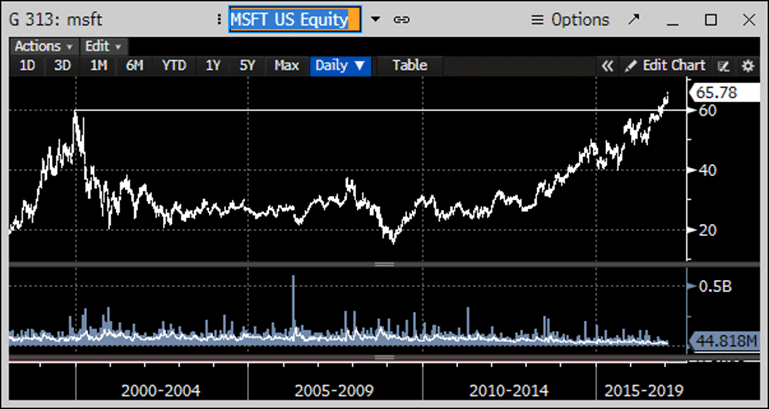

Does growth matter? Yes. You certainly do not want to buy a company without the prospects of growth; however, we believe the price you pay for something matters as well. Let’s look at Microsoft. If you purchased MSFT at the peak of the tech bubble for $59.97 on 12/30/1999, it would have taken you over 16 years to break even. Meanwhile Microsoft remained a fantastic company. It never stopped growing, it continually raised its profits, but the valuation was simply too high in 2000. We believe fundamentals matter and they always will.

To continue with the baseball analogy, for those early in the ball game in the wealth accumulation phase, this is a learning opportunity as you will inevitably experience many drawdowns over your lifetime. Understand it may be a wonderful buying opportunity. Whatever you do, do not panic. Panicking is not a strategy. The best game plan in any area of life is one that you can stick to.

If you are 5 or more years away from retirement, you are not trying to bunt a runner home on a suicide squeeze because you are in the 3rd inning. The batter’s goal is to hit singles and doubles while the defense focuses on making routine plays to record outs. The other team will likely score some runs, but time is on your side and you have a proven strategy to win.

For those in the 5th – 7th innings of life, this is not your first rodeo. This is a good time to reflect on your portfolio and how it is positioned. We are not trying to suicide squeeze a runner home to score in the 5th inning. Stay focused on spending less than you make, investing often, and positioning your portfolio accordingly. In other words, hit singles and doubles and throw strikes. The other team will likely score some runs, but time is on your side and you have a proven strategy to win.

If you are experiencing dramatic swings in net worth, please call us and we will review your allocation and diversification. If your goals or time horizon have shifted, maybe it is time to update the return objective of your portfolio.

For those in the 7th seventh inning stretch and beyond with a 5 run lead, it is crucial to understand the purpose behind your assets and how they are being managed. Do not let a solo home run by the opponent shift your mindset. Now is the time to define and understand the purpose for your assets and how to manage them according to your goals. If they are invested solely to support your retirement, you should not experience massive drawdowns, while funds invested for the benefit of subsequent generations would carry a higher risk profile subjecting them to more volatility.

Regardless, the message is the same. Define your goals, develop your plan, and stick to it. That is how you win in this game.

Here are 2 simple rules to handle these rough markets.

1) Pitching is simple if you throw strikes – stay diversified

- a. Although it is tempting to concentrate your positions in up markets, where everything seems to only go up (ARKK mentioned above), that strategy is not sustainable. It is impossible to hit big on every stock you pick. Even if you bought Apple or Amazon at their IPOs, many investors would have sold them when they lost over 50% of their value multiple times. They are two of the best companies in the world in the past century.

- b. Although diversification may suppress returns in up markets, it allows you to participate and minimize volatility throughout your investment journey. We are investors, not speculators. If you want to gamble through concentration, go to the MGM. The black jack table is much more fun and the drinks are free, vs. going all in on a company and watching the stock chart zig and zag as you are consumed with anxiety.

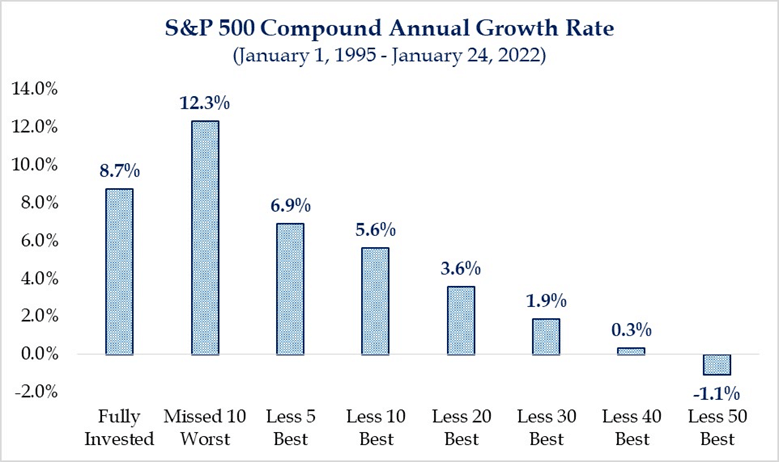

2) Hitting is hard – so is timing the market.

- a. The chart below highlights that by missing just the 5 best days in the market over the past 27 years would result in annualized returns lagging nearly 2% per year vs. a fully invested portfolio. We construct portfolios based on a plethora of data to achieve your goals. It is important to stick to your game plan. As Warren Buffett simply states it: “The stock market is a device which transfers money from the impatient to the patient.”

If you are feeling anxious, please call us. We are here to help you navigate through volatile times and provide you with objective insights. In a world full of chaos, an internet full of click bait, and news channels filled doom and gloom, we provide a voice of reason.

This market commentary represents the opinions of Greenwood Capital Associates, LLC and is for informational purposes only. The information contained herein has been obtained from sources believed to be reliable but cannot be guaranteed for accuracy. It is not intended as a basis for the implementation of any particular investment strategy or any decision to purchase or sell. The opinions expressed are subject to change from time to time and do not constitute a recommendation to purchase or sell any security nor to engage in any particular investment strategy. Investment Advisory Services are offered through Greenwood Capital Associates, LLC, an SEC-registered investment adviser.