Financial Health for Your Peace of Mind

As a healthcare worker, you are used to solving problems and focusing on details. After all, in your career, the stakes can often be life or death.

But it can be more difficult to navigate the maze of personal finance. In this series, we dive into the specific financial issues facing medical professionals at every career stage. We will provide straightforward answers to the economic concerns faced by doctors, nurses, administrators, and other healthcare workers.

Starting a career in healthcare often looks like twelve-hour shifts, long hours on call, and making quick decisions for patient care. If you are like most early-career medical professionals, you are focused on the transition from a supervised classroom into the fast-paced environment of a surgery suite or ICU ward, not on the deductions line on your pay stub. And when you come home from caring for your patients, you have your own family and life to focus on.

So, what about retirement—how do you save when you’ve just started your career?

With student loan debt looming over your head and a new paycheck that doesn’t seem like enough after Uncle Sam takes his cut, it can be hard to think about saving early in your career. However, saving for retirement can have the most impact NOW, while compounding interest has time to grow your accounts.

Just Get Started

If your employer offers a retirement savings plan, such as a 401(k) or 403(b) plan, start contributing!

If you are not sure how to begin, you can start small. Actually contributing to your retirement plan is more important than how much you contribute. You can begin by contributing a percentage of your pay, even just 1%! It is a great way for your savings to grow as your paycheck increases.

You can also increase the percentage every time you receive a raise or bonus. If you can contribute more, try contributing 3-5%. This is especially important if your employer offers matching contributions!

Remember: Retirement plan accounts can be used for anything in retirement, not just bills. They can pay for travel, a new car, funding college tuition for a loved one…the list goes on!

Small Savings Add Up!

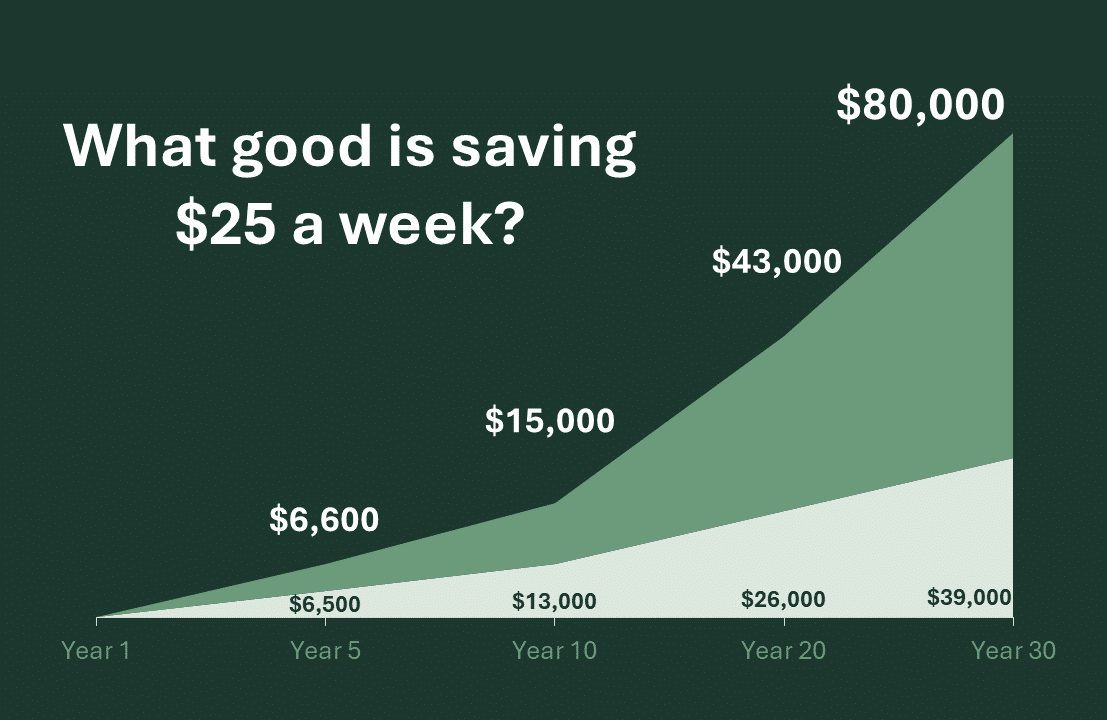

A daily latte is $5. If you go every day before work, you will spend $25 a week. If that same amount is invested in a retirement account, it could grow exponentially.

In the chart above, the light green shows how much you would have saved over 30 years if you did not invest. The darker green shows how much you would have if you invested those funds, assuming a modest 5% return annually.

If you want more clarity on how much you should be saving, a financial advisor can help you create a budget and run the numbers.

Your advisor can create a financial plan that shows your income, contributions, and goals. This way, you can see how much those savings will impact your retirement options. Your advisor can also help you navigate the balancing act of savings versus debt reduction.

How Does Your Retirement Plan Work?

If you are working for a for-profit organization, you will probably have access to a 401(k) retirement plan. However, many healthcare professionals work in hospitals or other non-profit organizations that provide 403(b) plans. These plans are nearly identical on the employee level. These retirement accounts allow you to set aside before-tax retirement savings, with large contribution limits and no income limitations.

According to the National Association of Plan Advisors (NAPA) as of 2021, 79.4% of all non-profit employees who have access to a Traditional 403(b) chose to participate.

One of the biggest advantages of contributing to a 401(k) or 403(b) plan is that your employer may also contribute. Often, this is in the form of a matching contribution, up to a certain percentage of the employee’s salary or savings rate. This allows you to possibly double your contribution at no personal cost.

These retirement accounts also offer a lot of flexibility. The plans offer a range of investment choices, allowing you to create an asset allocation model that aligns with your personal risk tolerance and savings goals. (Your financial advisor can help with that!)

401(k) and 403(b) retirement accounts are also portable. If an employee leaves the job, the account can follow, either by being rolled over into another plan or an IRA – individual retirement account. This can help you avoid taxes and penalties on early withdrawals and ensure that your retirement savings continue to grow.

Ready for your next step?

Whether you are a resident who just matched, a nurse working the night shift in the NICU, or a pharmacist who just started their first job, don’t let your financial health fall by the wayside. Take steps to address your debt and get started on saving.

We are here to help, whether by answering a quick question or building an in-depth personalized financial plan.

John W. Cooper, CFP®

Senior Private Client Advisor

During his first decade in the workforce, John worked at Self Regional Hospital (then Self Memorial) in materials management. His previous experience at the hospital provided him with a unique insight into the financial challenges that healthcare workers face.

Even after pivoting to a career as a financial advisor, John has remained dedicated to supporting nurses, doctors, and administrators. Instead of ordering new operating room equipment, he now provides customized, informed financial plans for his former colleagues.

Further Reading

Swallowing the Pill: How to Handle Student Loan Debt

This article tackles how to approach your student loans and lays out the options you may have for repayment or forgiveness.

All About Your 403(b): Traditional vs. ROTH

Learn more about your 403(b) plan, including the differences between a traditional and ROTH account.

Start with Strategy: Retirement Savings Part 1

What strategies should you be implementing as you start saving for retirement?

Want to receive financial guidance in your inbox?

Excerpts from or links to this article on the Greenwood Capital Insights page have been included in Greenwood Capital social media pages and distributed Greenwood Capital newsletter. As is the nature of social media, the general public is able to post comments and/or “likes” in response to these excerpts and/or links. These comments are unsolicited and are posted by either clients or non-clients, which could be interpreted as client testimonials or public endorsements, respectively, and no cash or non-cash compensation is provided. A conflict of interest could exist related to unsolicited posts as Greenwood Capital and its investment adviser representatives could indirectly benefit from these posts.