July 7, 2025

“I can calculate the motion of heavenly bodies, but not the madness of men.”

We are just going to keep this trend going with the opening quote for the letter. The one above is attributed to Sir Isaac Newton when asked about the continuously rising stock price of the South Sea Company in the early 1720s (note that Newton reportedly owned some of the stock as well). This was an early example of an investment bubble and collapse that came to be known as The South Sea Bubble (see chart to the right of the stock price of the South Sea Company). Albert Einstein said that Sir Isaac Newton was the smartest person who ever lived and the greatest scientific mind of all time.

I am not implying we are in a bubble currently but watching the equity market fall over 21% and rally back over 28% in little more than 120 days, I very much understand Newton’s confusion at the movement of markets (or to paraphrase, “the madness of investors”). But here we are, with most major asset classes all positive on the year and that’s a good thing! Let’s examine some of the major topics of the past three months and what they mean going forward.

Budget Bills & Dollar Bills

First, as always, I hope this letter finds you well and that you enjoyed a pleasant July 4th Holiday with family and friends. We mentioned in the letter last quarter about the budget and tax bill being discussed in the House. The “One Big Beautiful Bill (OBBB),” as it was called, ping-ponged from the House to the Senate and back to the House, ultimately making it to the President’s desk on July 4 for signing. Understanding the controversial nature of this legislation and the way in which it passed, let me focus on the main areas that most impact financial markets.

The OBBB makes most of the tax provisions permanent from the TCJA of 2017 including, importantly, the estate tax exemptions and levels. It provides accelerated R&D expensing and depreciation which should encourage capital spending in the coming months and quarters. This legislation also increased the Debt Ceiling by $5 trillion. This avoids a standoff that threatens the ability of the US government to continue to issue debt (like 2011). As we have stated many times, the path of spending is not sustainable in the long run, but this does remove a short-term risk to financial markets. The price movement of US assets from here will demonstrate what investors believe about US fiscal sustainability.

Related to this, one topic I get questions about often from clients is regarding the US Dollar (USD). While interest rates are virtually unchanged and stock prices are higher than they were prior to the tariff announcement in April, the USD is over 10% lower. Sentiment has changed quite quickly as the two magazine covers included here demonstrate. The first from October 2024 says the USD is the “Envy of the World.” Six months later, the April cover from The Economist talks about a Dollar crisis.

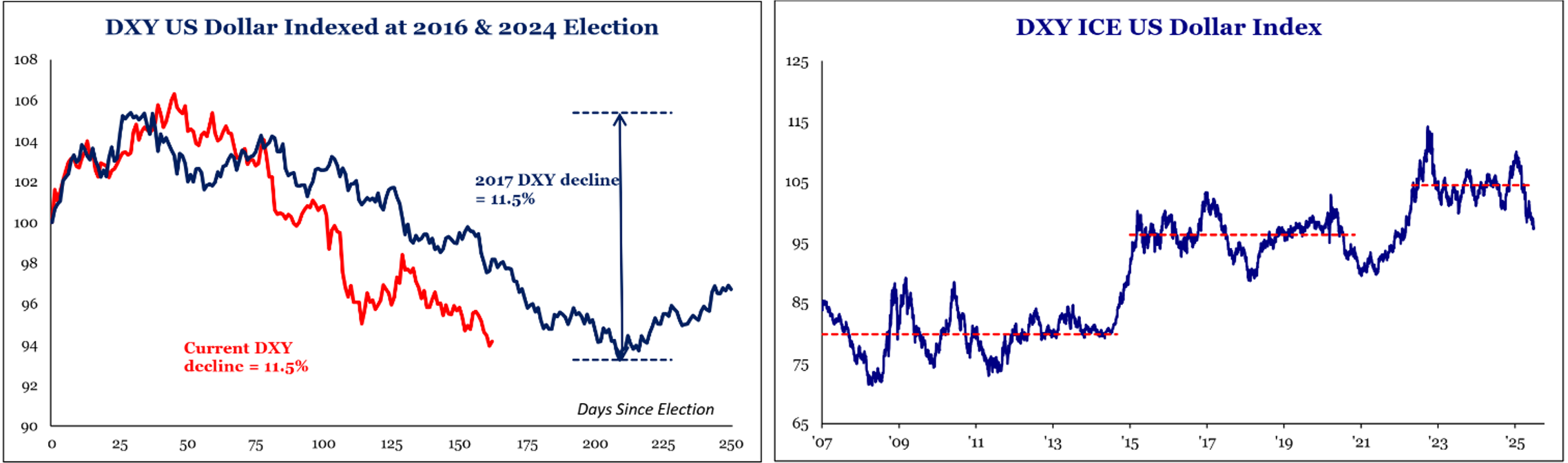

While the 11.5% decline since the election is significant and 2025 represents the worst start to the year for the USD in over 50 years, context is important. The first chart below left (from Strategas Research) shows the DXY Index which is the USD relative to a basket of other currencies. As you can see, the decline we have seen is similar to the one experienced in President Trump’s first term. In addition, looking at a longer time frame (chart on the far right, also from Strategas) shows that the DXY Index has fallen into a range it was in for over five years.

While a weaker USD does make those trips overseas more expensive, it also makes US goods less expensive to our trading partners. This dynamic also provides a tailwind for the earnings of US multinationals selling overseas. To be sure, Treasury Secretary Bessent would not admit it publicly, but I think the current administration welcomes a lower USD. However, a USD that falls too far, too fast could destabilize financial markets so it certainly bears watching as we move forward.

The Tariff Situation

The ongoing tariff situation is also a hot topic of discussion. Recall that within a week of the initial announcement on April 2, many tariffs were paused for 90 days to allow for negotiation. This 90-day period is set to end on July 9. While there have been deals announced with several countries, including one just last week with Vietnam, many countries are set to see tariffs come back on as the pause expires (note this July 9 date may now be August 1 according to some comments made by Treasury Secretary Bessent on July 6).

So, the good news is tariff rates are set to be lower than the nearly 30% average rate that was estimated in early April, however, it is clear they will be multiples higher than the 2.5% average rate that existed at the beginning of this year. The Vietnam example is evidence of this dynamic. The deal announced last week indicated a 20% tariff rate on goods imported from Vietnam – down from the original 46% announced on April 2, but up from 0% prior. It is likely the weighted average tariff rate overall will come in around 15% when all is said and done with negotiations.

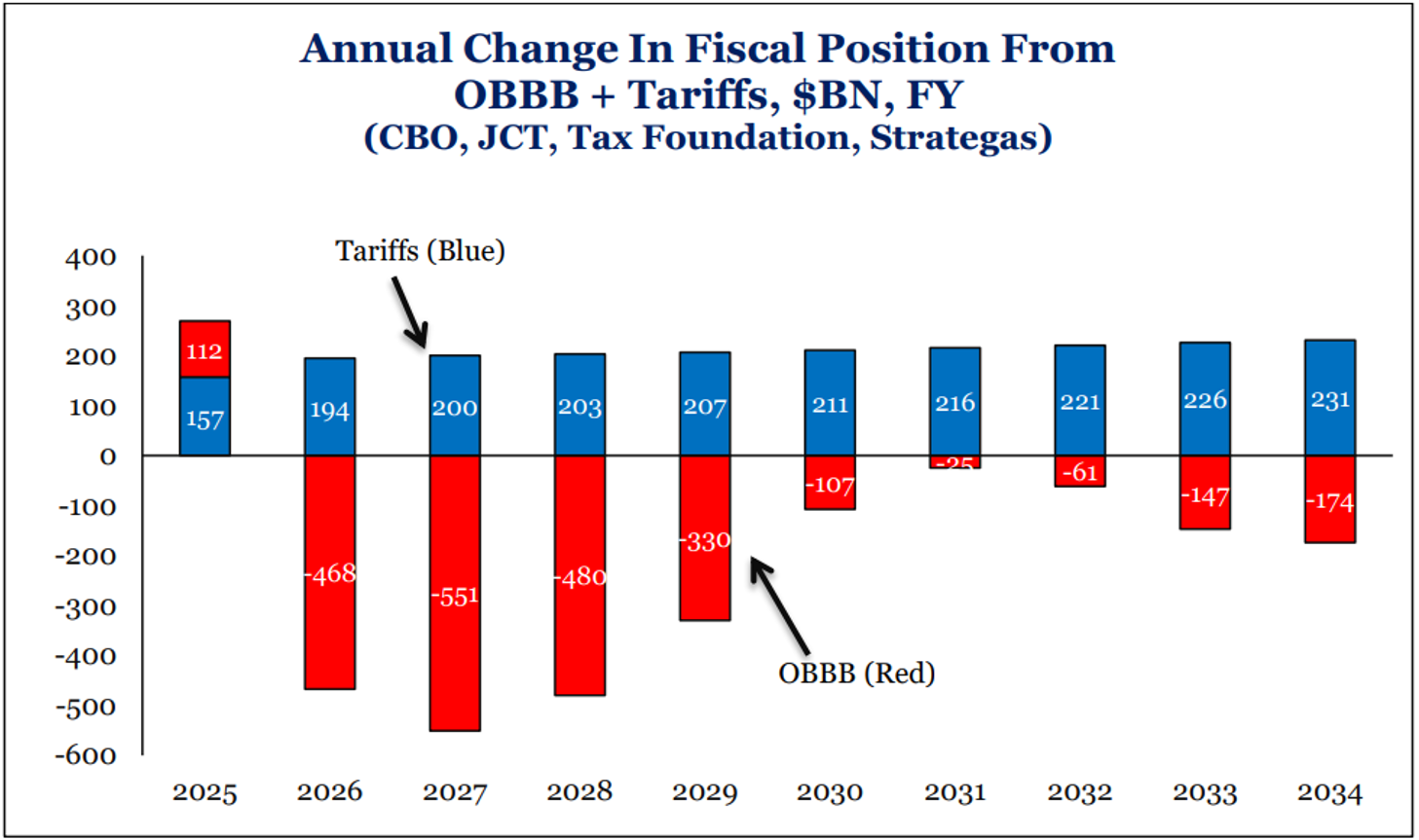

The anticipated effect of these increased prices making their way into the inflation data in the coming months is keeping the Federal Reserve on hold for now (more discussion on this in our Market Commentary). With tariff rates at these high levels, revenue collections are running at over a $200 billion annualized rate. According to Strategas Research, this revenue would approximately offset the cost of the just passed and earlier discussed “OBBB” over 10-years (see chart to the left).

Looking Forward

As we look forward to the remainder of 2025, there are a few dynamics we would highlight. First, as discussed above, regarding the OBBB, while there are a myriad of provisions and pieces to this legislation, from a financial market perspective we have clarity and surety that the current tax regime will largely remain in place, which is positive. The ambiguity of where tariff policy and rates will settle is an offset to this but at least there is some balance. As discussed by Dr. Mark Pyles in our Market Commentary, the economy is undoubtedly slowing.

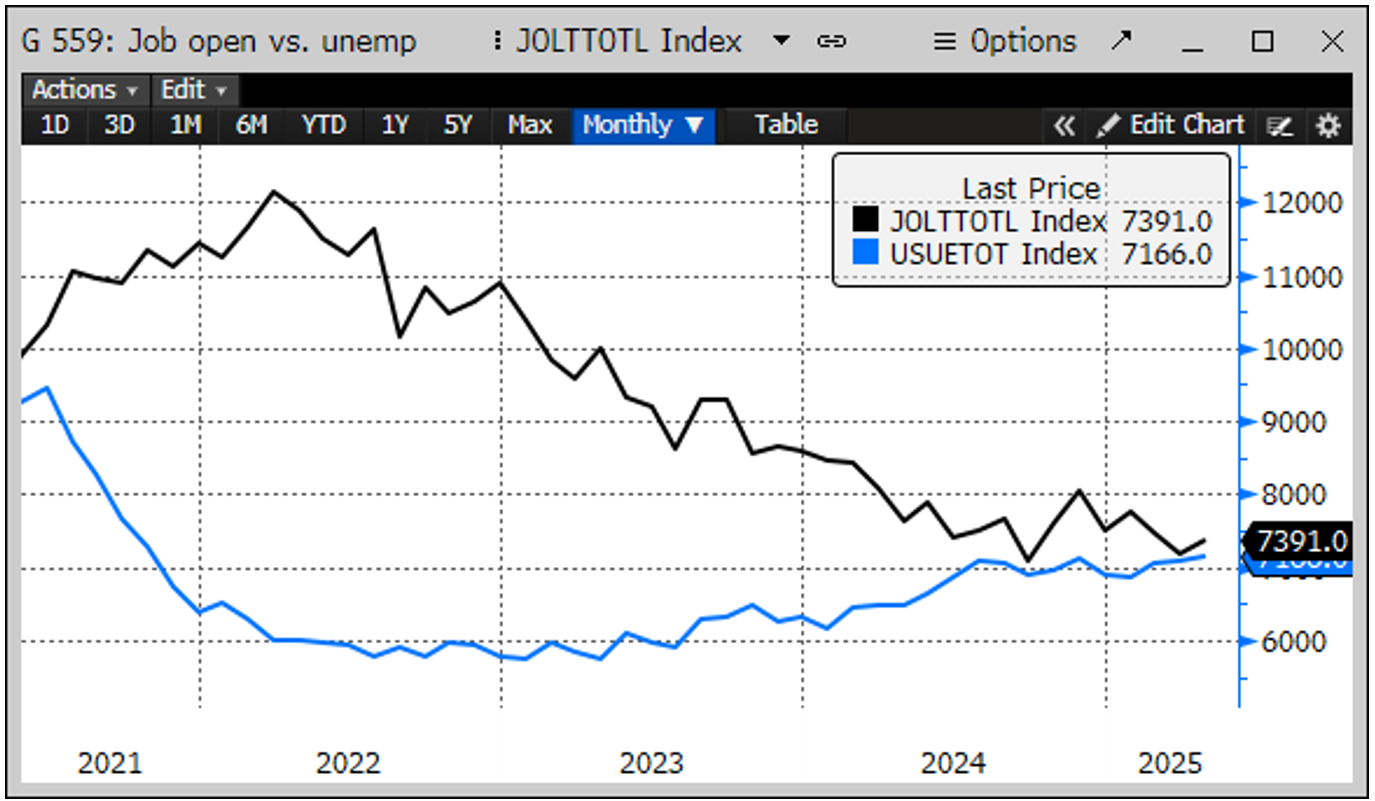

However, the resilience of the data continues to surprise us. The Polymarket contract for a recession in 2025 has dropped to 21% at the most recent reading (yes, through sites like Polymarket, you can place a wager on a recession happening), down from a high of over 60% in April. As noted in several recent commentaries and videos, we continue to watch the labor market very closely. The chart on the right from Bloomberg shows the number of job openings (black line), roughly matches the number of unemployed (blue line), down from a roughly 2 to 1 ratio back in 2022.

While this reflects a labor market that is roughly in balance, the direction of travel for both data series could easily see unemployed exceed job openings in the coming months. Based on financial markets today (stocks at all-time highs, bond spreads near lows and financial conditions relatively loose), investors are clearly discounting a benign outcome to this situation along with many of the potential headwinds out there (we have not even mentioned the geopolitical backdrop which saw the US bomb Iran during the quarter). To quote Mark Twain “I am an old man and have known a great many troubles, but most of them never happened.” – but that will not keep us from looking for them.

Firm News

In firm news, we continue to grow and are excited to welcome the newest addition to our team, Kara Nalbone. Kara joins us as Private Client Administrator in the Greenville office. For those with a thirst for market updates, we launched a series called Views from the Bullpen late last year. This is a bi-weekly publication from the investment team with a high-level overview on happenings in the economy and financial markets. You can subscribe to it on LinkedIn or here and it will hit your inbox as new editions come out. I will remind you also that there are many resources and insights on our updated website, greenwoodcapital.com.

Thank you as always for the confidence you have placed in us and your continued support of Greenwood Capital. We look forward to seeing and talking with you soon.

On behalf of all the employees at Greenwood Capital,

Sincerely,

Walter B. Todd, III

President/Chief Investment Officer

The information contained within has been obtained from sources believed to be reliable but cannot be guaranteed for accuracy. The opinions expressed are subject to change from time to time and do not constitute a recommendation to purchase or sell any security nor to engage in any particular investment strategy. Investment Advisory Services are offered through Greenwood Capital Associates, LLC, an SEC-registered investment advisor.