January 6, 2025

I have one life and one chance to make it count for something. I’m free to choose that something. That something –the something that I’ve chosen – is my faith. My faith demands that I do whatever I can, wherever I can, whenever I can, for as long as I can with whatever I have, to try to make a difference.

Happy New Year. I hope that you and your family had a happy and safe holiday season. While I know my high school English teacher would scold me for starting out a letter with a quote, I thought the one above was appropriate given the passing of our 39th President, Jimmy Carter, in late December 2024. Regardless of your politics or thoughts about the job he did while in office, I think we can all agree he had one of the more impactful post-Presidential careers in history. In 2002, he was awarded the Nobel Peace Prize “for his decades of untiring effort to find peaceful solutions to international conflicts, to advance democracy and human rights, and to promote economic and social development.” God speed Mr. President.

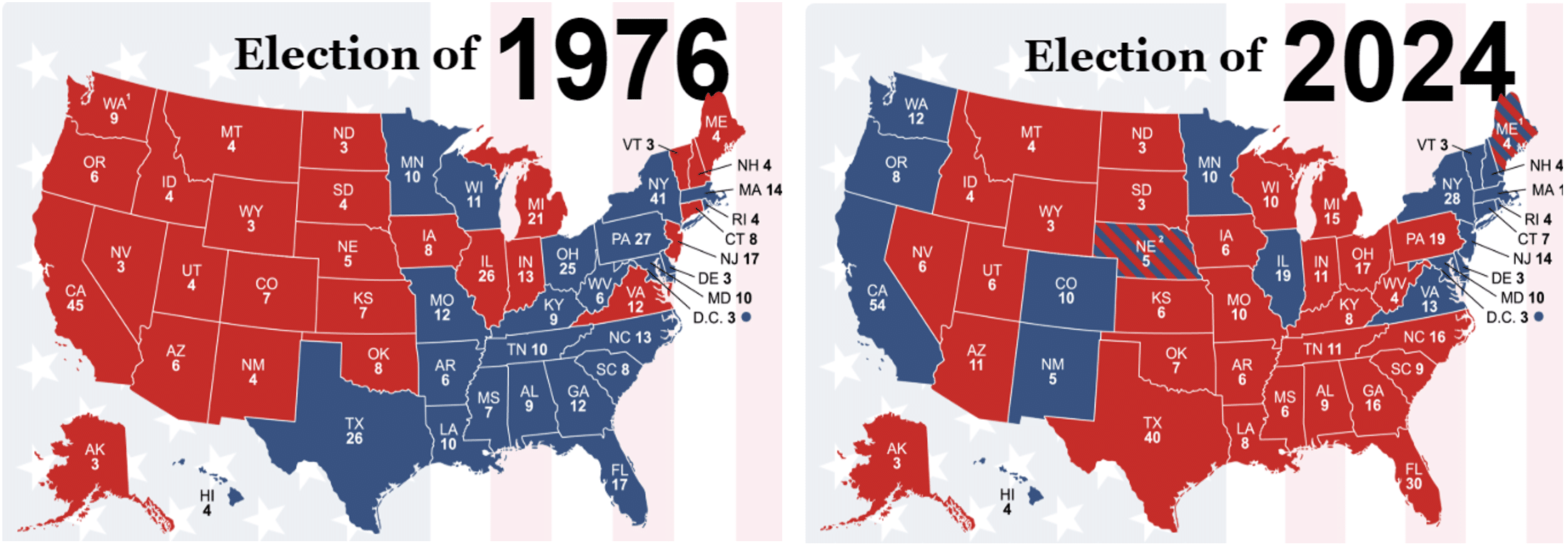

One final point of interest before we leave this topic is a comparison of the electoral map in 1976 when Carter was elected and the most recent 2024 election. Quite a shift in geographical party preferences over that time. A reminder that in politics, as in life, sometimes the only constant is change.

Financial Markets

Moving on to the financial markets, perhaps the biggest change we saw in the last quarter of the year was the shift in the outlook for the Federal Reserve. We touch on this topic in the attached Market Commentary as well, but the best way to see this is looking at the change in the 10-year Treasury rate and the 2025 year-end estimate for the Fed Funds rate from September to now.

When the Fed started its rate cut cycle in September (with a 1/2% cut) the 10-year rate was around 3.6% and today it is close to 4.6%. At the same time, the futures market estimated the Fed Funds Rate (5.5% at the time of the first cut) was estimated to fall to 2.8% by December of 2025 after the September Fed meeting. Today the expectation is 3.9%.

So, to recap, the Federal Reserve cut interest rates by 100 basis points (bp) or 1% in 2024 and both current interest rates and the expectations for future interest rates moved higher during that time. Of course, as with most things, there is more to the story. The thought that some of the tariff policies of the incoming administration may be inflationary – along with a one-party election outcome and the implications for spending – also contributed to the moves we have seen in these rates. Regardless, it has an impact on the cost of capital for corporations and the US government as the US must refinance over $7 trillion of debt in 2025.

Upcoming Policy Decisions

Speaking of a new administration and the Federal Government, we got an election outcome quickly on November 5th. With expectations of an elongated and contested election scenario, this clarity provided a lift to financial markets initially in November. However, as we highlighted in our letter last quarter, the prospect of many policy issues that need to be addressed in the new year is likely starting to weigh on the outlook or at least inject some uncertainty into the equation. To start, the government has technically hit the debt ceiling to start the year, meaning the US government cannot issue any net new debt. Treasury does have a general account (TGA) which it can spend down and will likely last until August.

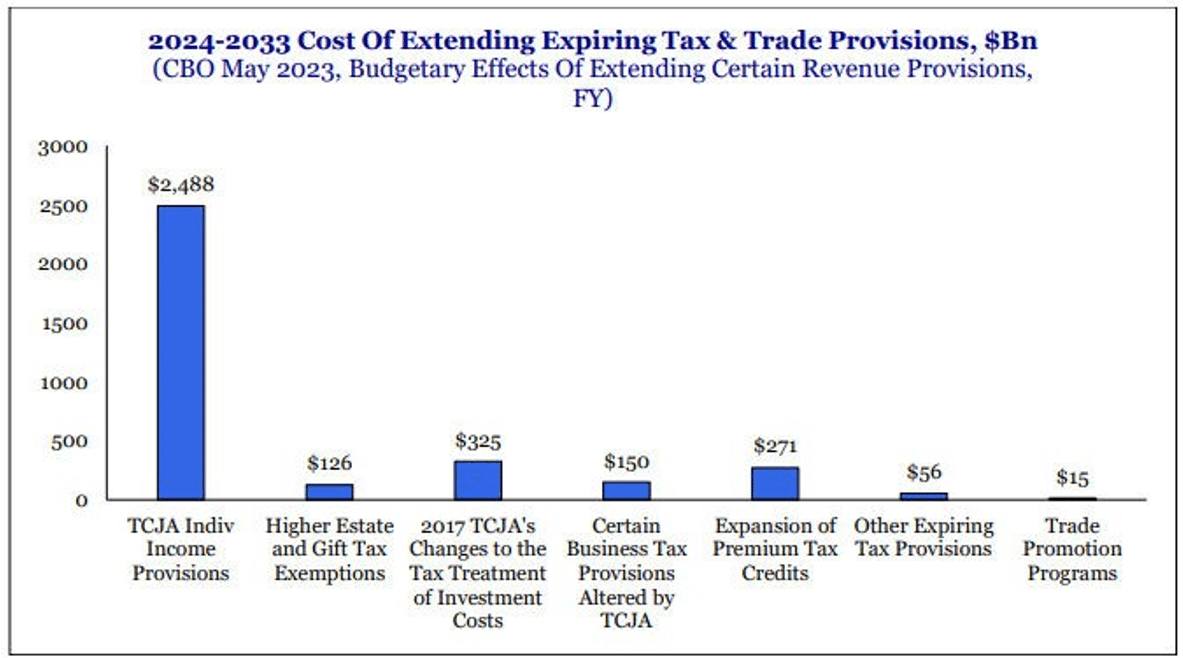

In addition, with Inauguration Day approaching, we can expect a flurry of executive orders on tariffs, immigration and likely energy policy to hit within the first few days of the new administration. Still, the biggest item on the agenda is addressing the over $4 trillion in tax provisions which are set to expire at the end of 2025 (see chart to left from Strategas Research).

With a Republican sweep, there is the prospect of addressing these early in the year, but the majorities in Congress are narrow and may not be unified enough to get a quick resolution. We will watch the early House Speaker vote and potential appointment nomination process for clues on this dynamic. Ultimately, we believe many of these provisions will be extended but the longer we move through the year without a resolution, the more nervous investors will become.

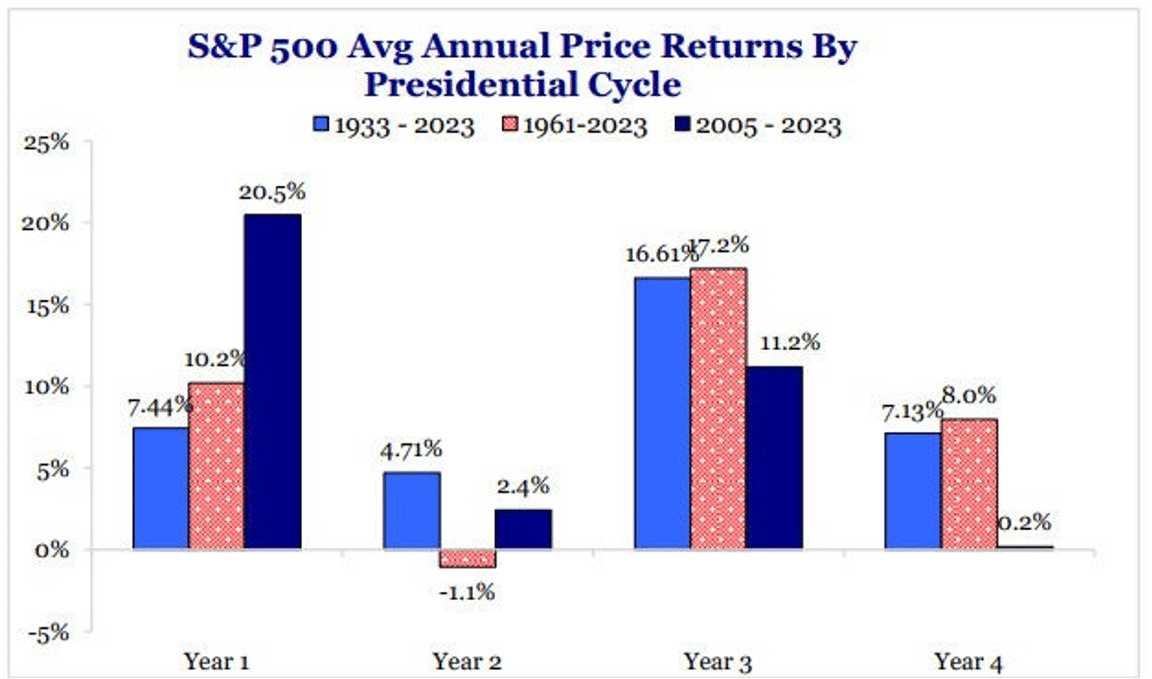

Presidential Cycle Performance Shift

Another interesting data point that falls under “The Only Constant is Change” heading is the shift we have seen in the presidential cycle performance of the stock market. As the chart at right from Strategas Research shows, since 2005 the performance has shifted from the traditional third year being the strongest to the first year. One explanation for this change could be the era of ultra-low interest rates and the spending flexibility they afforded. As this backdrop changes, with higher debt and higher rates, it will be interesting to examine this dynamic in the future.

Firm News

We have lots of exciting company news to share with you this year with two new hires at Greenwood Capital. Anne Thompson joins us as a Private Client Advisor in the Greenville office and Garrett Minton as an Associate Advisor in the Greenwood office.

We are excited to add Garrett and Anne to the team as we continue to grow and work to provide our clients with the best service possible.

I wanted to end this letter with another quote if you will allow me. However, first some context ahead of the words.

Anne Thompson

Private Client Advisor

Anne has over twenty years of experience in the communications industry before pivoting to finance in 2015 and working with companies such as Merrill Lynch and Charles Schwab.

Garrett Minton

Associate Advisor

Garrett joins the firm with over eight years of experience in the financial industry with organizations such as Merrill Lynch, Vanguard, and Robinhood.

When I am working in our Greenville office, I often go to work out at the YMCA in town. Every day the staff at the Caine-Halter Y post a quote on a whiteboard that you see as you leave the gym. I often take a picture of these and send them to my kids (all in their 20s) under the moniker of “Wisdom from the Y.” Like many other people at the start of every year, I was in the gym on January 2 trying to make good on a New Year’s resolution to lose some weight and the whiteboard quote again caught my eye, and I thought it was good enough to share with you. It’s from a freelance writer in the US, Peggy Toney Horton.

“Each new year, we have before us a brand-new book containing 365 blank pages. Let us fill them with all the forgotten things from last year; the words we forgot to say, the love we forgot to show, and the charity we forgot to offer.”

The events in New Orleans and Las Vegas on Jan. 1 highlight how unpredictable life can be. Our thoughts and prayers are with those affected by these senseless acts of violence. The quote above is reminder to me to not let words go unspoken.

Thank you as always for the confidence you have placed in us and your continued support of Greenwood Capital. We look forward to seeing and talking with you in 2025.

On behalf of all the employees at Greenwood Capital,

Sincerely,

Walter B. Todd, III

President/Chief Investment Officer

The information contained within has been obtained from sources believed to be reliable but cannot be guaranteed for accuracy. The opinions expressed are subject to change from time to time and do not constitute a recommendation to purchase or sell any security nor to engage in any particular investment strategy. Investment Advisory Services are offered through Greenwood Capital Associates, LLC, an SEC-registered investment advisor.