January 7, 2022

I hope this letter finds you safe and healthy and that you were able to enjoy some time with loved ones over the holiday season. I don’t know about you, but if I never hear another letter in the Greek alphabet, that would be just fine with me. After being forced to memorize them in college as a member of a fraternity, I never thought I would see those letters again. But now we all dread hearing the next one (it’s Pi). For now, we have Omicron. And while we can debate how to pronounce this one, it appears the market believes this should be Omega (the end). I say that because just as cases appear to be hitting new highs here in the US, the market signals are full-speed ahead.

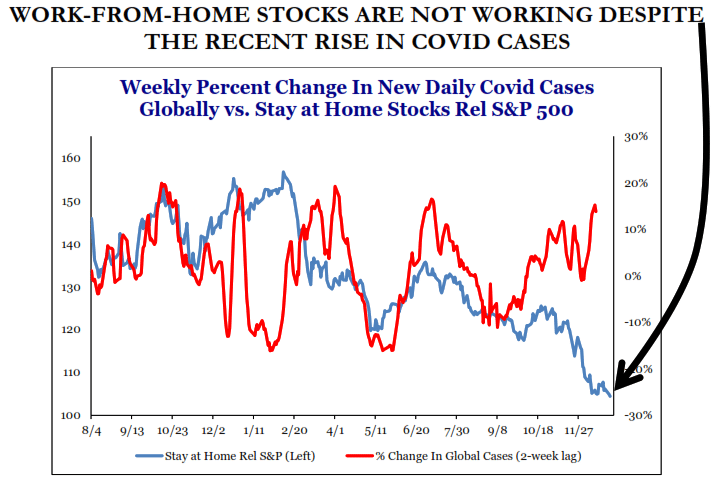

The “reopening playbook” seems to be in effect over the last few weeks, with Consumer Discretionary, Energy, Financials and Materials among the top performers in the equity markets. The chart to the right shows the “stay at home stocks” relative to the S&P (blue line) are not moving higher as global cases jump (red line). In addition, both interest rates and the spread between 2-year rates and 10-year rates are moving higher.

I talked in the last quarterly letter about the bricks in the wall of worry that the market has to climb. A few of those have been removed but others have replaced them. Still, the market continues to climb that wall like Spiderman on a mission. Let’s explore what has changed and what remains the same as we enter 2022, and how these items may impact financial markets.

We started our discussion last time with the debt ceiling. This did get “resolved” for the time being, at least until after the mid-term election, when it will have to be suspended or raised again (can’t wait). This brings us to the fact that 2022 is a mid-term election year. I have good news and bad news related to this (besides the endless string of campaign commercials headed your way).

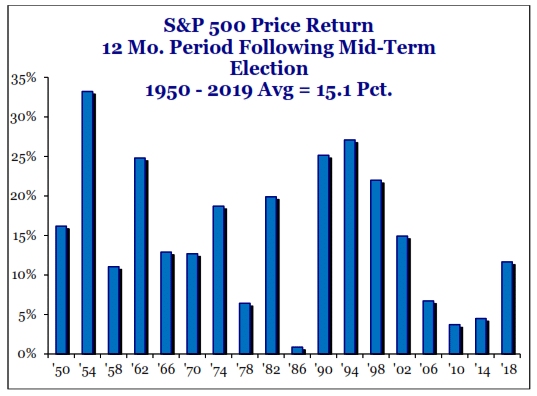

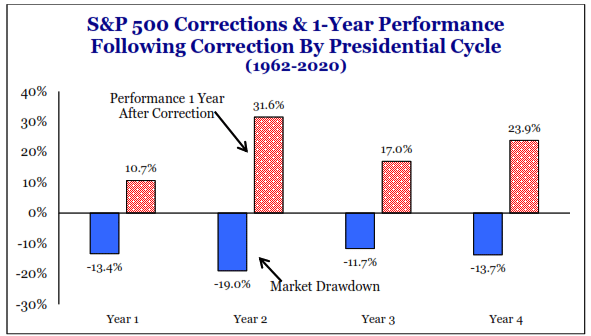

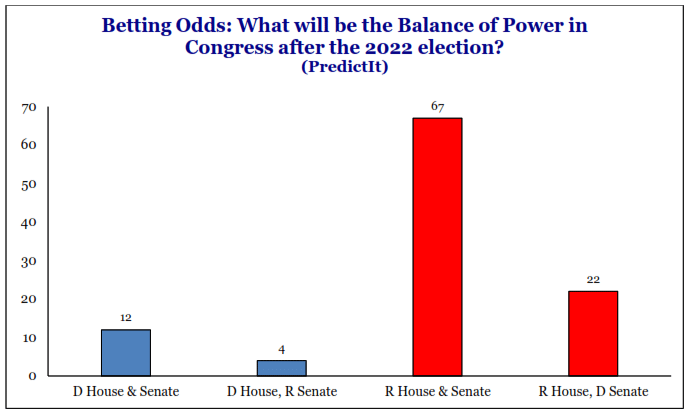

The good news is, since 1946, the 12-month period following a mid-term election has not seen a negative market return (see chart to the bottom left). The bad news is the months leading up to the mid-term election tend to be more volatile, particularly during a first term presidential cycle. As the middle chart below shows, the average drawdown in these years is around 19%. While eleven months is a lifetime (or two) in politics, at the moment the betting markets are predicting a change in the make-up of Congress (see bottom left).

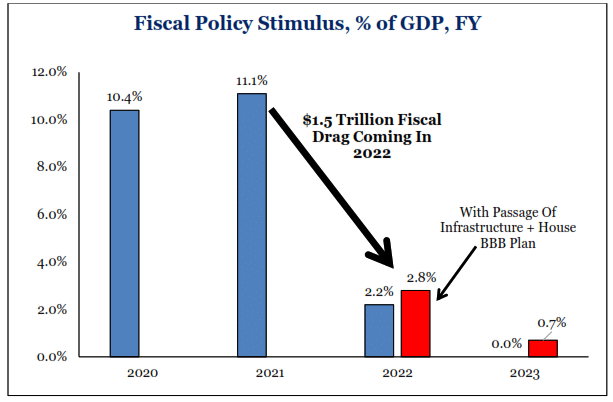

In addition to avoiding a debt ceiling standoff, our elected leaders were also busy keeping the government open by passing a continuing budget resolution to keep the lights on. Another short-term fix, but we will take it. Despite this “progress” out of Washington, the Build Back Better (BBB) plan did not get passed before year-end. This resulted in major individual and corporate tax rates remaining unchanged, at least for now. While the legislation appeared dead in the water upon its rejection by Senator Manchin (the swing vote in the Senate) there are some indications that a smaller version of it could be passed in 2022. Recall this was originally floated at a size of $3.5 to $4 trillion and later reduced to $1.75 to $2 trillion. Despite these eye-popping numbers, this spending was going to be spread out over a 5 to 10-year period.

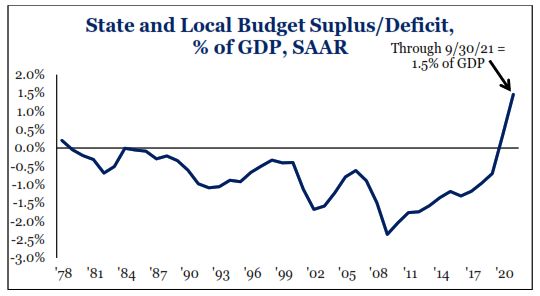

Regardless of whether BBB eventually passes in some form in the future, the chart at the left shows that Federal spending is set to fall significantly in the coming years relative to the past two years. On the flip side, states are flush with cash from previous Federal aid as well as increased tax collections for capital gains and sales taxes. The final chart on this page (right) shows state and local governments are in the best fiscal position in over 40 years. Spending by states could offset some of the slowdown from the Federal government in the coming year.

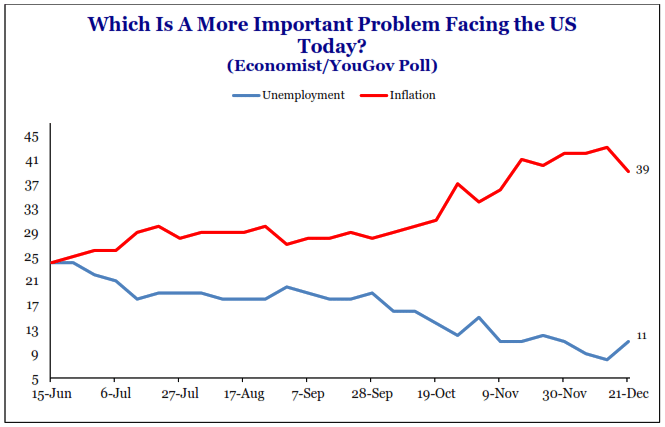

Of course, no discussion of the current state of affairs would be complete without talking about inflation. As outlined in our Market Commentary, inflation in the US (and around the world), is at the highest level in decades.

Our belief is that inflation will peak on a year-over-year basis in the first quarter of 2022 and start to slowly moderate as we move through the year.

Note, we are not saying that prices will fall, but rather grow less quickly. The supply chain challenges we discussed last quarter remain, keeping upward pressure on the prices of goods and services. If we see Omicron cases peak in late January, these bottlenecks should start to abate.

So, we have high inflation right now, but we also have healthy underlying economic growth in the US. Estimates for fourth quarter real GDP growth range from 5% to 7% without the impact of inflation. This underlying growth as well as inflation have been the drivers of earnings for stocks in 2021. Earnings per share growth has come in much better than expected, estimated to be up over 45% for the year (for S&P 500) after beginning the year with an expectation of 18% growth. This has been a fundamental catalyst for equity prices over the past eighteen months. We know that earnings growth rates peaked in the second quarter (+92% year-over-year), but earnings are still estimated to grow in 2022.

With earnings growth so strong this year, despite the S&P 500 being up over 28%, the price-to-earnings ratio (P/E) actually went down from the start of the year, from 26.3x to 22.9x estimated earnings for 2021. With approximately 10% earnings growth projected for 2022, no multiple compression would indicate an outlook of a 10% return for stocks. However, given the elevated level of inflation, the prospect for higher rates and a less accommodative Federal Reserve, it would not be surprising to see valuation multiples for the overall market compress again in the coming year. Having said that, we still see significant opportunity beyond the headline indices in individual names and industries as valuation dispersion among different areas of the market and geographies remains significant.

In summary, whether it is Omicron, Pi or Omega, there are some encouraging signs that perhaps we may be seeing a light at the end of the Covid tunnel. That would be a welcome development. To be sure, the equity market is reflecting some of this good news already, but stocks can continue to work higher if earnings can do the same. We do expect more volatility in 2022 versus the modest pullbacks we saw this past year. That would be more of the norm vs. the exception. While we have seen some excesses rung out of corners of the market, there are still those that make us scratch our heads (like Tesla increasing in market cap by nearly the size of GM and Ford combined on the first trading day of year). A more subdued liquidity backdrop and higher rates might solve those questions as we move forward. After a very prosperous 2021, we think the navigation gets a little trickier in 2022…but we are up for the challenge.

I will conclude my remarks there and, as always, please feel free to email or call if you have any questions or follow up. We remain in the office and welcome the opportunity to meet with you and reconnect in person if that is something you desire and are comfortable doing. Thank you as always for your continued trust in and support of Greenwood Capital.

On behalf of all the employees at Greenwood Capital,

Sincerely,

Walter B. Todd, III

President/Chief Investment Officer

The information contained within has been obtained from sources believed to be reliable but cannot be guaranteed for accuracy. The opinions expressed are subject to change from time to time and do not constitute a recommendation to purchase or sell any security nor to engage in any particular investment strategy. Investment Advisory Services are offered through Greenwood Capital Associates, LLC, an SEC-registered investment advisor.