October 6, 2025

“You know, we don’t—no one really knows where the economy will be….”

You know the drill by now: a quote to start us off. Chairman Powell made the one above in a response to a question at the most recent post-Fed meeting press conference on September 17. To be fair, the rest of the sentence was “…in three years.” He was answering a question about the wide divergence of views provided by Fed members as they released their Summary of Economic Projections (SEP) at the September meeting.

I get it, it’s hard to forecast anything three years out. I mean, who would have guessed three years ago that in 2025, Clemson would start the football season 1-3. Sorry, I digress. The ironic thing to me about Powell’s statement is why he added the time frame to the end of it at all. The Federal Reserve employs over 800 Ph.D. economists, and I don’t think Powell or the Fed staff know where the economy will be in three months, much less three years.

My colleague Dr. Mark Pyles touched on this difficulty of forecasting and interpreting data in the current environment in his economic overview section of our Market Commentary. Given this highly complex and confusing backdrop, I continue to be amazed at all the “talking heads” I hear speak with such certainty about the future. Yogi Berra said it best – “It’s difficult to make predictions, especially about the future.” Similarly, the financial markets appear to have great conviction that all will come up roses – seemingly pricing for perfection in a very imperfect world. As I heard one commentator say recently that in a market making new highs with regularity, “every new high should be bought except the last one.” Well, that’s the trick, isn’t it – figuring out which one is the last one. For now, let’s discuss some of the major topics moving markets and see if we can’t figure it out together.

Government Shutdown

I’m going to go ahead and get the shutdown question out of the way. Yes, we are in a government shutdown as I write this letter on October 3. We have had one of these about every 2.5 years over the last 50 years. They last an average of 8 days (see chart from Strategas Research, below left) and usually have a modest impact on markets and economic growth. In fact, the S&P has been positive over the last 5 shutdowns, and economic growth (GDP) has been positive in the last six shutdowns, and 11 of the last 12.

Dan Clifton at Strategas believes this shutdown could extend into the third week of October, but it’s a fluid situation. One potentially important consequence of the shutdown (reflecting back to the discussion above and Mark’s commentary on data) is a lack of government economic data during a possible inflection point in the economy. Of course, we will eventually get the information, but markets may be flying blind for a bit as we wait for an agreement in DC.

Big Beautiful Bill Impact

I know what you’re thinking. With an approval rating of around 20%, is it any surprise that we are here with Congress? Probably not, but they did get the OBBBA passed during the third quarter, and the benefits to corporations are offsetting most of the cost of tariffs so far. Companies are benefiting from accelerated expensing and depreciation in 2025 to the tune of over $100 billion in lower cash taxes.

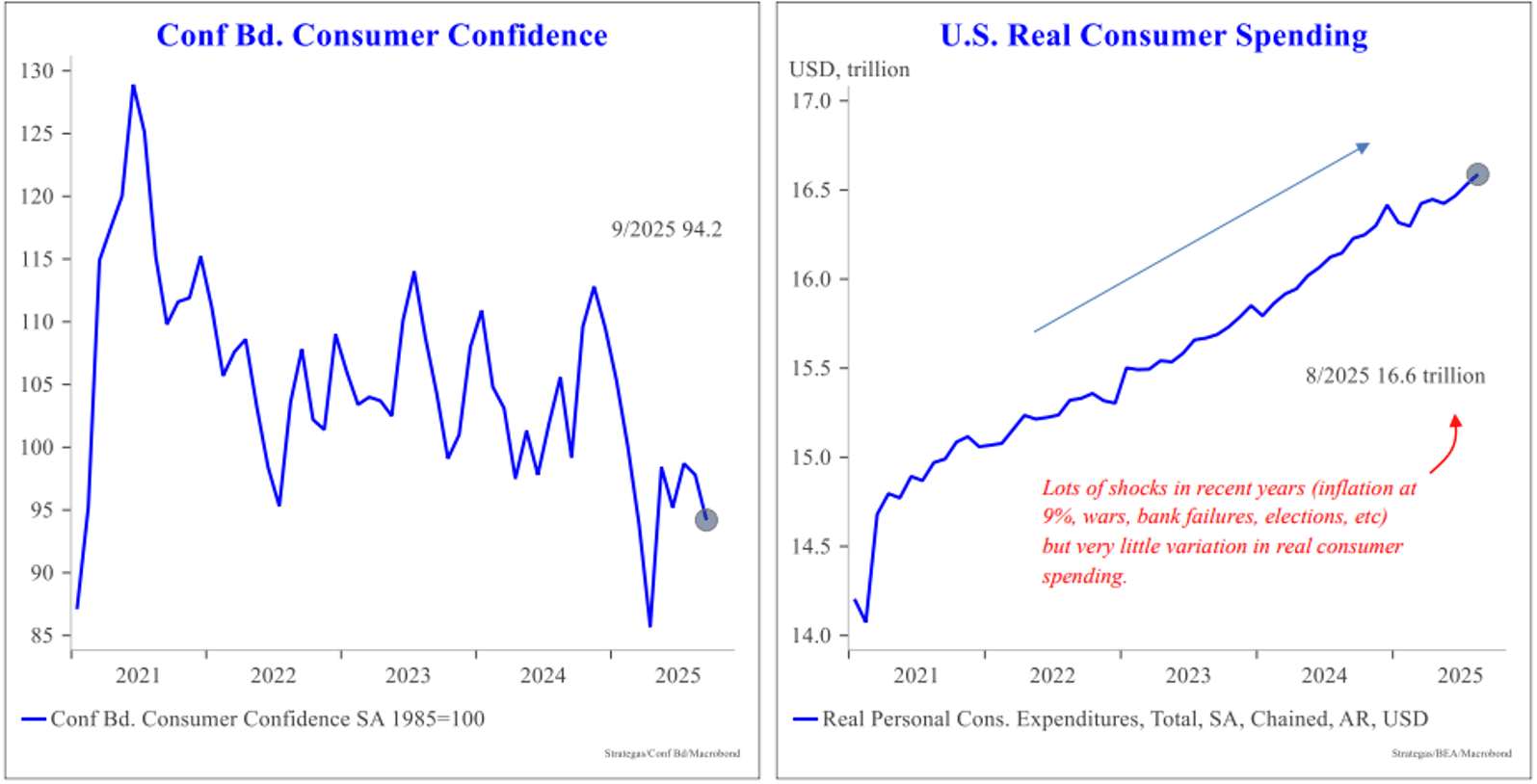

In addition, the chart from Strategas to the right shows an expected $150 billion of consumer aid scheduled to hit in early 2026 due to provisions in the OBBBA. This stimulus should help underpin economic growth in the first half of 2026. This seems likely because even as consumer confidence remains depressed, their actions related to spending tell a different story.

The charts below from Strategas present the data visually, showing a confidence level well below that from four years ago, with a real consumer spending level over $2.5 trillion higher. It’s worth noting that the real spending level excludes the impact of inflation on numbers, so this is not just higher prices. To be fair, this consumption has happened with the backdrop of a healthy labor market and excess government support coming out of the COVID period.

Those excess savings from Covid are wearing thin and, as Dr. Pyles highlighted in his Economic Overview, the labor market appears to be softening. Something to monitor as we move toward the holiday season (only 82 more shopping days till Christmas – yikes).

Tariff Updates

Tariffs remain in the news as we moved beyond the pause from early April and new tariffs have been implemented across countries. The average rate looks like it is coming in around 14-15%, with a wide range depending on the trading partner. Brazil and India, for example, have 50% tariff rates at the moment, while Mexico and Canada have effective rates that are in the single digits. The specifics of many of the “trade deals” announced have yet to be written. In addition, the Supreme Court is about to start hearing a case regarding the legality of the existing tariffs being implemented under IEEPA (International Emergency Economic Powers Act). Should they be deemed unenforceable, the administration does have a backup plan using other statutory authority. We have already seen the use of these sectoral tariffs on specific industries such as steel, pharmaceuticals, lumber, and furniture recently. So, tariffs are likely here to stay, it’s just a question of how they are enforced. Tariff revenue is coming in at $150-$200 billion at an annualized rate.

As discussed in prior commentaries, this revenue is helping to offset spending. However, I am not sure we have seen the full effect on those who are paying the costs. These additional expenses borne by a combination of companies and consumers present a risk to economic growth in 2026. In addition, the rolling announcements seemingly weekly on new tariff rates have created an uncertain operating backdrop for many industries and corporations.

A.I. Spending

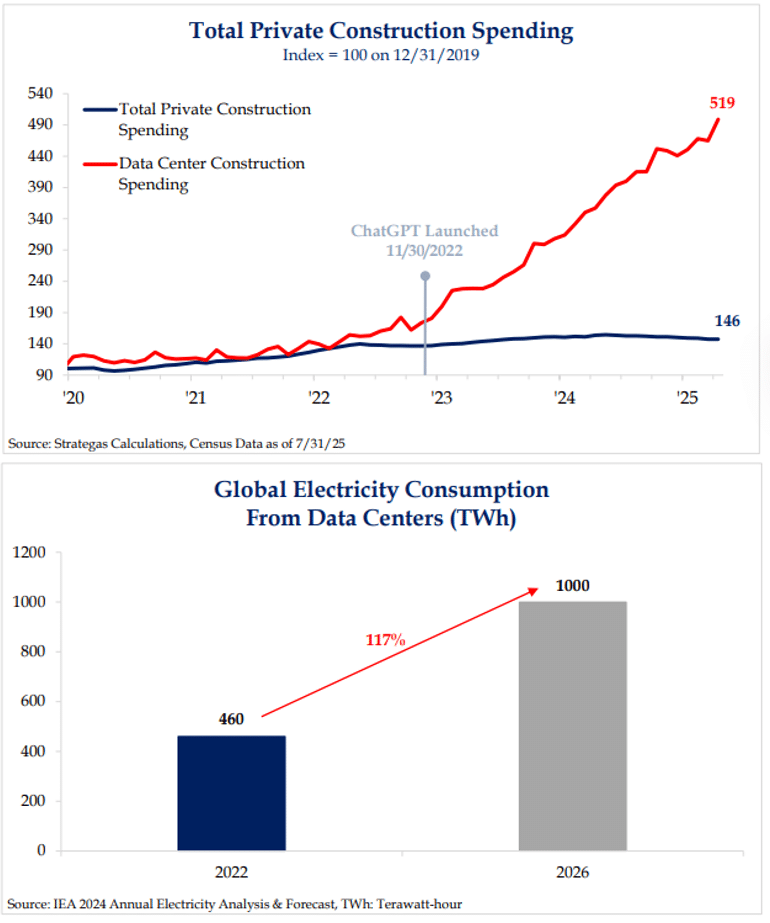

Shifting gears to the topic and narrative sucking all the oxygen out of the air in financial markets: Artificial Intelligence (AI). According to Garnter, worldwide spending on AI is forecasted to total nearly $1.5 trillion in 2025. Nowhere is this more evident than in the build-out of data centers, the large industrial complexes housing all the chips and servers necessary to build the large-language models that drive AI.

The first chart to the right from Strategas shows that data center construction spending has grown over 5x since 2020. Recently, we have heard announcements from a variety of companies regarding future spending in growth on the AI build-out, with $100 billion per announcement as the base case. This seems all well and good except for the energy/electricity demands of this technology. The second chart below, also from Strategas, shows the global electricity consumption from data centers is projected to grow over 100% from 2022 to 2026, to 1,000 Terawatt-hour (TWh). A terawatt hour (TWh) is a unit of energy representing one trillion (1,000,000,000,000) watt-hours. For some relative comparison, the country of France consumed 437 TWh in 2023.

In the US, electricity supply is a major bottleneck for reaching the astronomical numbers being thrown out for data center and AI growth. This is true both for reliability of the grid itself and access to it. “Speed-to-power” is the time it takes for a data center site to receive access to electricity supply. In the world’s largest data center market in Northern Virgina this wait time can be up to 7 years. There have also been reports, in areas of the country, which have attracted large data center construction, of uneven and intermittent power in surrounding residential areas.

This dynamic of big, long-term prognostications about changing technology reminds me of the race to transition from internal combustion engines (ICE) to fully electric vehicles back in 2020 and 2021. Car companies and countries were making bold predictions about going all-electric by 2030 and 2035. Beyond the simple fact of whether consumer demand was there or not for that move; if you simply did the math of the raw materials needed for that type of large-scale transition, they didn’t exist. We did not have enough copper or lithium or cobalt, etc. Now we see hybrid technology gaining more traction in autos as a way to balance consumer demand and supply. AI technology is no doubt revolutionary but, in the race to top the last big announcement, let’s not forget facts and figures and the consequences of getting there.

Firm News

As we march quickly toward the holiday season in the fourth quarter, we are grateful for your continued confidence in Greenwood Capital. I will again put in a plug for the resources available on our website, greenwoodcapital.com and for our Views from the Bullpen commentary which you can subscribe to on LinkedIn or on our website. Please don’t hesitate to reach out with any questions or concerns and we look forward to seeing and talking to you soon.

On behalf of all the employees at Greenwood Capital,

Sincerely,

Walter B. Todd, III

President/Chief Investment Officer

The information contained within has been obtained from sources believed to be reliable but cannot be guaranteed for accuracy. The opinions expressed are subject to change from time to time and do not constitute a recommendation to purchase or sell any security nor to engage in any particular investment strategy. Investment Advisory Services are offered through Greenwood Capital Associates, LLC, an SEC-registered investment advisor.