October 4, 2024

I start this letter with a heavy heart and thoughts for all those impacted by Hurricane Helene. While I recognize that many may still not have power and may have suffered property damage, I hope that you and your families are safe. These past few days are a reminder that life can change in an instant. We are here to help in any way we can. All in the Greenwood Capital family are safe and I must also acknowledge the teamwork and compassion they have worked with to lift each other up during these challenging times. I am grateful to be part of such a special group of colleagues.

The Market Led the Fed

Turning to the financial markets and economy, you may recall we spent the first part of this letter last quarter outlining why the Federal Reserve could and should cut their benchmark rate by 50 basis points (0.50%) at the meeting in September. While it has been difficult to predict anything in this crazy world, the Fed did come through with the rate cut.

Interestingly, the 10-year Treasury rate was 3.65% the day before the Fed cut rates and sits at 3.93% today as I write this letter. That is a very counterintuitive concept for many. Why are rates higher after the Fed cut rates? It may help to know the 10-year rate was 4.5% at the beginning of July and moved down in anticipation of the cut (i.e. the market led the Fed). Dr. Mark Pyles and John Wiseman write more about this dynamic in their commentary.

In our last letter, we also discussed the Jackson Hole Fed Symposium in August as a possible messaging opportunity for Chairman Powell and he said one specific thing in his speech there that I think is worth highlighting: “We do not seek or welcome any further cooling in labor market conditions.”

We believe this statement was a clear signal of the Fed switching to a focus on the labor market to determine the path forward. We have a real-time update to this letter, this morning (October 4) we received the payroll report for September. This report was much stronger than expected with over 250,000 jobs created and an unemployment rate that fell to 4.1% from 4.2%. Average hourly earnings were also a touch higher than expected at 4.0% YoY growth. This certainly thickens the plot for the next Fed meeting.

We will see another payroll report on November 1, ahead of that meeting on November 7. A softer print could still push the Fed to move at a quicker pace lowering interest rates, but the October report referenced above certainly raises the bar for that action. The November jobs report will be particularly interesting because it may capture several temporary disruptions caused by the strike at Boeing and the hurricane. These events will likely lower the jobs numbers for that report, making it difficult to interpret for financial markets and the Fed. Add it to the list of an already confusing backdrop. When I started writing this letter in the first few days of October, I had also included the East Coast port strike in this discussion, but overnight this work stoppage was settled, at least for a few months. Certainly a favorable outcome that takes a near-term economic disruption and potential inflationary catalyst off the table. Still, with a 60%+ wage increase over six years on the table for dock workers, this does highlight upside risks to wages in these situations.

International Influences on Inflation

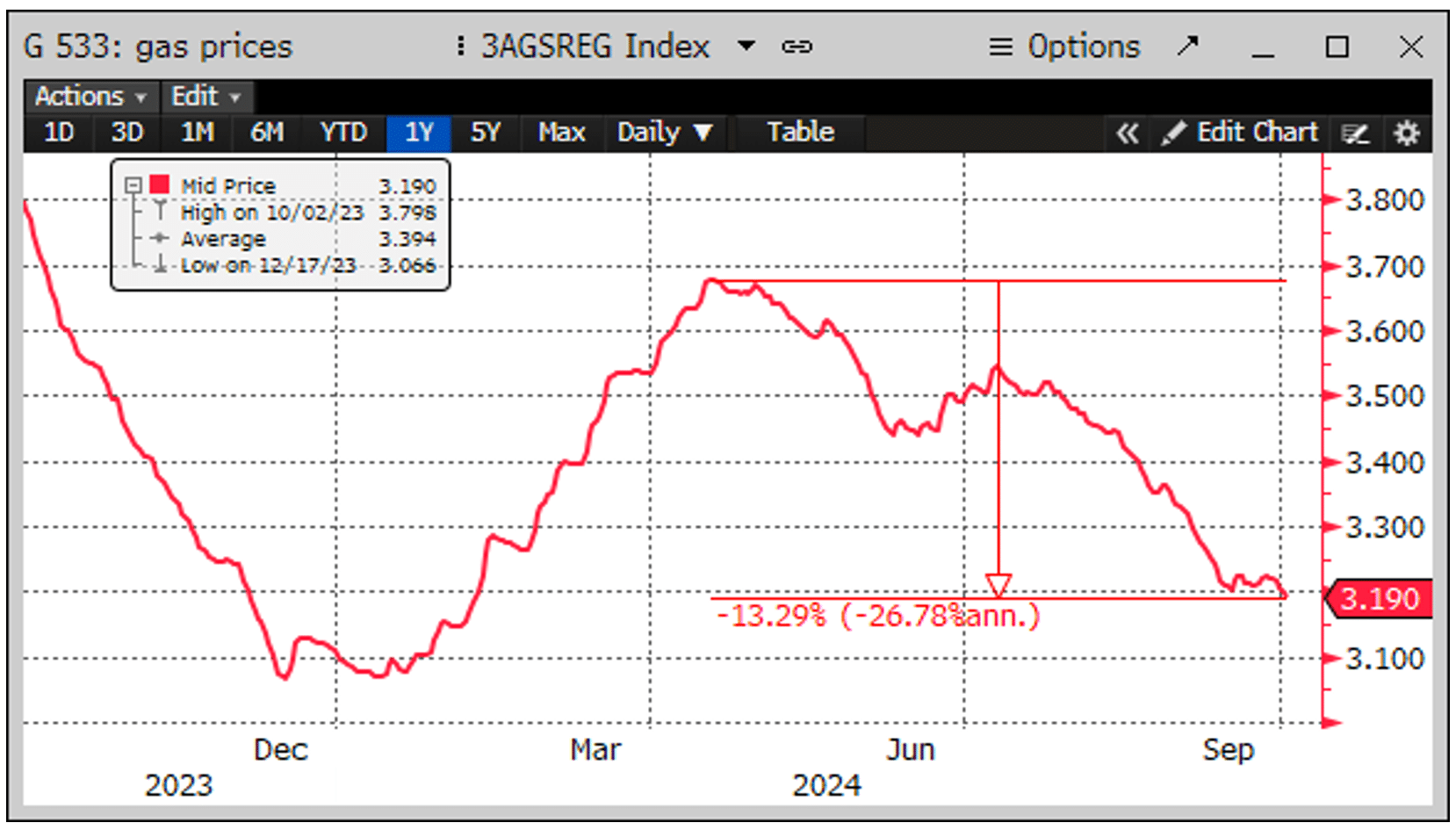

One other risk to inflation emerging in recent days is the increased tensions in the Middle East. Since peaking in mid-April, gas prices in the US are down just over 13% on average (see chart at left from AAA on daily national average for regular gas). Oil prices have moved about 9% higher in recent days as Israel and Iran trade blows. If sustained, this will eventually increase prices at the pump. Fortunately, global supplies seem ample at the moment despite the increased risk of disruptions from the conflict in the Middle East.

One final note on inflation is related to China. China’s economic malaise over the past two years has helped ease global inflation pressures as commodity demand from the country has softened. Last week, China announced a series of stimulus efforts that look similar in scale to what the US did coming out of Covid – it was dramatic. Whether these measures will be effective in the medium to long-term in reviving sustainable economic growth is to be determined, but in the short-term, they have sparked a significant rally in Chinese equities and global commodities. For example, Copper, Iron Ore and Aluminum are up 10% to 15% off recent lows in response to these moves by China.

I know you are thinking: “All this talk about inflation but you told us to focus on US employment.” It reminds me of the advice Shoeless Joe Jackson gave the rookie, Archie Graham, when he was batting in the movie Field of Dreams.

After Archie had some close calls with wild pitches inside, Shoeless Joe asked Archie what he thought was coming on the next pitch and Archie responded, “Either low and away or in my ear.”

Shoeless Joe said, “They’re not going to want to load the bases so look for low and away (employment) but watch out for in your ear (inflation).”

A Political Pivot

Turning from financial markets to the political sphere, we have certainly witnessed quite of few changes since we last wrote you in early July, from a new Democratic candidate on the ticket as well as assassination attempts of the Republican candidate. As Dan Clifton from Strategas Research says, it is a political summer like no other (post at right from his recent election chartbook). Despite the PredictIt betting markets giving a 54 to 49 edge to Harris, Dan expects this election to be extremely close.

In his estimation, the path for Harris to win either includes winning Pennsylvania’s 19 electoral votes or winning North Carolina and Nevada which equals 22 electoral votes (assuming she wins Michigan and Wisconsin in both cases).

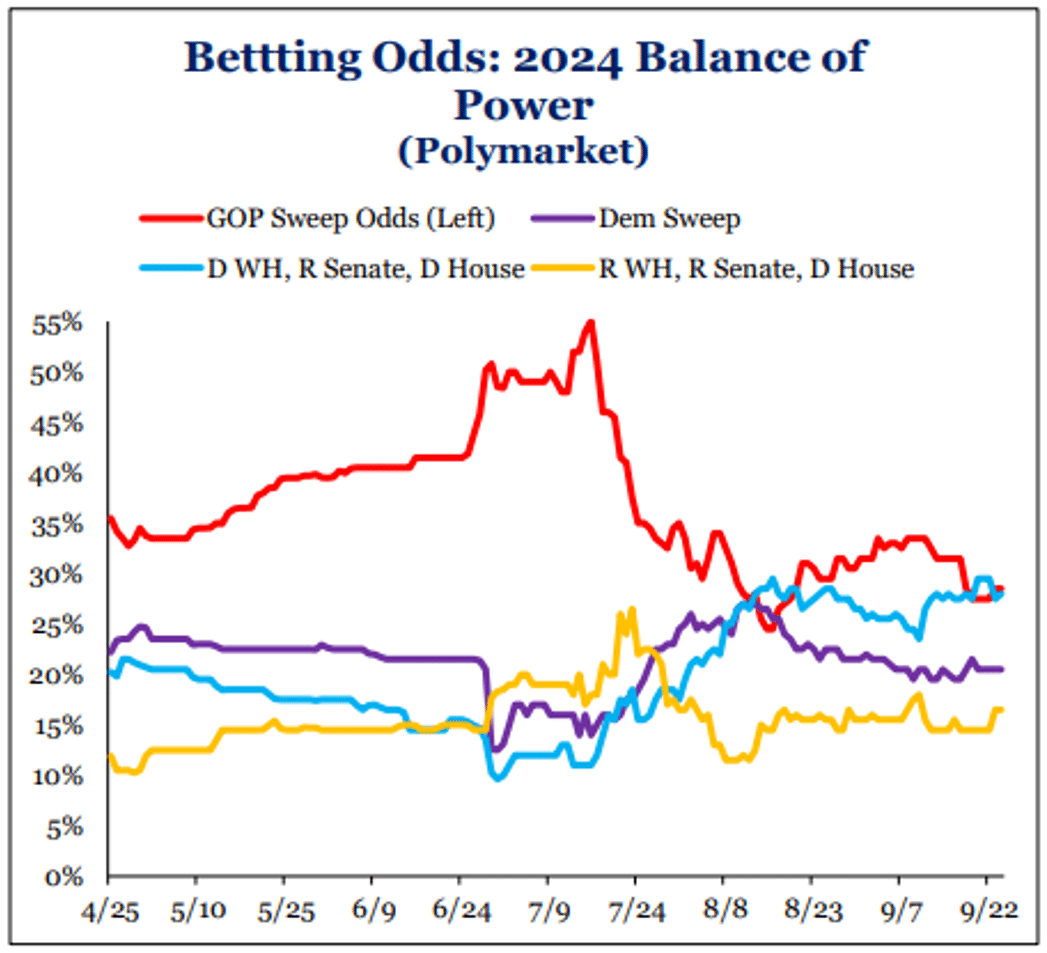

As we have said before, the composition of Congress is exceptionally important as well. Right now, it looks highly likely that the Senate will flip to a narrow Republican majority. The House is harder to gauge at this point and may fall the way of the top of the ballot ultimately. According to betting markets, the most likely combination of government is basically a tie between a GOP Sweep and D WH, R Senate and D House. Both only have around 30% odds, so still highly uncertain. The chart on the left highlights these different outcomes.

Conclusion

In conclusion, while I’ve highlighted a variety of different items to watch, we must remember that right now we have an economy that continues to grow at a solid pace, a historically low unemployment rate and a Federal Reserve that is cutting interest rates while the second largest economy in the world (China) has joined the stimulus party. That’s not a bad backdrop for financial markets (but we will continue to watch for the “in your ear” pitch as well).

In firm news, we are excited to announce we are growing! We recently hired Colin Burns as an Associate Advisor. Colin recently completed his MBA at Roanoke College and will be spending some time in both our Greenwood and Greenville offices. I want to again wish everyone well as they work to recover from the impacts of the storm. Stay safe and let us know how we can help. Please check out our website (www.greenwoodcapital.com) or follow us on LinkedIn, Facebook or Instagram for the latest news and commentaries from our professionals.

As always, we appreciate your continued support of Greenwood Capital. Please do not hesitate to email or call with questions, concerns, or updates or make an appointment to come see us in the office. We would love to see you.

On behalf of all the employees at Greenwood Capital,

Sincerely,

Walter B. Todd, III

President/Chief Investment Officer

The information contained within has been obtained from sources believed to be reliable but cannot be guaranteed for accuracy. The opinions expressed are subject to change from time to time and do not constitute a recommendation to purchase or sell any security nor to engage in any particular investment strategy. Investment Advisory Services are offered through Greenwood Capital Associates, LLC, an SEC-registered investment advisor.