October 5, 2020

As always, I hope this letter finds you and your family safe and healthy. Webster’s defines normal as – “the usual, average or typical state or condition.” As we enter the last quarter of 2020, it is sometimes hard to imagine what “normal” is anymore. I mean, I remember going to restaurants and traveling on a plane but these seem like visions from a past life at this point. Can we get back to that “old normal?” Or are we stuck with this “new normal?” Regardless of what we think, financial markets seem to have decided, like the old bridal verse, there will be something old and something new, something borrowed (actually a lot borrowed) and something blue. Admit it; you did not see that reference coming, did you? Let’s explore it more fully.

Something Borrowed

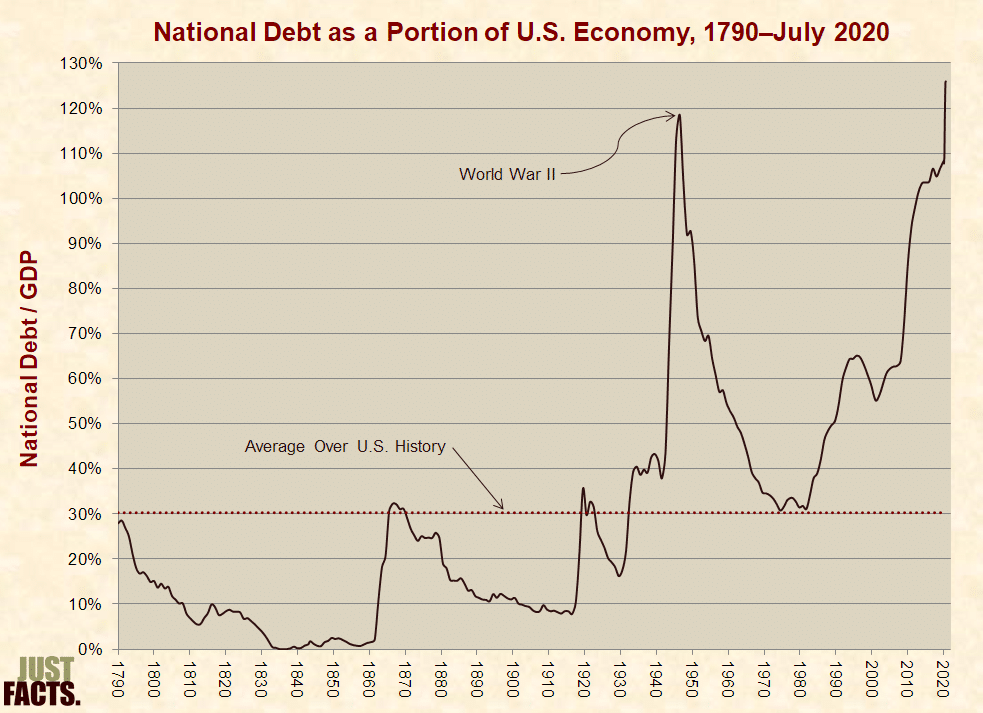

I am not going to go in order because “something borrowed” is the easiest topic to hit and perhaps the most painful, so we should just rip off the Band-Aid. The “something” we are borrowing is about $27 trillion. That is the total federal debt outstanding. As a percentage of the size of our economy, this equates to over 120% of GDP, illustrated by the chart on the left. Now admittedly we owe some of this to ourselves. That is to say, the Federal Reserve owns approximately $4.5 trillion of that total.

Theoretically, I guess, the Fed and the US government could shake hands and say if you’re good, then I’m good and have that debt “go away” but I am not holding my breath.

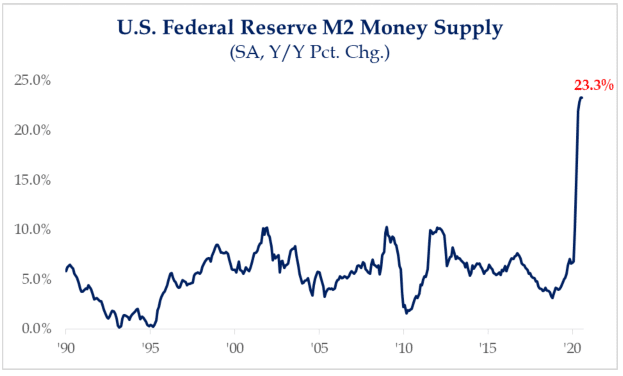

The implications of all these borrowed “somethings” are multifaceted. In the short-term, all these dollars are causing the money supply to grow at over 20% (see chart at right) and providing a boost to financial markets. Also, in the short-to-medium term, this supply of dollars should put downward pressure on the US currency relative to others around the world. This is ultimately inflationary for us as our dollars have less purchasing power over time. Left unchecked, in the longer-term, this debt threatens the US dollar status as the reserve currency of the world. All this means is, like it or not, higher taxes are coming in some form in the future. There does not seem to be much way around that fact.

Something Old

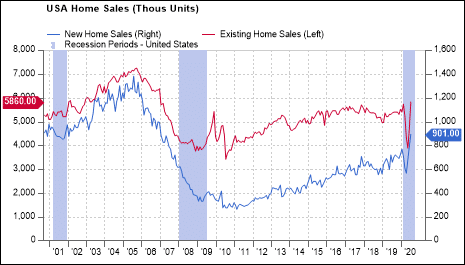

If I told you we were going into a deep recession, even if briefly, would the natural inclination be – “Boy, I bet the housing market is going to be on fire.” I am guessing not, yet here we are with our “something old” category. The National Association of Homebuilders Index just hit 83, eclipsing the peak from 2005 of 72. Keep in mind this index hit 30 in April. The combination of record low interest rates and movement out of cities to the burbs (who needs to worry about a commute when you are working from home) has driven a record demand for new houses. Now consider also that the bursting of the housing bubble in 2006-2009 has led to a decade long period where supply has lagged demand and you have the lowest months’ supply of new single family homes (3.3) on record back to 1963.

From our economics class we know that increasing demand with shrinking supply leads to higher prices. That is exactly what we have seen, especially with existing homes prices, rising 11.4% year-over-year. Lumber prices have doubled since the lows in April and other supplies related to housing have seen demand surge as well – think decking, appliances, wallboard, etc. As the CEO of Generac stated on their earnings call in July, “what appears to be fairly clear to date is the demand for our residential products is significantly benefiting from an emerging trend that we are referring to as home as a sanctuary where millions of people are working, learning, shopping, entertaining and in general, spending more time at home.” It is not home is where the heart is; it is home is where the home is and spending on this “sanctuary” is likely to continue.

Something New

Next, we are on to “something new.” And while some would say technology is not something new, the way in which it is dominating society and financial markets is. Imagine for a minute if we had this pandemic twenty years ago, when the internet was in its infancy and all you could really do with a cell phone was flip them open and flip them closed. The world economy would still be on its knees. It is hurting right now, but the ability for many to manage business while working remotely and to be able to teach children on-line has provided a significant cushion from the experience we would have had in years past.

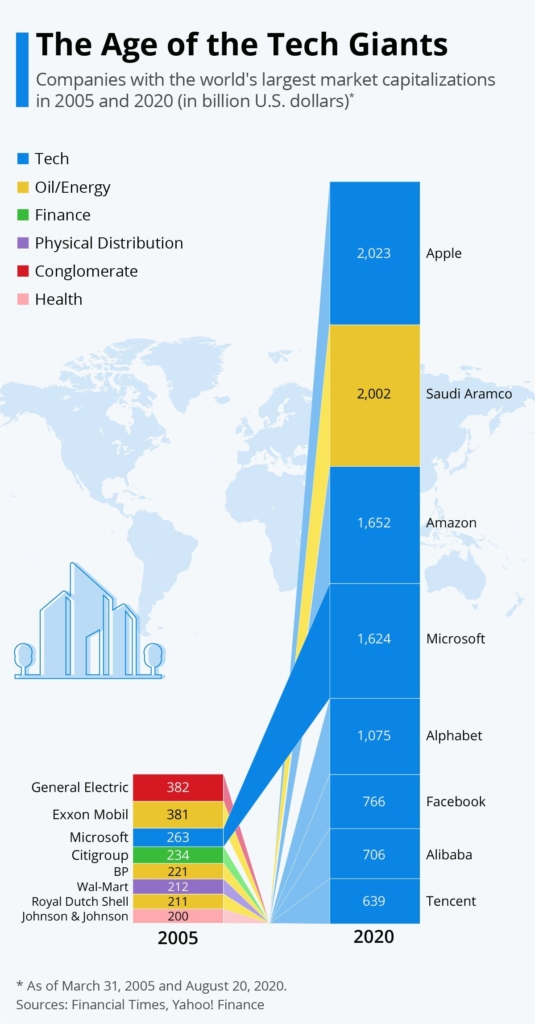

So perhaps it is no surprise that, as the chart at left demonstrates, Technology companies dominate the world’s most valuable enterprises. Technology is also altering the make-up of markets in less obvious ways as well. The chart to the left is not just noteworthy for what companies are listed in 2020 but for those that were on there in 2005 and are nowhere in sight today. Three oil companies, Exxon, BP and Royal Dutch Shell, whose market cap in 2005 combined for $813 billion, now total less than $300 billion. Technology has allowed alternative energy costs for solar and wind to drop dramatically and begin to truly disrupt traditional fossil fuels. This has implications for financial markets but also for the planet.

Something Blue

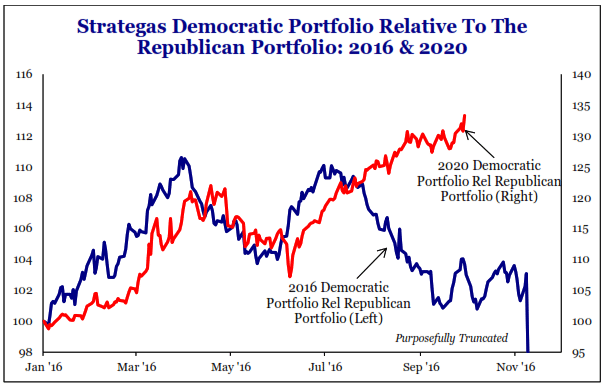

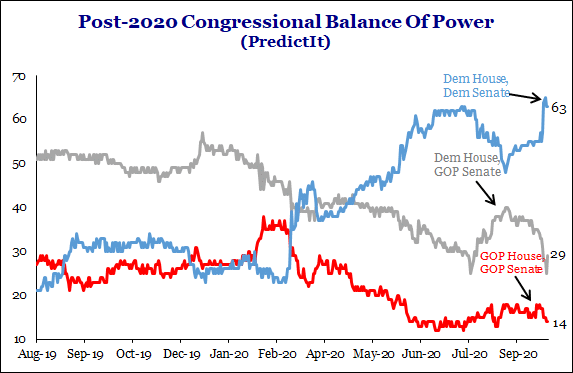

We are now just 29 days away from the election and things are as clear as mud. The race for the White House narrowed significantly in August since our last letter to you but has recently widened back out following the first debate. The race for control of the Senate has followed a similar path (see chart below). Recall it is our belief that we either keep the status quo or there is a “(something) blue” wave in November. Moving beyond the polls themselves, we have a few opposing indicators at the moment. When you look at the “Democratic” portfolio (a basket of stocks that would benefit from a Democratic victory), it is outperforming the “Republican” portfolio handily over the past several months (see chart at left), giving a nod to the Democrats winning in the election. Note that this is different from what we saw in 2016, when the Republican portfolio started to outperform in the summer, despite Hillary having a lead in the polls.

On the other hand, the broader market indicator we talked about in our last letter, S&P 500 performance three months out from the election, is solidly positive at +3.8%, which historically has favored the incumbent party. This is all before taking into account the President’s recent diagnosis of COVID-19 and the potential impact on polling and voting. By most accounts, the race will come down to several key states, including Michigan, Wisconsin, Pennsylvania and North Carolina. So, while national polling is in the headlines, the races in these individual states are likely more important and indicate a closer race than national polls would lead you to believe. Perhaps the bigger concern is not knowing the outcome when we wake up on November 4th. There has been much speculation about this situation given the amount of mail-in voting as well as the potential to challenge a close race in the courts. Because this has been widely discussed and debated, to the extent we get a clear winner one way or the other, you might see a relief rally as a result. From an actual policy standpoint and what can be done over the next four years, the outcome in the Senate is more impactful than the White House. Democrats would need to pick up a net four seats to take over the majority, but would likely need more to see substantive legislative changes occur. We will be out with some commentary in the days following the election regardless. Remember it is 2020. Anything can happen.

On a firm level, we continue to have about half of our staff working remotely while others are in the office. However, we are all reachable via email, telephone and to meet in person by appointment. Also, a reminder that our notes and videos can be found on our website on the newly launched Insights page at www.Greenwood Capital.com/insights. Back to that old normal vs. new normal discussion, I was excited to have college football back during the past month. I use the past tense “was” because as a Gamecock fan, it was a fleeting happiness. If nothing else, we can count on the Gamecocks to take us back to that “old normal” feeling of disappointment during the college football season. As a “house divided” here at Greenwood Capital, we wish the best of luck to our Clemson Tiger fans at the firm (especially since we do not have to play them). Please stay safe and healthy.

Thank you as always for your continued trust in Greenwood Capital. We look forward to hearing from you.

On behalf of all the employees at Greenwood Capital,

Sincerely,

Walter B. Todd, III

President/Chief Investment Officer

The information contained within has been obtained from sources believed to be reliable but cannot be guaranteed for accuracy. The opinions expressed are subject to change from time to time and do not constitute a recommendation to purchase or sell any security nor to engage in any particular investment strategy. Investment Advisory Services are offered through Greenwood Capital Associates, LLC, an SEC-registered investment advisor.