July 5, 2024

No, the picture to the right is not the latest cover of GQ, but your esteemed Federal Reserve Chairman, Mr. Jerome (Jay) Powell. This Barrons cover from early June states he will not cut rates this year. This is consistent with the discussion in these pages last quarter about the change in the market perception for rate cuts shifting from nearly seven in 2024 to now less than two. I recently spoke at the SC Bankers’s Association conference and the title of my talk was – “To Cut or Not to Cut – That is the Question.” With apologies to Shakespeare for borrowing the idea from Hamlet, this is a fairly straight forward proposition, isn’t it? Yet with a budget of over $3 billion and more than 300 PhDs on staff, the Fed cannot seem to make up its mind on the answer.

After taking a (premature) victory lap on inflation in December 2023, Powell and staff have determined they need more confidence that inflation is heading toward their target of 2% before starting to ease rates. There are four more Fed meetings this year (July, September, November and December) in which to act. Below, we examine why Powell and company will (or at least should) get the ball rolling in September.

The Job Market’s Impact on Rate Cuts

The Federal Reserve has a dual mandate of stable prices and full employment. These are the official mandates from Congress for the Fed; however, there is a third leg to this stool which is financial stability – we will circle back to this in a minute.

Since the start of the tightening cycle in March 2022, all the focus has been on the stable price mandate, i.e. getting inflation back to target (2%). While not all the way there, the latest Personal Consumption Expenditure (PCE) reading was 2.6%, down from a peak of 5.6% – so moving in the right direction. Employment, on the other hand, appears to be softening. The unemployment rate is up from a low of 3.4% in April 2023 to 4.0% in the latest reading (May 2024).

So, while the market and most Fed speakers appear to remain hyper-focused on inflation, we believe attention could quickly turn to the labor market should conditions continue to fade. We are watching the Payroll vs. Household report differences. These reports come out the first Friday of each month and by the time you are reading this, there will be an update (July 5) on this data. In the last report, Payrolls said we added 272,000 jobs while the Household Survey said we lost 408,000. That seems rather significant. If this divergence continues and the unemployment rate rises further, that could be the catalyst for Fed action to cut interest rates.

Furthermore, the inverted yield curve we have spoken about many times (short rates higher than long rates) is not a sustainable condition in our financial system. Back to that third leg of financial stability, the Fed needs to start the process of normalizing rates to reshape the curve and insure financial stability. It is for these reasons – softer employment (and weakening economic data in general) as well as financial stability concerns – that we believe the Fed should begin the process of cutting rates in September.

AI Infrastructure

Switching topics entirely, there has been significant focus on Artificial Intelligence (AI) and the build out of infrastructure to support the development and use of this technology. Most of the attention has been around technology and semiconductors specifically used in data centers needed to build and sustain large language models (LLM) for AI.

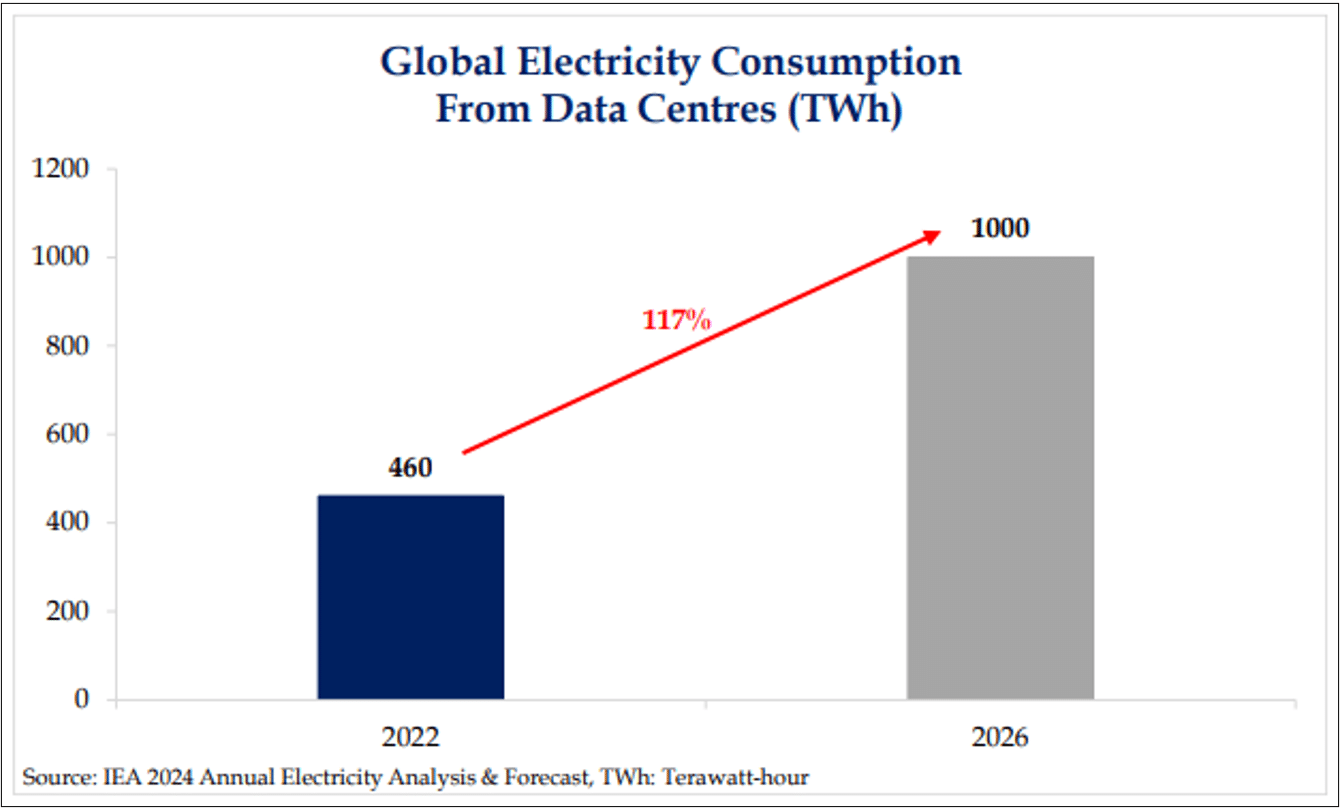

However, one aspect of this development that has not received as much press is the power used by these data centers. The chart to the right shows the growth in energy consumption by data centers in Terawatt-hours (TWh) per year. For perspective, 1000 TWh is roughly equivalent to the electricity consumption of France and Germany combined in 2023. Needless to say, it is not a great leap to assume that our electrical grid globally and certainly in the U.S. is not prepared to handle this level of additional demand.

This should benefit companies that provide equipment and services needed to upgrade the electrical grid as well as those independent power producers that can meet this demand. However, even with this investment, newer technologies such as hydrogen energy and small-scale nuclear reactors will be needed in order address these needs. We have some exposure to these areas and are actively looking for others, but we are also mindful of the headwind a potential electricity bottleneck could create for other AI beneficiaries that already have a lot of good news incorporated in their stock prices.

The Election Wildcard

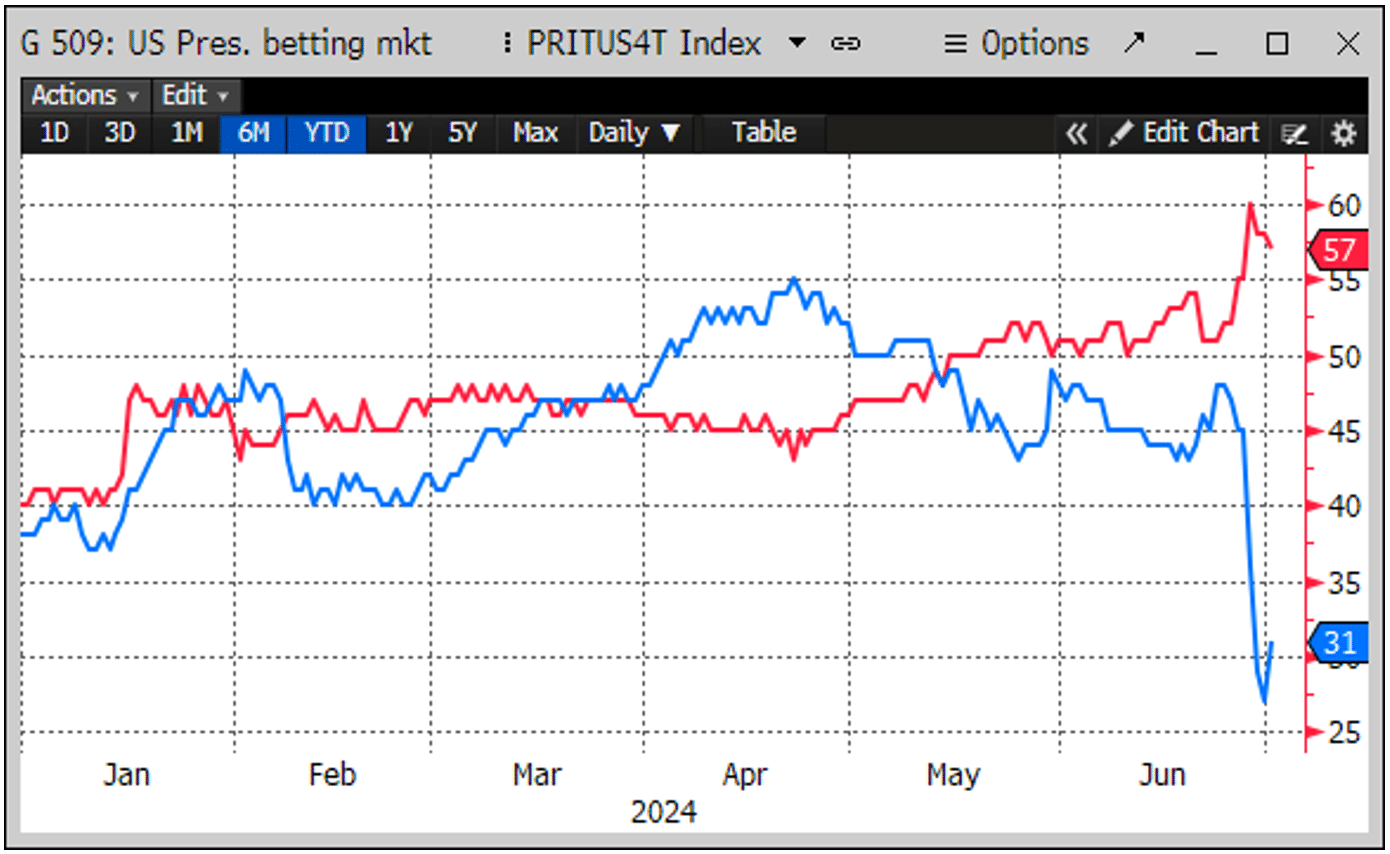

Now for the elephant in the room (or is it a donkey): the upcoming election. As you might suspect, the recent debate had a significant impact on the betting market outlook for who will win the White House in November.

The chart to the left from PredictIt highlights this dynamic with President Biden’s odds dropping from around 47% to below 30% before rebounding slightly to 31%. Now there is the question of whether he will be on the ticket come November. While we are not going to speculate on the answer to that question, we will simply note that according to our expert in this area, Dan Clifton at Strategas, a decision would have to be made by August 7th if it’s going to happen.

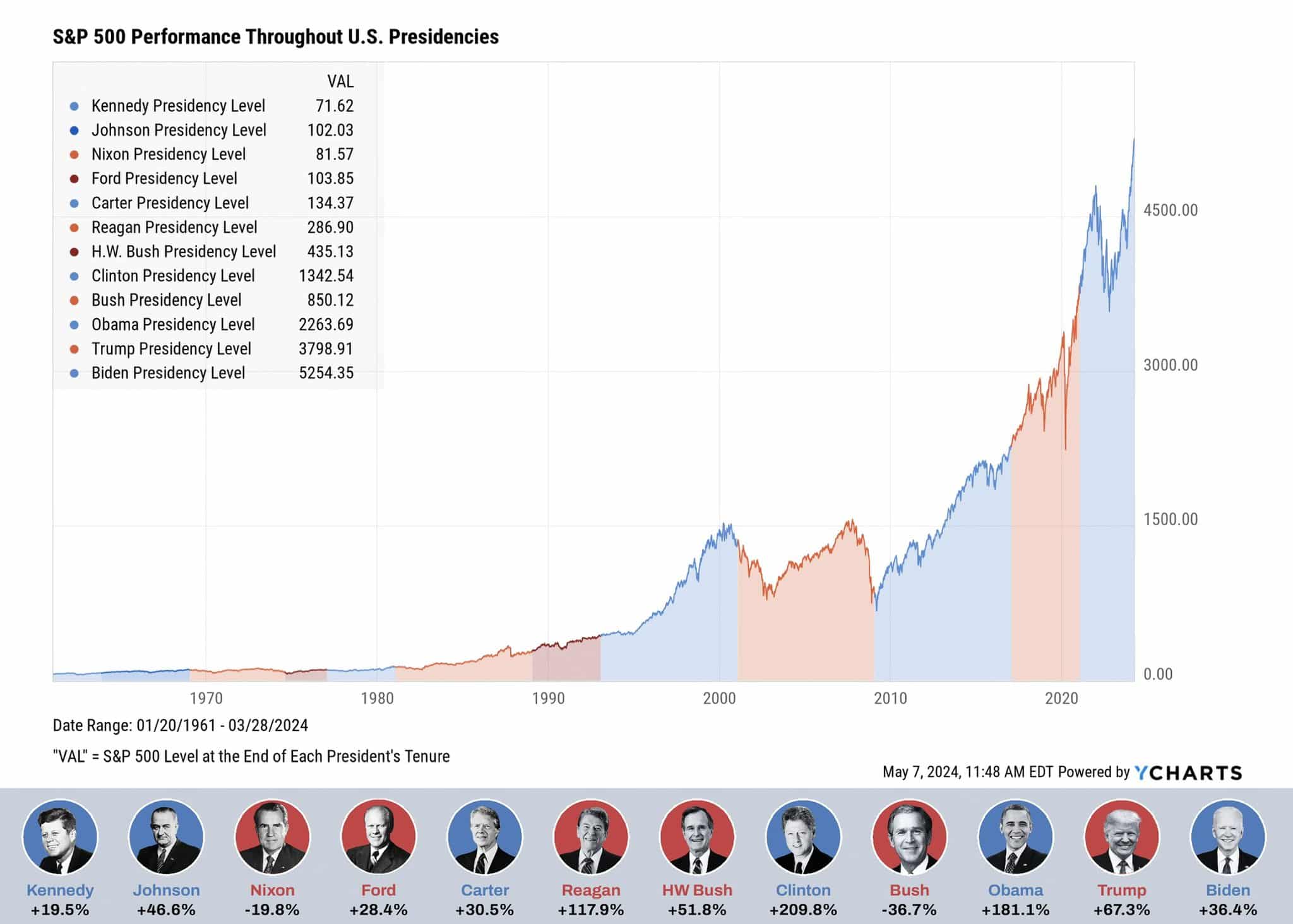

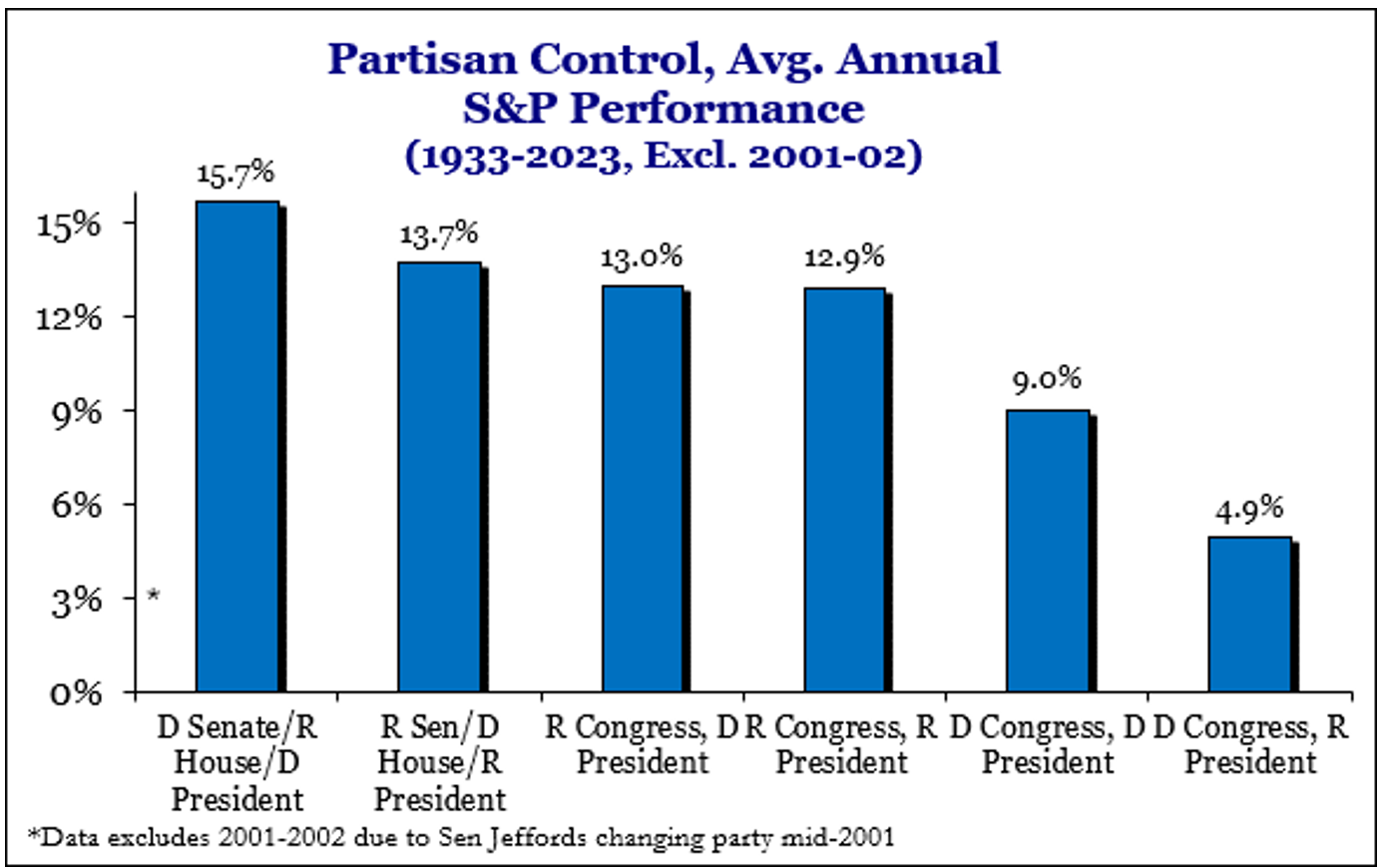

While the focus is clearly on the Presidential election right now, the control of the House and Senate are also up for grabs and initially it appears there’s a chance that the House may flip to the Democrats while the Senate may flip to Republican control. Believe it or not, we have actually never seen control flip for both parts of Congress to the opposite party in the same election. It is worth noting that a divided government is typically a good backdrop for stocks (see chart right).

Finally, while there is a knee-jerk reaction to do something ahead of an election or in response to an election outcome based on one’s party predisposition, the final chart (left) demonstrates that “Mr. Market” is squarely in the independent camp when it comes to political parties in the White House, spreading joy and pain across both sides.

We remain mindful of the policy differences between the parties and are watching for any spillover in volatility as a result of the “uniqueness” of this election cycle.

However, at this point do not plan any dramatic changes in strategies. Regardless of the outcome of the election, Congress and the President will have their hands full with tax legislation and the debt ceiling in 2025. These situations may be more relevant for markets as they come into focus in the new year.

Firm News

In firm news, we are wrapping up our 40th anniversary celebration. A special thanks to Kalisse Evert for heading up our news and related coverage of this year-long reflection of our past, as well as highlighting our evolution to the full-service wealth management firm we are today. The picture to the right is our team today from our 40th-anniversary party.

If you have not had a chance to see the pieces along with other articles and employee profiles, please check them out here or follow us on LinkedIn, Facebook, or Instagram.

We are also excited to announce that we are growing our team and have job postings for new financial advisors in Greenville and Greenwood.

As always, we appreciate your support and confidence in Greenwood Capital. Please do not hesitate to reach out to us via email, phone, or in person at the office. We look forward to hearing from you.

On behalf of all the employees at Greenwood Capital,

Sincerely,

Walter B. Todd, III

President/Chief Investment Officer

The information contained within has been obtained from sources believed to be reliable but cannot be guaranteed for accuracy. The opinions expressed are subject to change from time to time and do not constitute a recommendation to purchase or sell any security nor to engage in any particular investment strategy. Investment Advisory Services are offered through Greenwood Capital Associates, LLC, an SEC-registered investment advisor.