April 3, 2024

Happy belated Easter to everyone. I hope you enjoyed the long weekend with family and friends. March Madness basketball started in earnest a few weeks ago as many higher-ranked seeds were ousted by the underdogs in the first round of the men’s tournament. That trend continued as the tournament progressed leaving just two #1 seeds remaining in the Final Four. The stock market in 2024 has followed a similar pattern through the first three months.

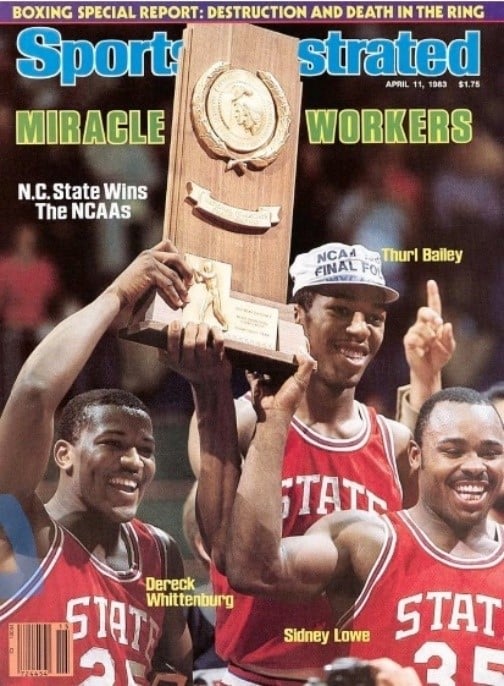

That is, we have seen a few of the “top seeds” from the so-called “Magnificent 7” of 2023 get knocked out of the top performer categories (e.g. Tesla and Apple); however, it is still the case that the market-cap weighted S&P 500 (SPX) outperformed its more democratic cousin, the equal-weight S&P 500 (SPW), by over 250 basis points (2.5 percentage points) in the first quarter. We discussed this dynamic in several commentaries over the past few quarters and you can find more details in our newsletter. Back to basketball, I must admit a bit of childhood nostalgia at the run N.C. State is making right now. I was 11 years old when the “Cardiac Pack” made their improbable run to the championship in 1983 under late coach Jim Valvano. Perhaps Small-cap stocks outperforming Large-caps this year would be the equivalent of N.C. State slaying the overwhelmingly favored Houston Cougars in 1983. We’ll see.

Cutting Rate Cuts

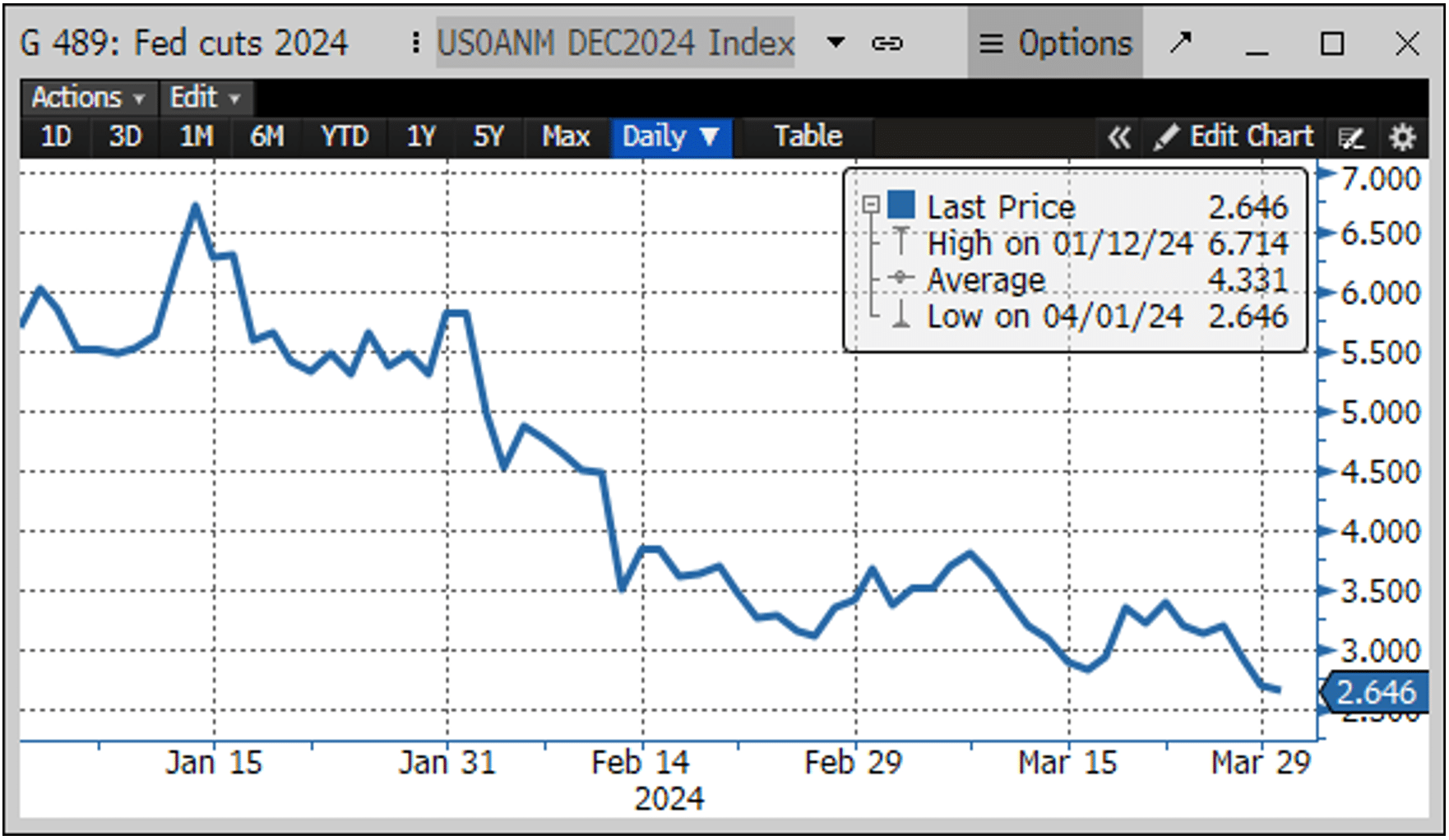

This year has started off much like 2023 in the sense that if you had perfect information about the events that were going to happen, you probably would have gotten the market reaction wrong. Take, for example, the Federal Reserve and the outlook for rate cuts in 2024. When we wrote our last letter in early January, the market (Fed Funds Futures) was predicting almost seven rate cuts during the year, beginning in March.

As we write this commentary today, the estimate is under three (see chart at left). If you had laid out that scenario to me on January 1, one would certainly have expected the equity market to struggle to advance and interest rates to be significantly higher. While Treasury yields are up marginally from the beginning of the year (10-year Treasury +0.32%), would have expected more given the change in the outlook for Fed actions. And equity markets? No problem. They are up 5% to 10% for the first quarter, depending on the index.

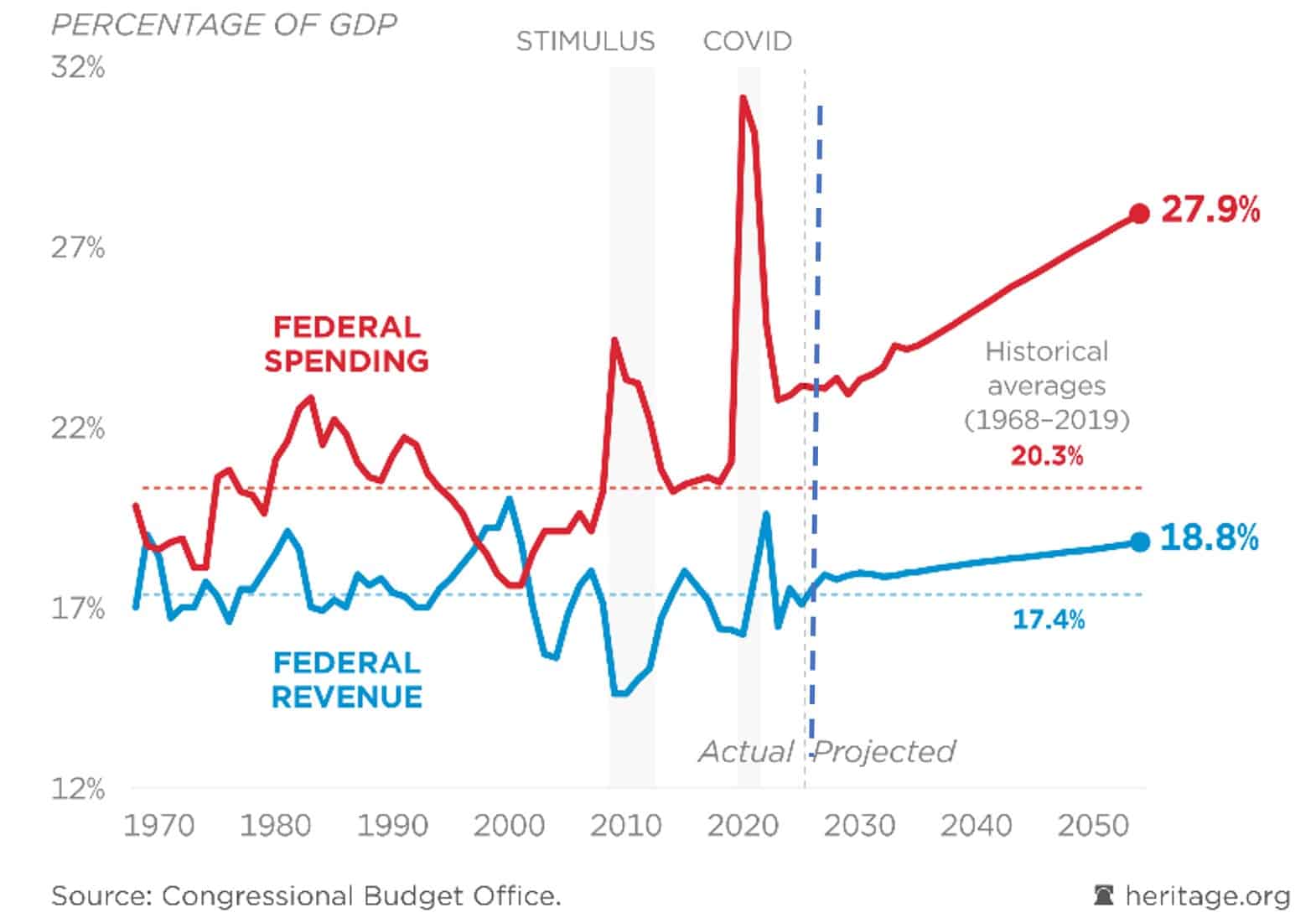

The answer to this conundrum revolves around the fact that the US economy continues to operate at a relatively high level despite interest rates remaining elevated. We have discussed some reasons for this in the past, including individuals and corporations being less interest-rate sensitive due to fixed financing costs (be it low-rate mortgages for homeowners or long-term bonds for companies). But another factor continues to be the federal government running a 5%+ deficit seemingly in perpetuity. This excess spending is steadily making its way into the economy, fueling growth (and perhaps sticky inflation). How sustainable is this excess spending? That leads us to our next topic for discussion.

The Embarrassment of US Spending

If you follow our social media posts and website data, you will know that I have been doing some media on BBC radio, specifically, a show called Business Matters. It is an hour-long show that covers a variety of topics with me and one other guest, usually from the other side of the world. An unfortunate topic of frequent discussion in recent episodes has been the functioning (or perhaps more appropriately disfunction) of our federal government. As a US citizen, it is difficult if not truly embarrassing to answer these questions. This is not a shot at one party vs. the other but rather an indictment of the overall state of politics and fiscal policy.

I should also note this is not something particularly new. As it relates to passing a budget and funding the government, Congress has not done one under regular order since 1997 (yes, 27 years ago). Rather, this is a “colossal failure of common sense” (to borrow the title of the book Larry McDonald wrote about the failure of Lehman Brothers).

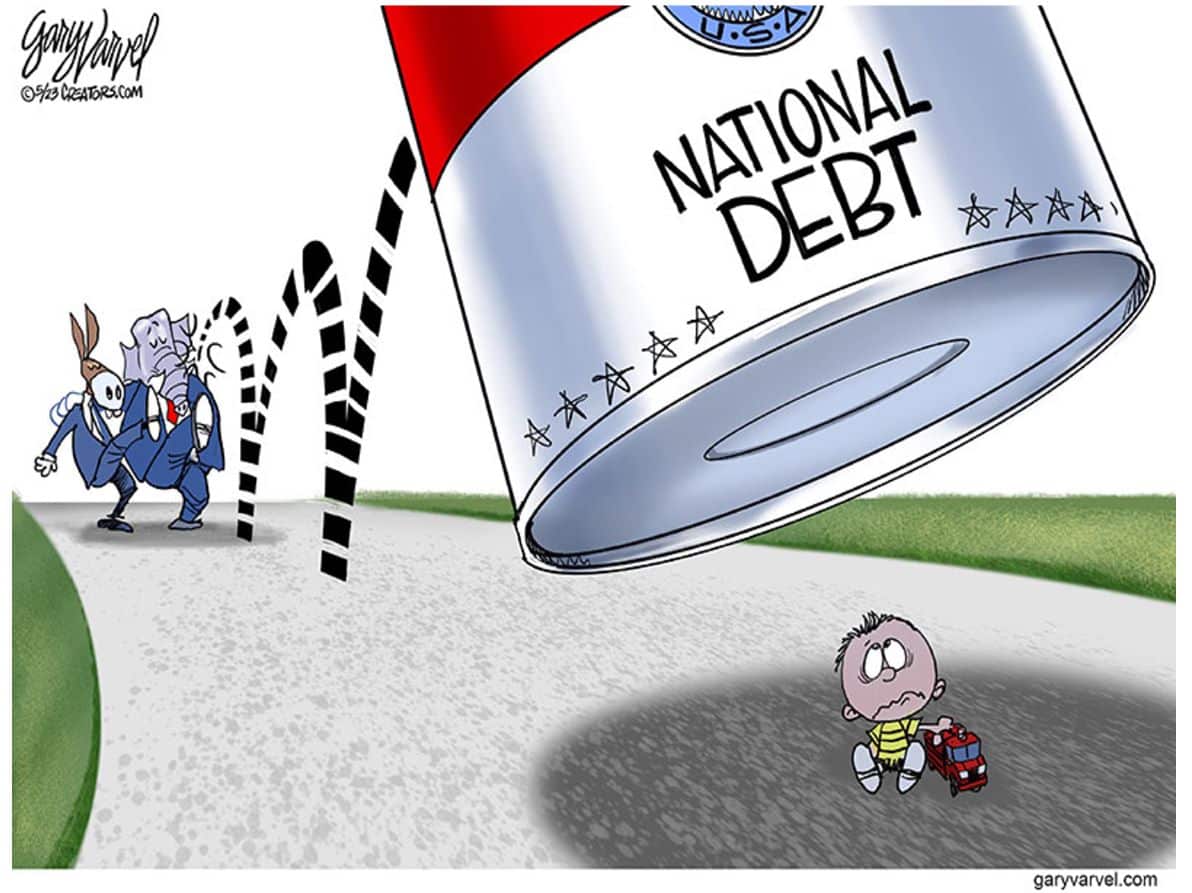

The proverbial can we are kicking down the road is getting steadily bigger by the day. At some point, lawmakers are going to attempt to kick it and break their leg without moving it.

I fully recognize that in an election year, this dynamic is very unlikely to change; however, the chart to the left highlights the unsustainability of the current path. I know, I know, we have heard this before, but at a minimum, it highlights that the tailwind of fiscal stimulus of the past four years is in the rear-view mirror and unlikely to be replicated going forward.

The Election Impact

Speaking of Washington DC, we have an election upcoming in November. I’m sure that’s a surprise to everyone since there has really been nothing in the news about it. A couple of relevant facts about the presidential election year’s impact on markets. First, reelection years (like this one) can be particularly positive for stocks, averaging a return of roughly 13%. Further, the S&P 500 has not had a negative return in a reelection year since 1940. As alluded to above, administrations seeking reelection like to prime the pump of the economy and financial markets to help their prospects.

Another dynamic around markets and elections is that they can also help predict the outcome. Specifically, according to Strategas Research Partners, if the three months leading up to the election are positive, the party in power wins (83% accurate back to 1928). The opposite is true if markets are down during the same period. Strategas also puts together baskets of stocks that should perform better or worse depending on a Republican or Democratic victory. These are compared to each other to determine what the stock market is anticipating as an outcome. Right now, it’s showing a toss-up. Finally, we can actually look at betting odds on Real Clear Politics which shows about 45% for Trump and 38% for Biden, with the remainder split among a few other candidates.

Regardless, seven months is a lifetime in politics, and we will use the markets as a guide as we approach November.

Firm News

In firm news, we continue to celebrate our 40th anniversary with various articles and news items. We encourage you to check out our website and follow us on Linkedln, Facebook, or Instagram to see all the news related to the firm and our associates.

We are also excited to highlight Melissa Bane for her recent honor. Melissa was named a “Woman of Influence” by the Greenville Business News.

Finally, we have some retirements to announce. Lessa O’Dell, who joined the firm in 1993 and transitioned to a part-time role in 2022 will transition to the full-time job of helping take care of her lovely and growing family. Lessa thank you for all your contributions over these many years (including taking part in three major software transitions!). Dave Halloran joined the firm in 2009 helping Greenwood Capital diversify its investment offerings through the use of exchange-traded funds (ETFs). Dave, thank you for all your investment guidance and perspective. Enjoy the mountain full-time now.

As always, we appreciate your support and confidence in Greenwood Capital. Please do not hesitate to reach out to us via email, phone, or in person at the office. We look forward to hearing from you.

On behalf of all the employees at Greenwood Capital,

Sincerely,

Walter B. Todd, III

President/Chief Investment Officer

The information contained within has been obtained from sources believed to be reliable but cannot be guaranteed for accuracy. The opinions expressed are subject to change from time to time and do not constitute a recommendation to purchase or sell any security nor to engage in any particular investment strategy. Investment Advisory Services are offered through Greenwood Capital Associates, LLC, an SEC-registered investment advisor.